Investment banking firm PJT Partners (NYSE: PJT) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 12.1% year on year to $535.2 million. Its non-GAAP profit of $2.55 per share was 6.4% above analysts’ consensus estimates.

Is now the time to buy PJT? Find out by accessing our full research report, it’s free.

PJT (PJT) Q4 CY2025 Highlights:

- Revenue: $535.2 million vs analyst estimates of $540.2 million (12.1% year-on-year growth, 0.9% miss)

- Pre-tax Profit: $122.9 million (23% margin)

- Adjusted EPS: $2.55 vs analyst estimates of $2.40 (6.4% beat)

- Market Capitalization: $4.23 billion

Company Overview

Spun off from Blackstone in 2015 and founded by former Morgan Stanley executive Paul J. Taubman, PJT Partners (NYSE: PJT) is an advisory-focused investment bank that provides strategic advice, restructuring services, and fundraising solutions to corporations, boards, and investment firms.

Revenue Growth

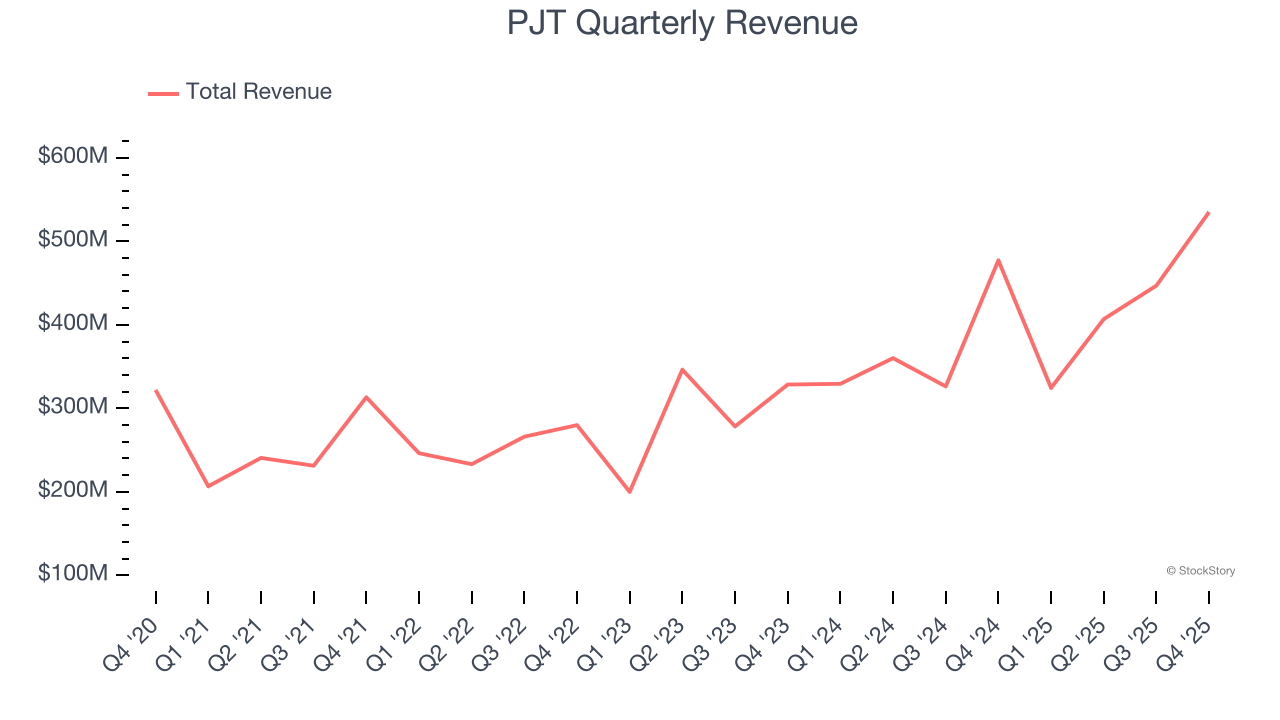

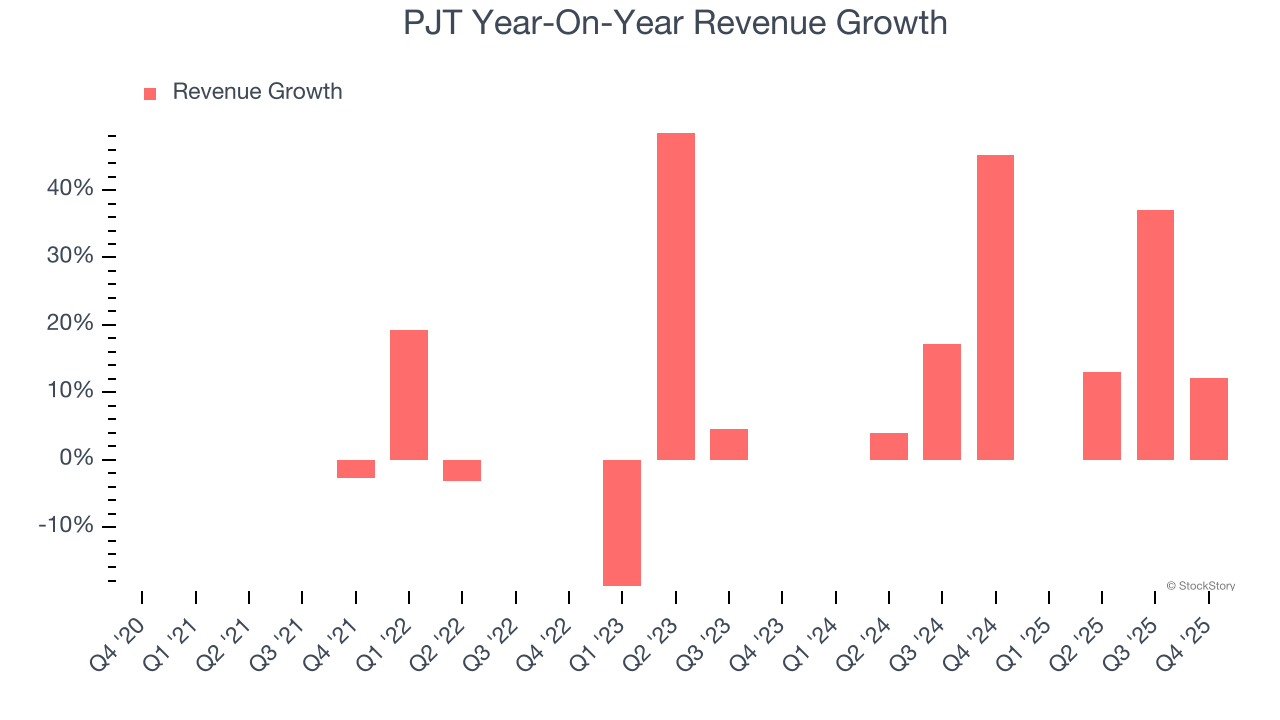

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, PJT’s 10.2% annualized revenue growth over the last five years was decent. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. PJT’s annualized revenue growth of 21.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, PJT’s revenue grew by 12.1% year on year to $535.2 million but fell short of Wall Street’s estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Key Takeaways from PJT’s Q4 Results

It was good to see PJT beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $174.03 immediately following the results.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).