Since June 2020, the S&P 500 has delivered a total return of 97.4%. But one standout stock has nearly doubled the market - over the past five years, Netflix has surged 175% to $1,261 per share. Its momentum hasn’t stopped as it’s also gained 35.3% in the last six months thanks to its solid quarterly results, beating the S&P by 35.5%.

Following the strength, is NFLX a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Is Netflix a Good Business?

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

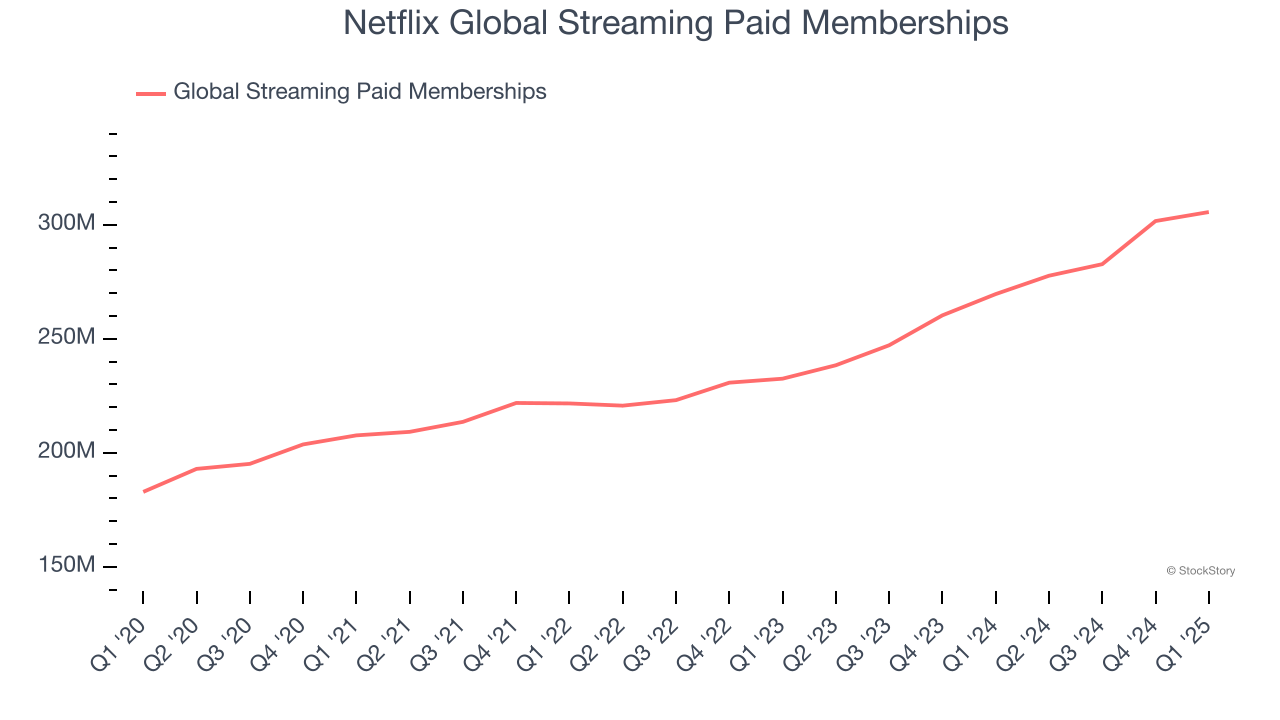

1. Global Streaming Paid Memberships Skyrocket, Fueling Growth Opportunities

As a subscription-based app, Netflix generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Netflix’s global streaming paid memberships, a key performance metric for the company, increased by 13.5% annually to 305.6 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

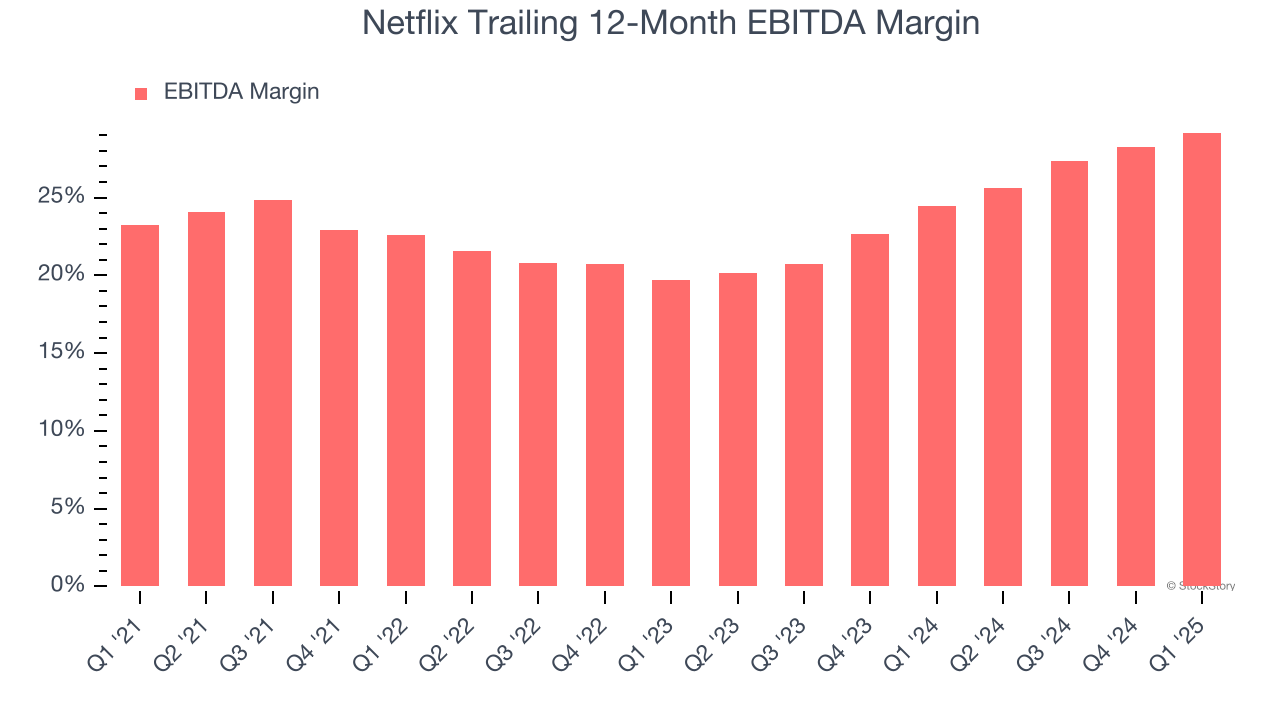

2. EBITDA Margin Reveals a Well-Run Organization

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Netflix has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 27%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

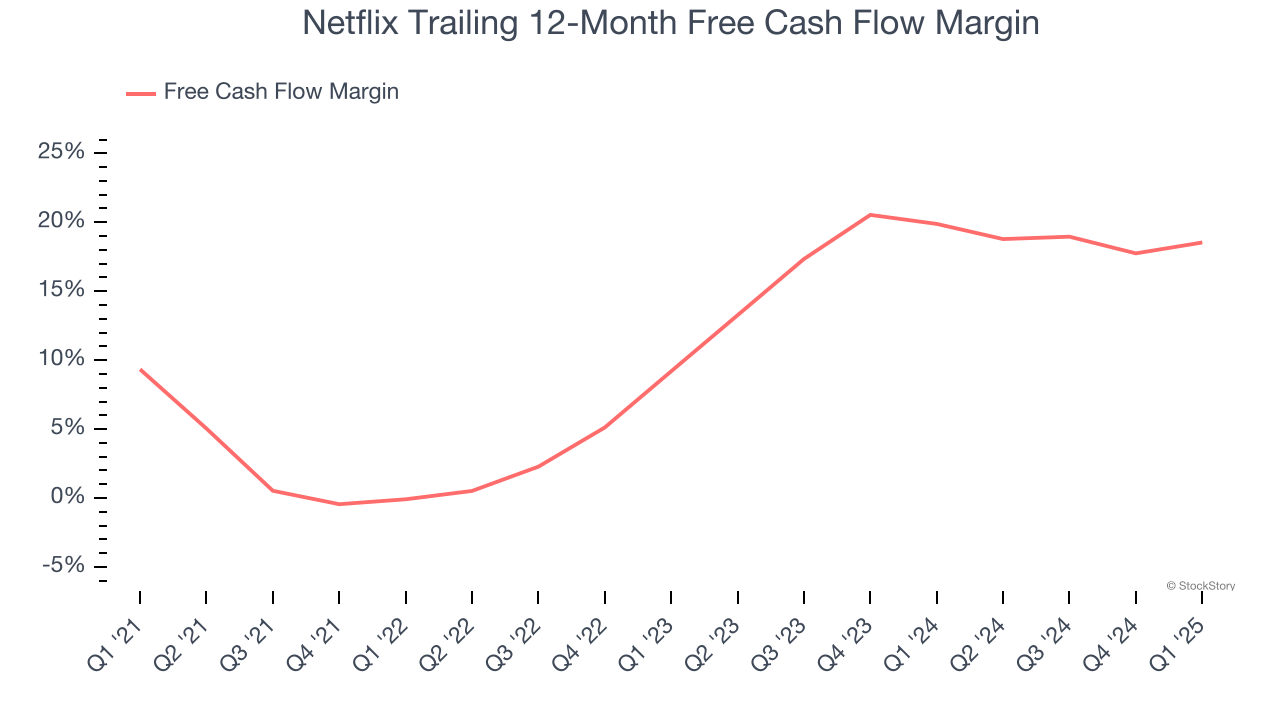

3. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Netflix’s margin expanded by 18.6 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Netflix’s free cash flow margin for the trailing 12 months was 18.5%.

Final Judgment

These are just a few reasons why Netflix ranks highly on our list, and with its shares beating the market recently, the stock trades at 38.7× forward EV/EBITDA (or $1,261 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.