The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how traditional fast food stocks fared in Q3, starting with Arcos Dorados (NYSE: ARCO).

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 13 traditional fast food stocks we track reported a satisfactory Q3. As a group, revenues were in line with analysts’ consensus estimates.

Thankfully, share prices of the companies have been resilient as they are up 7.9% on average since the latest earnings results.

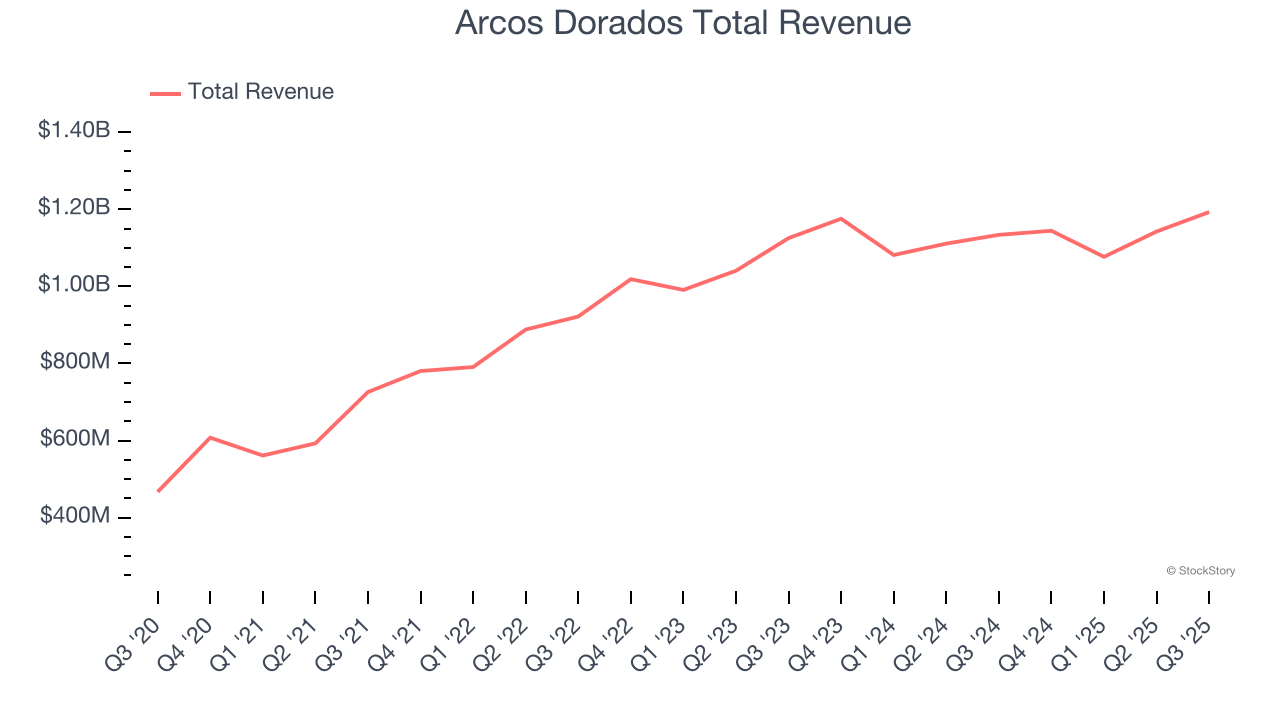

Arcos Dorados (NYSE: ARCO)

Translating to “Golden Arches” in Spanish, Arcos Dorados (NYSE: ARCO) is the master franchisee of the McDonald's brand in Latin America and the Caribbean, responsible for its operations and growth in over 20 countries.

Arcos Dorados reported revenues of $1.19 billion, up 5.2% year on year. This print fell short of analysts’ expectations by 3%. Overall, it was a mixed quarter for the company with a beat of analysts’ EPS estimates but a significant miss of analysts’ same-store sales estimates.

Arcos Dorados delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 6.3% since reporting and currently trades at $7.67.

Is now the time to buy Arcos Dorados? Access our full analysis of the earnings results here, it’s free for active Edge members.

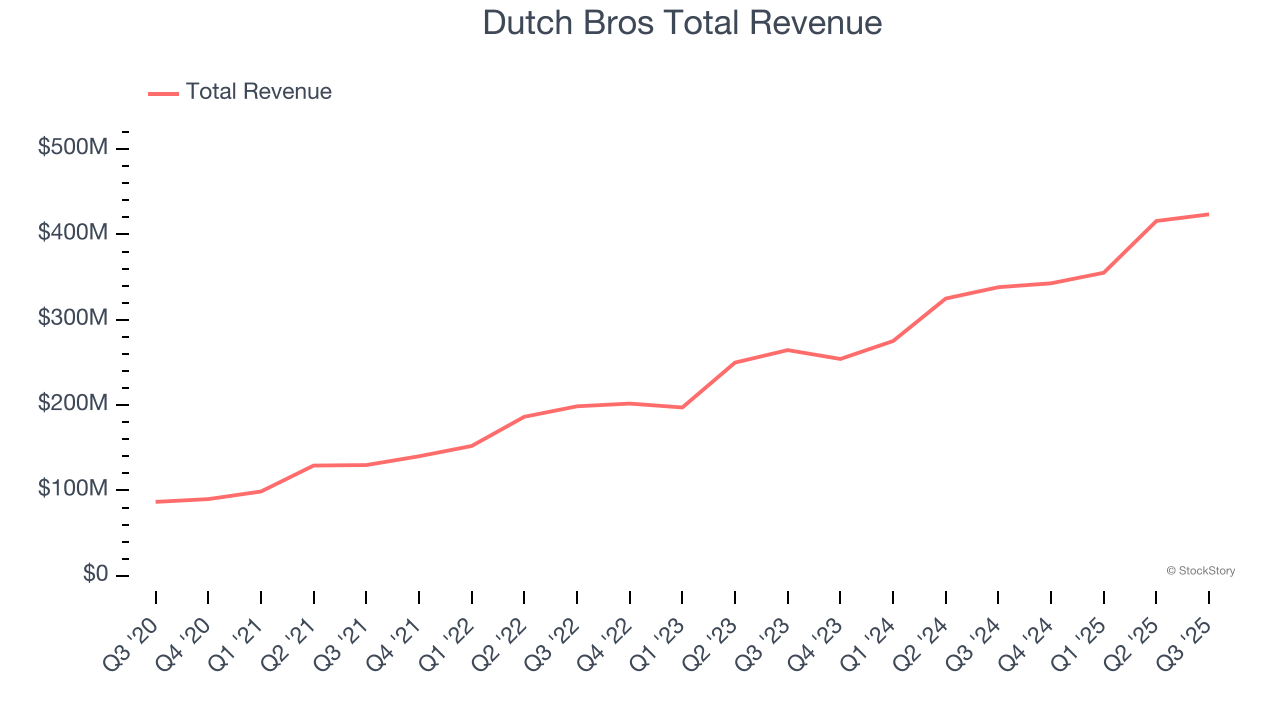

Best Q3: Dutch Bros (NYSE: BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE: BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Dutch Bros reported revenues of $423.6 million, up 25.2% year on year, outperforming analysts’ expectations by 2.3%. The business had an exceptional quarter with a solid beat of analysts’ same-store sales estimates and an impressive beat of analysts’ revenue estimates.

Dutch Bros scored the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 12.7% since reporting. It currently trades at $63.31.

Is now the time to buy Dutch Bros? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Papa John's (NASDAQ: PZZA)

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ: PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

Papa John's reported revenues of $508.2 million, flat year on year, falling short of analysts’ expectations by 2.9%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations significantly and a miss of analysts’ revenue estimates.

As expected, the stock is down 8.7% since the results and currently trades at $37.68.

Read our full analysis of Papa John’s results here.

Wendy's (NASDAQ: WEN)

Founded by Dave Thomas in 1969, Wendy’s (NASDAQ: WEN) is a renowned fast-food chain known for its fresh, never-frozen beef burgers, flavorful menu options, and commitment to quality.

Wendy's reported revenues of $549.5 million, down 3% year on year. This print surpassed analysts’ expectations by 3.1%. It was an exceptional quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

Wendy's pulled off the biggest analyst estimates beat among its peers. The stock is down 6.6% since reporting and currently trades at $8.25.

Read our full, actionable report on Wendy's here, it’s free for active Edge members.

Domino's (NASDAQ: DPZ)

Founded by two brothers in Michigan, Domino’s (NYSE: DPZ) is a globally recognized pizza chain known for its creative marketing and fast delivery.

Domino's reported revenues of $1.15 billion, up 6.2% year on year. This number beat analysts’ expectations by 0.9%. Overall, it was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a narrow beat of analysts’ revenue estimates.

The stock is flat since reporting and currently trades at $406.34.

Read our full, actionable report on Domino's here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.