Alphabet trades at $203.55 per share and has stayed right on track with the overall market, gaining 9.9% over the last six months. At the same time, the S&P 500 has returned 5%.

Is GOOGL a buy right now? Find out in our full research report, it’s free.

Why Are We Positive On Alphabet?

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ: GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

1. Skyrocketing Revenue Shows Strong Momentum

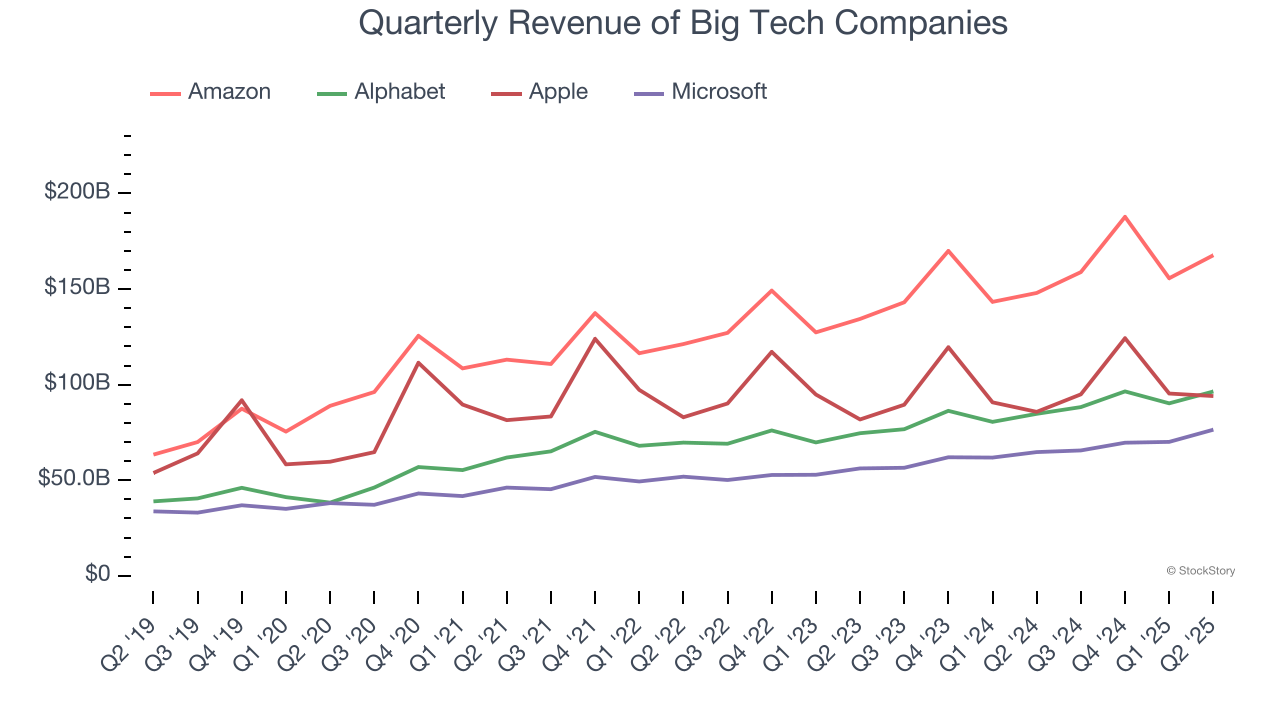

Alphabet shows that fast growth and massive scale can coexist despite conventional wisdom. The company’s revenue base of $166 billion five years ago has more than doubled to $371.4 billion in the last year, translating into an incredible 17.5% annualized growth rate.

Alphabet’s growth over the same period was also higher than its big tech peers, Amazon (15.8%), Microsoft (14.5%), and Apple (8.3%).

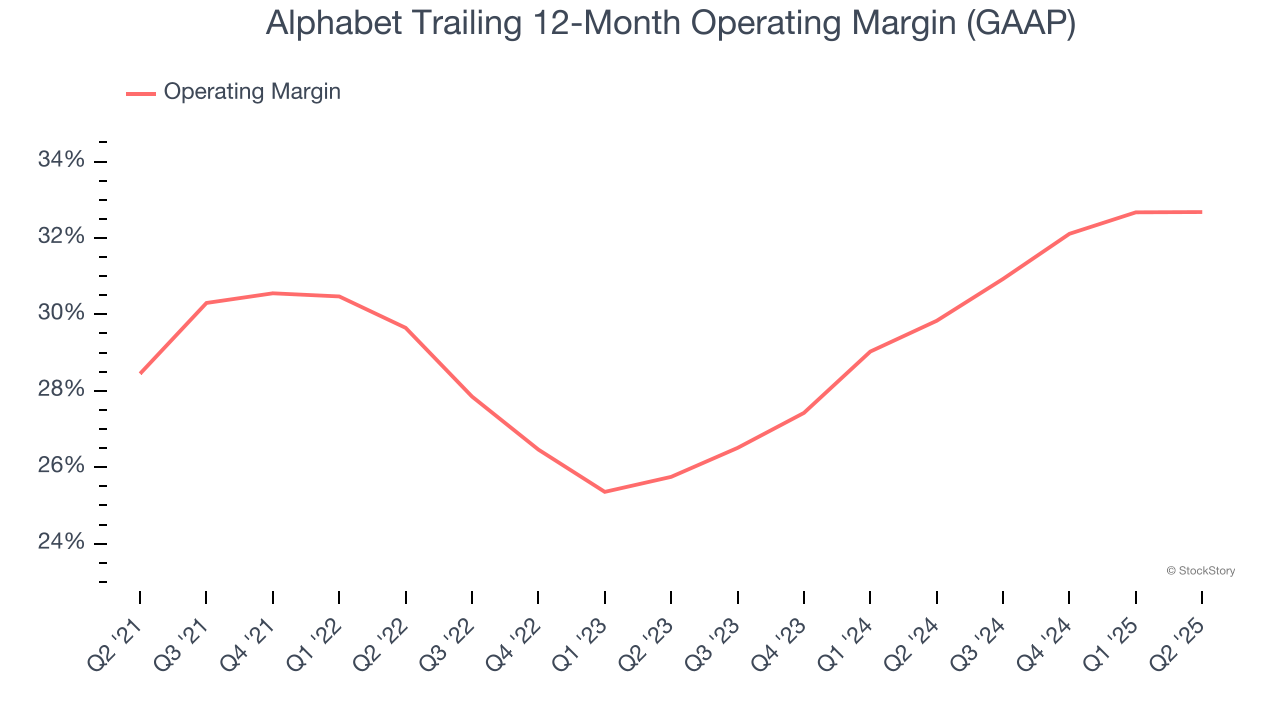

2. Operating Reveals a Well-Run Organization

Operating margin is the key profitability measure for Alphabet. It’s the portion of revenue left after accounting for all operating expenses – everything from the IT infrastructure powering online searches to product development and administrative expenses.

Alphabet has been a well-oiled machine over the last five years. It demonstrated elite profitability for a consumer internet business, boasting an average operating of 29.5%. A closer examination is required, however, because the company’s individual business lines have very different margin profiles.

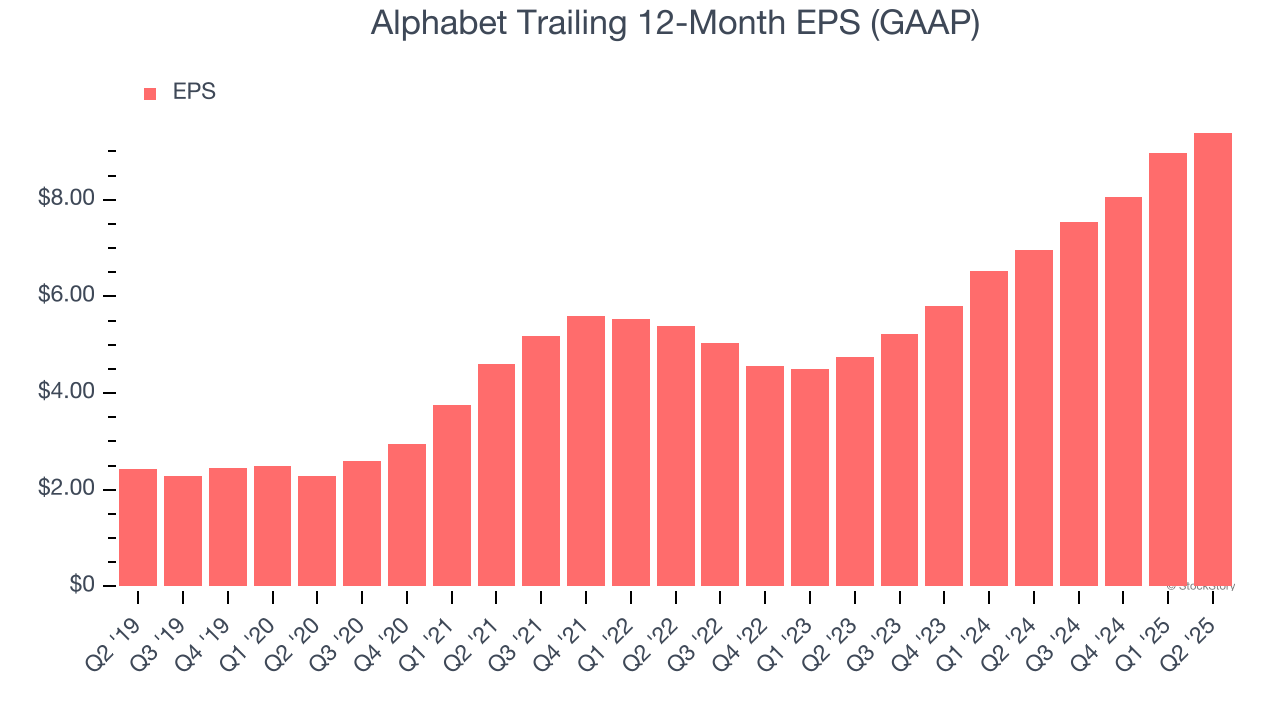

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it shows whether a company’s growth is profitable. It also explains how taxes and interest expenses affect the bottom line.

Alphabet’s EPS grew at an astounding 32.7% compounded annual growth rate over the last five years, higher than its 17.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons Alphabet is a rock-solid business worth owning, but at $203.55 per share (or 21.2× forward price-to-earnings), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Alphabet

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.