Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at monday.com (NASDAQ: MNDY) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was in line.

While some productivity software stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.7% since the latest earnings results.

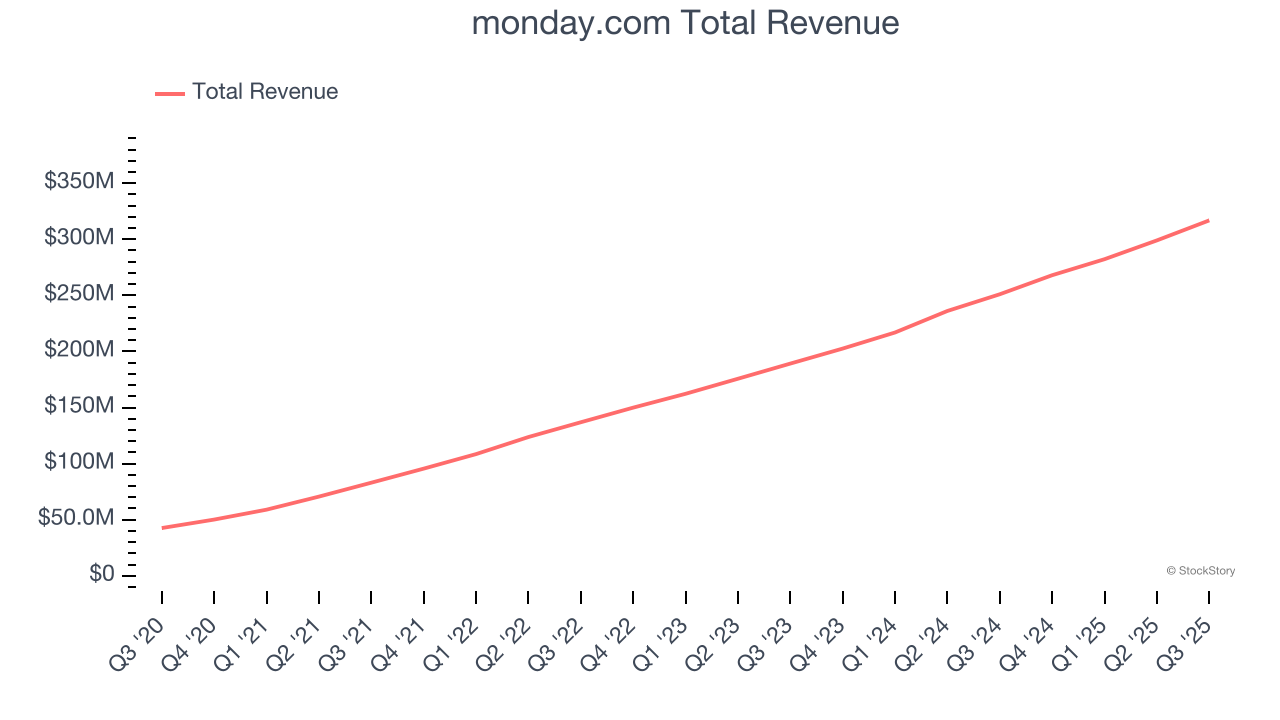

monday.com (NASDAQ: MNDY)

With its colorful interface of boards, columns, and automation that replaced the chaos of spreadsheets, monday.com (NASDAQ: MNDY) is a cloud-based work operating system that helps teams manage projects, track tasks, and streamline workflows through customizable interfaces.

monday.com reported revenues of $316.9 million, up 26.2% year on year. This print exceeded analysts’ expectations by 1.4%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ EBITDA estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

“We delivered our highest ever non-GAAP operating profit this quarter, underscoring our focus on efficient, profitable growth,” said Eliran Glazer, monday.com CFO.

Unsurprisingly, the stock is down 22.1% since reporting and currently trades at $147.71.

Is now the time to buy monday.com? Access our full analysis of the earnings results here, it’s free.

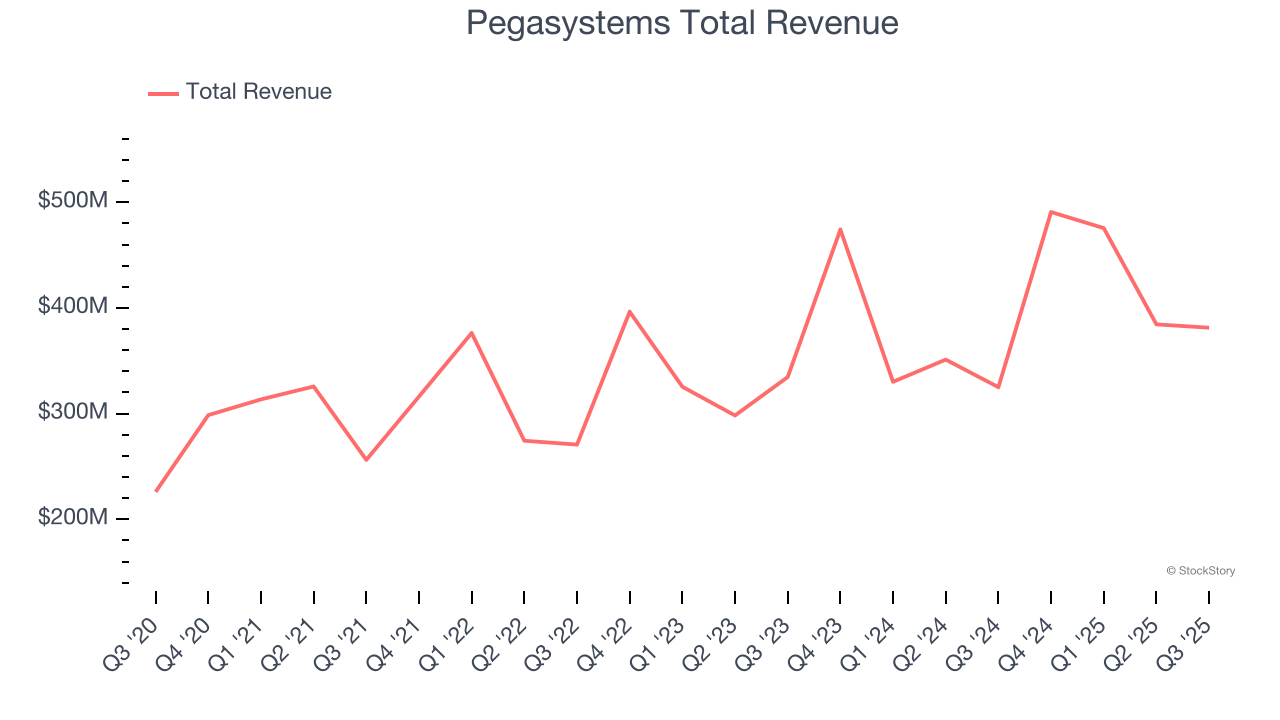

Best Q3: Pegasystems (NASDAQ: PEGA)

With a "Center-out Business Architecture" approach that transcends organizational silos, Pegasystems (NASDAQ: PEGA) develops software that helps organizations automate workflows and use artificial intelligence to improve customer experiences and business processes.

Pegasystems reported revenues of $381.4 million, up 17.3% year on year, outperforming analysts’ expectations by 8.5%. The business had a stunning quarter with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Pegasystems scored the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 4.3% since reporting. It currently trades at $59.48.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: SoundHound AI (NASDAQ: SOUN)

Born from the idea that machines should understand human speech as naturally as people do, SoundHound AI (NASDAQ: SOUN) develops voice recognition and conversational intelligence technology that enables businesses to integrate voice assistants into their products and services.

SoundHound AI reported revenues of $42.05 million, up 67.6% year on year, exceeding analysts’ expectations by 2.7%. Still, it was a softer quarter as it posted a significant miss of analysts’ EBITDA and billings estimates.

As expected, the stock is down 22.1% since the results and currently trades at $11.19.

Read our full analysis of SoundHound AI’s results here.

8x8 (NASDAQ: EGHT)

Named after its founding year (1987) with "8x8" representing binary code for communications, 8x8 (NASDAQ: EGHT) provides cloud-based contact center and unified communications solutions that enable businesses to manage customer interactions and internal communications through a single platform.

8x8 reported revenues of $184.1 million, up 1.7% year on year. This print topped analysts’ expectations by 3.1%. It was a very strong quarter as it also recorded a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 10.4% since reporting and currently trades at $1.97.

Read our full, actionable report on 8x8 here, it’s free.

Jamf (NASDAQ: JAMF)

With its name playfully derived from "Just Another Management Framework," Jamf (NASDAQ: JAMF) provides software that helps organizations deploy, manage, and secure Apple devices across their workforce while maintaining a seamless user experience.

Jamf reported revenues of $183.5 million, up 15.2% year on year. This number beat analysts’ expectations by 3.4%. Overall, it was an exceptional quarter as it also logged a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 1.4% since reporting and currently trades at $13.04.

Read our full, actionable report on Jamf here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.