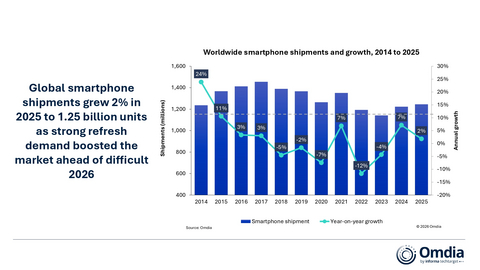

The latest research from Omdia reveals that global smartphone shipments grew by 2% in 2025 to 1.25 billion units, marking the highest annual level since 2021. All regions grew compared to 2024, except for Greater China, which marginally declined amid the fading effect of the national subsidy scheme that boosted its performance in early 2025. Strong demand from both upgraders and replacement-buyers continued to boost the market, as several vendors broke records despite uncertainty reigning in the business environment throughout the year.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260129170791/en/

Worldwide smartphone shipments and growth, 2014 to 2025.

The global smartphone market ended 4Q25 with 4% year-over-year growth, bolstered by seasonal tailwinds and strong vendor performance. Despite this momentum, rising costs for key components and memory late in the period have started to dampen volume growth expectations for the start of 2026.

Apple delivered its highest annual volume ever in 2025 as iPhone shipments grew 7% to 240.6 million units, helping it maintain the title as the world’s largest vendor for the third consecutive year. An all-time high quarterly iPhone volume in 4Q25 fueled its performance, with Apple notably posting 26% year-on-year growth in Mainland China driven by stronger iPhone 17 series demand. Samsung delivered a meaningful rebound in 2025 after three consecutive years of annual declines, growing 7% year on year and finishing marginally behind Apple. The year culminated in a standout fourth quarter, with shipments up 16% YoY, supported by resilient flagship demand alongside a notable recovery in mass-market volumes. Samsung maintained healthy Galaxy S and Z shipments while regaining share in entry-level and mainstream tiers (A0x and A1x), marking an important reversal after several years of pressure at the lower end of the market.

Xiaomi defended its third-place position in 2025, despite a tougher finish to the year, with shipments declining 2% amid entry-level softness and a sharp 4Q25 contraction in key markets. Expanding value growth through a broader portfolio push from POCO to premium and AIoT across retail remains key. Meanwhile, vivo claimed the fourth spot for the first time, driven by continued success in India alongside a consistent performance in its domestic market, to grow 4% to 105.3 million units. OPPO completed the top 5, with its shipments returning to growth in 4Q25 after a tricky first half of 2025 with newly launched A6x models. OPPO reached 100.7 million units in 2025, down 3% from 2024. With realme going under OPPO’s umbrella from 2026, OPPO will gain key volume and market strengths that can help it challenge for a higher position in the rankings.

Beyond the top 5, several vendors continue to experience positive demand despite challenging market conditions. HONOR and Lenovo grew 11% and 6% respectively, reaching record highs, with growth from rapid geographical expansion amid fierce competition in their core markets. Huawei continued growing as it reclaimed the top spot in Mainland China for the first time in five years. Nothing was the fastest-growing vendor of 2025, with shipments growing 86% to surpass 3 million units.

“Although 2025 overall has been a positive year for most vendors, headwinds are building for the 2026 outlook,” said Runar Bjorhovde, Senior Analyst at Omdia. “According to the recent Omdia report, 'DRAM Eats Smartphones: What Matters for Success in 2026,' escalating supply-side pressures in DRAM, NAND, and other semiconductors are a primary concern for vendors. These constraints threaten to squeeze margins, force pricing adjustments, and ultimately dampen consumer demand. However, vendors are not impacted similarly. Particularly those operating with smaller scale, limited long-term relationships with suppliers, high LPDDR4/4X exposure, and large low-end shares will be particularly exposed. It is also essential that vendors manage pressure points in the supply chain and sales channel effectively with long-term relationships in mind, while attempting to limit the end-buyers’ exposure to the increased costs.”

“With market contraction looking increasingly unavoidable for 2026, vendors will shift toward prioritizing profitability while expanding alternative revenue streams,” added Le Xuan Chiew, Research Manager at Omdia. “Periods of disruption offer a competitive edge to the vendors, suppliers, and partners who navigate challenges with agility. These conditions create a strategic opening to capture upgrade switchers, scale across new channels, and secure the market share vital for long-term resilience. Capitalizing on this momentum not only gains immediate market share but also fortifies long-term viability. Vendors’ core focus must remain on the end-customer, as buying journeys are evolving, it is no longer enough for vendors to understand what consumers want. Equally important is figuring out how and why they buy, to target key influence points where opinions must be swayed. The defining question for 2026 and beyond is which vendors will most effectively acquire customers and optimize partnerships while navigating persistent supply-side pressures.”

Worldwide smartphone shipments (market share and annual growth) Omdia Smartphone Market Pulse: 4Q25 |

||||||||||

Vendor |

4Q25

|

4Q25

|

4Q24

|

4Q24

|

Annual

|

|||||

Apple |

84.3 |

25% |

77.1 |

23% |

9% |

|||||

Samsung |

60.4 |

18% |

51.9 |

16% |

16% |

|||||

Xiaomi |

37.8 |

11% |

42.7 |

13% |

-11% |

|||||

vivo |

27.5 |

8% |

26.4 |

8% |

4% |

|||||

OPPO |

26.8 |

8% |

24.6 |

7% |

9% |

|||||

Others |

102.7 |

30% |

105.3 |

33% |

-3% |

|||||

Total |

339.5 |

100% |

328.1 |

100% |

4% |

|||||

|

|

|

|

|

|

|||||

Note: Xiaomi includes Redmi and POCO, OPPO includes OnePlus, vivo includes iQOO.

|

|

|||||||||

Worldwide smartphone shipments (market share and annual growth) Omdia Smartphone Market Pulse: 2025 |

||||||||||

Vendor |

2025

|

2025

|

2024

|

2024

|

Annual

|

|||||

Apple |

240.6 |

19% |

225.9 |

18% |

7% |

|||||

Samsung |

239.1 |

19% |

222.9 |

18% |

7% |

|||||

Xiaomi |

165.4 |

13% |

168.6 |

14% |

-2% |

|||||

vivo |

105.3 |

8% |

100.9 |

8% |

4% |

|||||

OPPO |

100.7 |

8% |

103.6 |

8% |

-3% |

|||||

Others |

394.4 |

33% |

401.4 |

34% |

-2% |

|||||

Total |

1,245.5 |

100% |

1,223.2 |

100% |

2% |

|||||

|

|

|

|

|

|

|||||

Note: Xiaomi includes Redmi and POCO, OPPO includes OnePlus, vivo includes iQOO.

|

|

|||||||||

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260129170791/en/

“Although 2025 overall has been a positive year for most vendors, headwinds are building for the 2026 outlook,” said Runar Bjorhovde, Senior Analyst at Omdia.

Contacts

Fasiha Khan: Fasiha.khan@omdia.com

Eric Thoo: eric.thoo@omdia.com