Vehicle systems manufacturer Commercial Vehicle Group (NASDAQ: CVGI) announced better-than-expected revenue in Q1 CY2025, but sales fell by 26.8% year on year to $169.8 million. The company expects the full year’s revenue to be around $675 million, close to analysts’ estimates. Its non-GAAP loss of $0.08 per share was 44.8% above analysts’ consensus estimates.

Is now the time to buy Commercial Vehicle Group? Find out by accessing our full research report, it’s free.

Commercial Vehicle Group (CVGI) Q1 CY2025 Highlights:

- Revenue: $169.8 million vs analyst estimates of $163.5 million (26.8% year-on-year decline, 3.8% beat)

- Adjusted EPS: -$0.08 vs analyst estimates of -$0.15 (44.8% beat)

- Adjusted EBITDA: $5.8 million vs analyst estimates of $2.19 million (3.4% margin, significant beat)

- The company dropped its revenue guidance for the full year to $675 million at the midpoint from $690 million, a 2.2% decrease

- EBITDA guidance for the full year is $24.5 million at the midpoint, below analyst estimates of $25.2 million

- Operating Margin: 0.8%, down from 3.5% in the same quarter last year

- Free Cash Flow was $11.21 million, up from -$7.42 million in the same quarter last year

- Market Capitalization: $29.5 million

James Ray, President and Chief Executive Officer, said, “Our first quarter results demonstrate sequential improvement in margins and free cash flow. Cash generation and debt paydown remain key priorities for CVG, as we look to build on our strong free cash performance in the first quarter through further margin improvement, working capital reduction, and reduced capital expenditures. We are beginning to see the benefits of efforts made in 2024, including strategic divestments of non-core businesses, to transform CVG. These divestitures, as well as our priority on improving operational efficiency, have allowed us to streamline operations, lower our cost structure, and drive cash generation to pay down debt. Despite industry-wide and global macroeconomic headwinds, we are prioritizing strong execution from the top down within CVG focused on cost mitigation, margin improvement, and operational efficiency.”

Company Overview

Formed from a partnership between two distinct companies, CVG (NASDAQ: CVGI) offers various components used in vehicles and systems used in warehouses.

Sales Growth

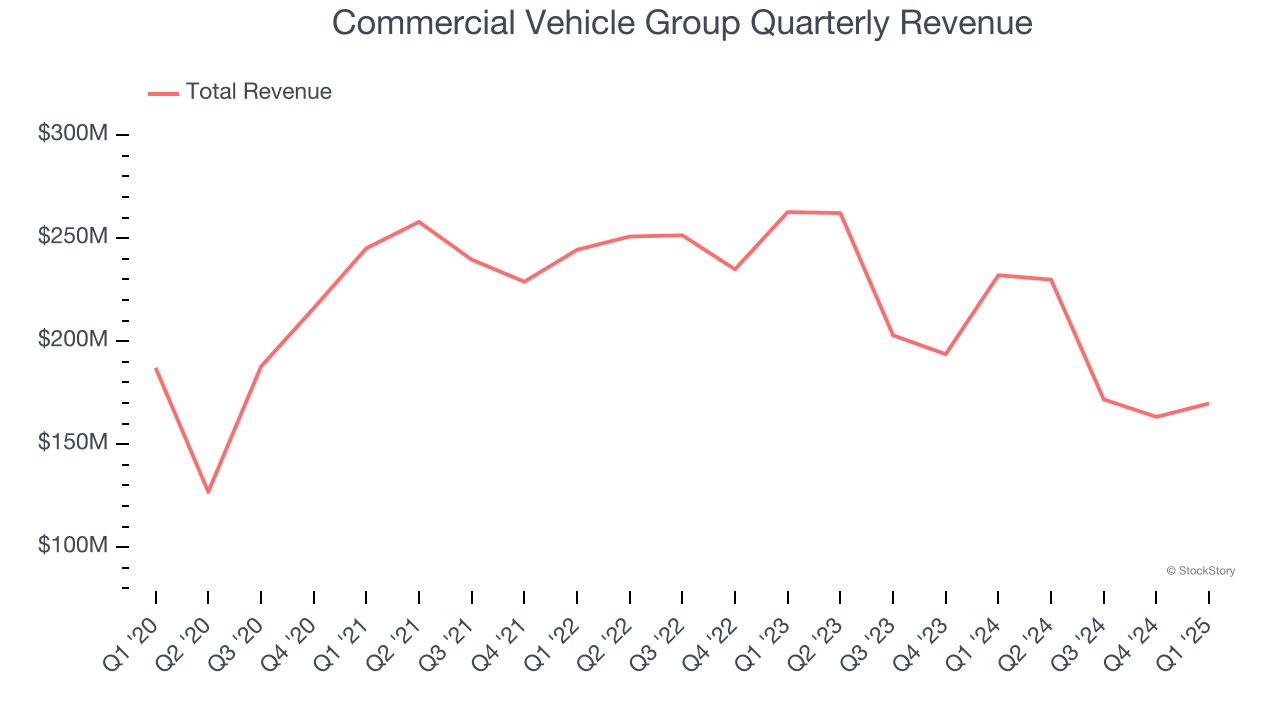

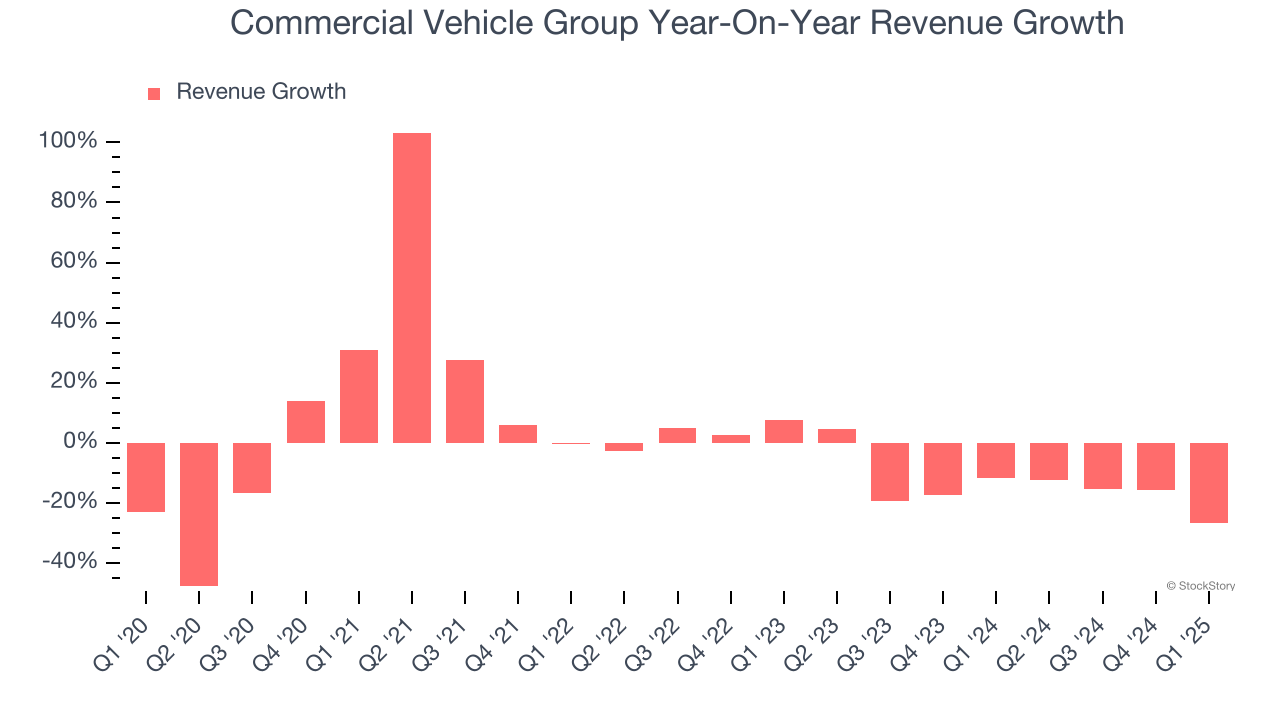

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Commercial Vehicle Group’s demand was weak and its revenue declined by 2.8% per year. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Commercial Vehicle Group’s recent performance shows its demand remained suppressed as its revenue has declined by 14.3% annually over the last two years.

This quarter, Commercial Vehicle Group’s revenue fell by 26.8% year on year to $169.8 million but beat Wall Street’s estimates by 3.8%.

Looking ahead, sell-side analysts expect revenue to decline by 6.7% over the next 12 months. While this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

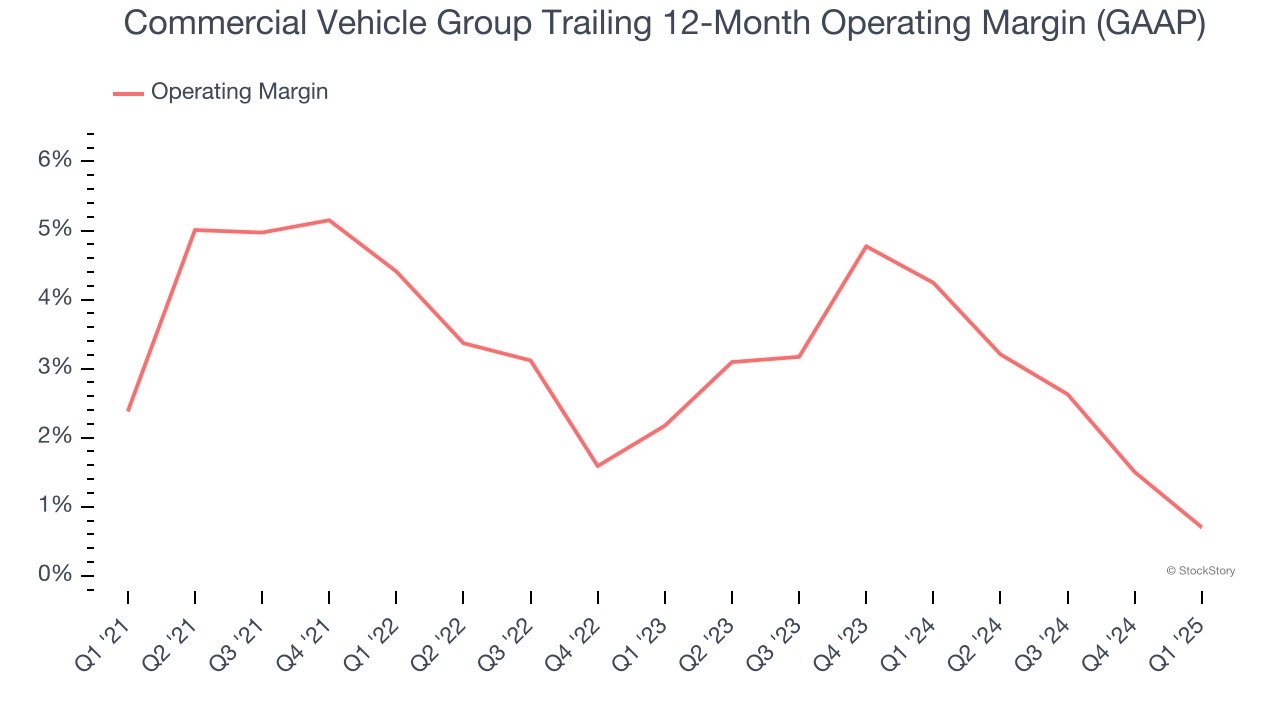

Commercial Vehicle Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.9% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Commercial Vehicle Group’s operating margin decreased by 1.7 percentage points over the last five years. Commercial Vehicle Group’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Commercial Vehicle Group’s breakeven margin was down 2.7 percentage points year on year. Since Commercial Vehicle Group’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

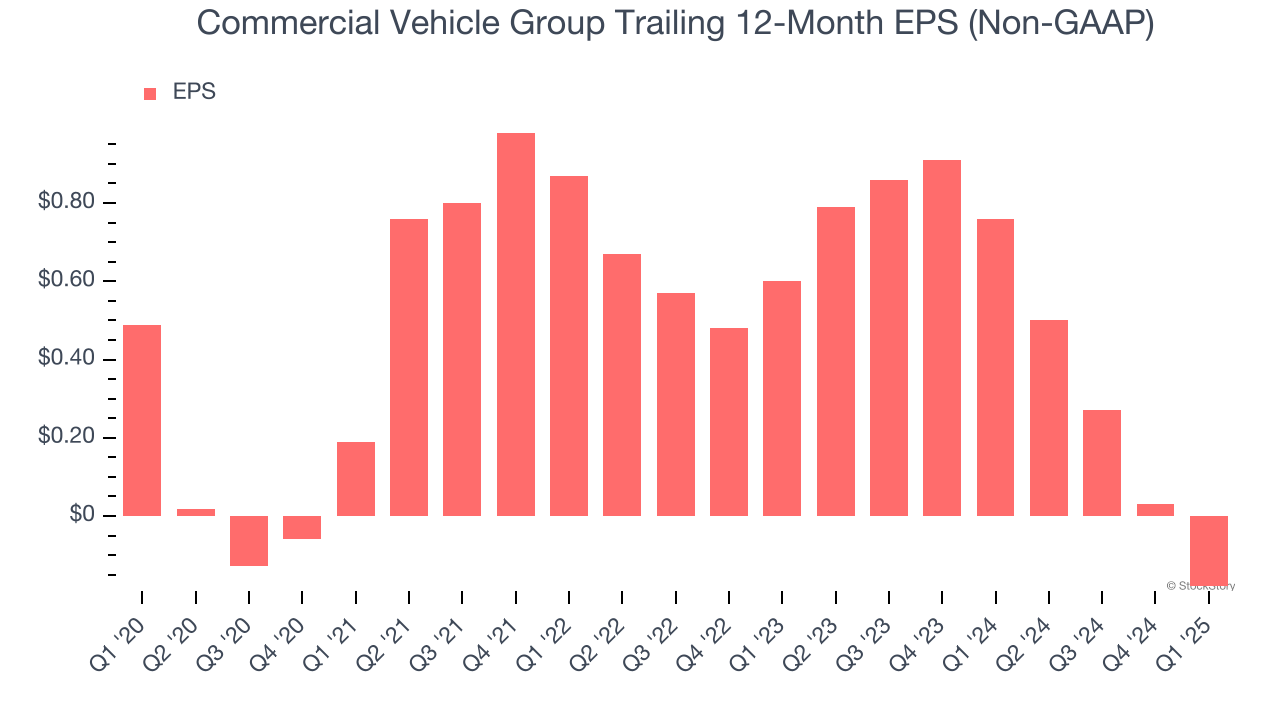

Sadly for Commercial Vehicle Group, its EPS declined by 18.8% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

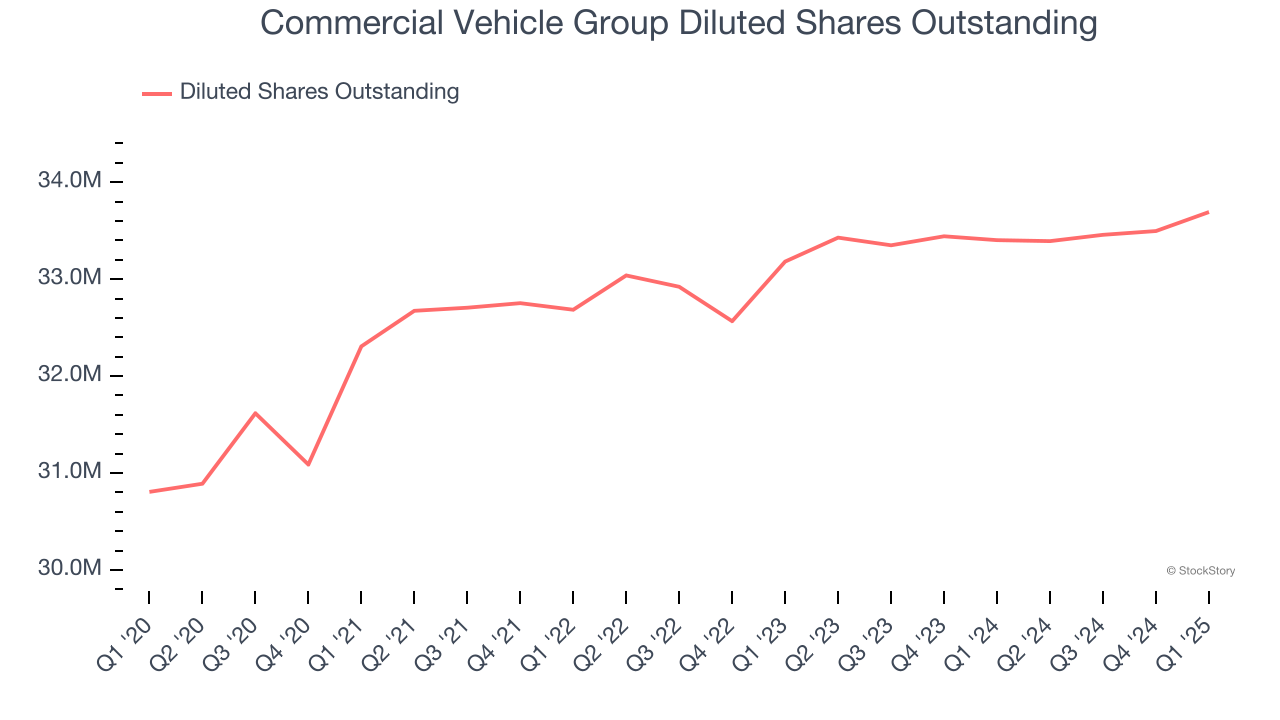

Diving into the nuances of Commercial Vehicle Group’s earnings can give us a better understanding of its performance. As we mentioned earlier, Commercial Vehicle Group’s operating margin declined by 1.7 percentage points over the last five years. Its share count also grew by 9.4%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Commercial Vehicle Group, its two-year annual EPS declines of 51.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q1, Commercial Vehicle Group reported EPS at negative $0.08, down from $0.13 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Commercial Vehicle Group’s full-year EPS of negative $0.18 will reach break even.

Key Takeaways from Commercial Vehicle Group’s Q1 Results

We were impressed by how significantly Commercial Vehicle Group blew past analysts’ EPS and EBITDA expectations this quarter. We were also excited its revenue outperformed. On the other hand, it lowered its full-year revenue and EBITDA guidance. Overall, we think this was a mixed quarter. The stock traded up 7.1% to $0.95 immediately after reporting.

Commercial Vehicle Group may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.