Invesco DB USD Index Bearish ETF (NY:UDN)

All News about Invesco DB USD Index Bearish ETF

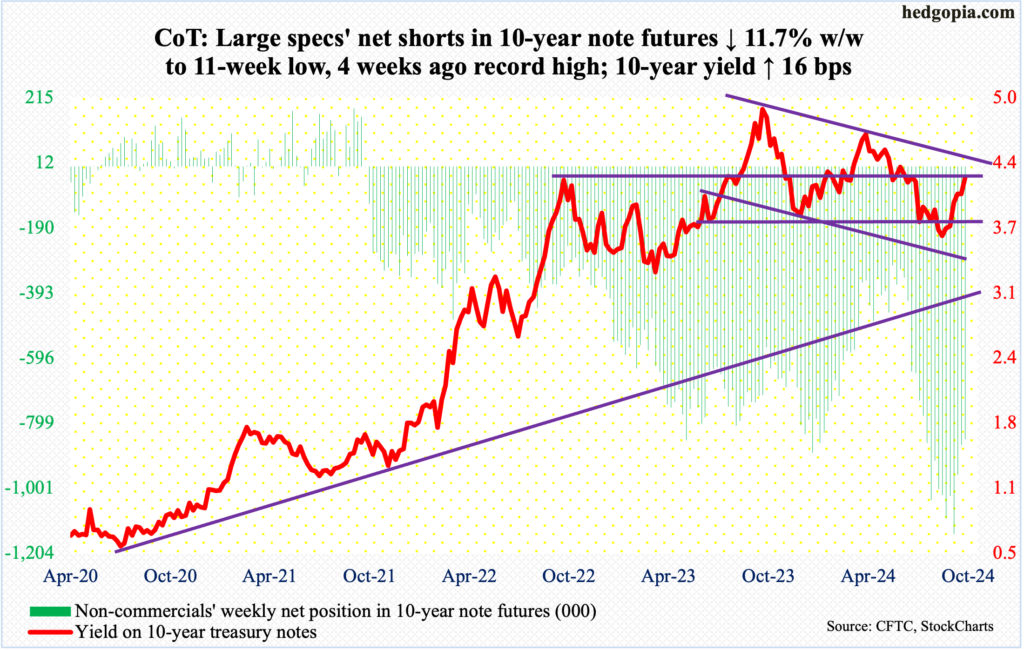

CoT: Peek Into The Future Thru Futures - How Hedge Funds Are Positioned, Feb. 23 ↗

February 23, 2025

Via Talk Markets

Topics

Stocks / Equities

Via Talk Markets

Degenerates, Delinquents, 'Soaring Demand,' And Dollar Devaluation ↗

February 14, 2025

Via Talk Markets

Via Talk Markets

Trump Trade Back In Vogue – Societe Generale ↗

January 26, 2025

Via Talk Markets

CoT - Peek Into Future Through Futures, Hedge Fund Positions ↗

January 19, 2025

Via Talk Markets

Speculator Extremes: Lean Hogs & Nasdaq Lead Weekly Bullish Positions ↗

December 16, 2024

Via Talk Markets

Possible Impact Of Trump's Immigration, Economic And Trade Policies ↗

December 08, 2024

Via Talk Markets

Via Talk Markets

Via Talk Markets

Via Talk Markets

Speculator Extremes: Russell 2000, VIX, USD Index & 5-Year Bonds Lead Bullish & Bearish Positions ↗

October 20, 2024

Via Talk Markets

Topics

Stocks

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.