General merchandise retailer Target (NYSE: TGT) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 2.8% year on year to $23.85 billion. Its non-GAAP profit of $1.30 per share was 21.3% below analysts’ consensus estimates.

Is now the time to buy Target? Find out by accessing our full research report, it’s free.

Target (TGT) Q1 CY2025 Highlights:

- Revenue: $23.85 billion vs analyst estimates of $24.34 billion (2.8% year-on-year decline, 2% miss)

- Adjusted EPS: $1.30 vs analyst expectations of $1.65 (21.3% miss)

- Adjusted EBITDA: $2.29 billion vs analyst estimates of $1.77 billion (9.6% margin, 29% beat)

- Management lowered its full-year Adjusted EPS guidance to $8 at the midpoint, a 14% decrease

- Operating Margin: 6.2%, in line with the same quarter last year

- Free Cash Flow was -$515 million, down from $427 million in the same quarter last year

- Locations: 1,981 at quarter end, up from 1,963 in the same quarter last year

- Same-Store Sales fell 3.8% year on year, in line with the same quarter last year

- Market Capitalization: $44.58 billion

"In the first quarter, our team navigated a highly challenging environment and focused on delivering the outstanding assortment, experience and value guests expect from Target," said Brian Cornell, chair and chief executive officer of Target Corporation.

Company Overview

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE: TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $105.9 billion in revenue over the past 12 months, Target is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To accelerate sales, Target likely needs to optimize its pricing or lean into international expansion.

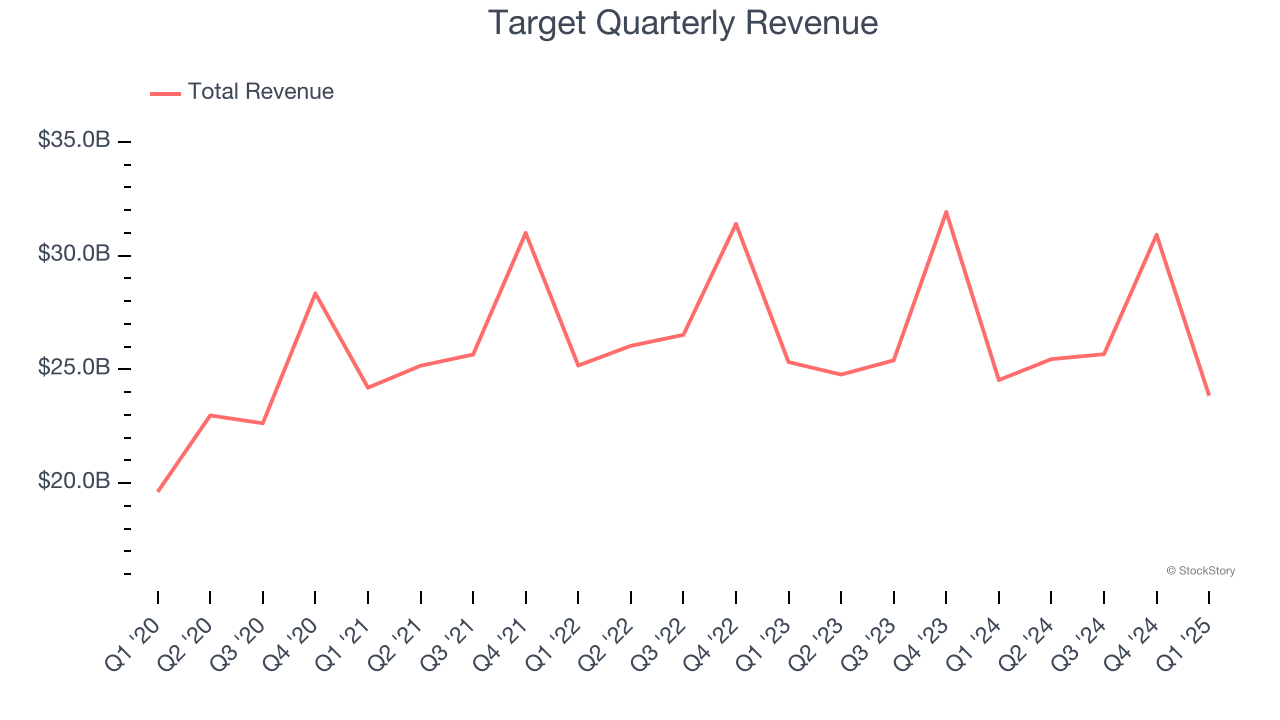

As you can see below, Target’s sales grew at a tepid 5.6% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new stores.

This quarter, Target missed Wall Street’s estimates and reported a rather uninspiring 2.8% year-on-year revenue decline, generating $23.85 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, a deceleration versus the last six years. This projection doesn't excite us and indicates its products will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

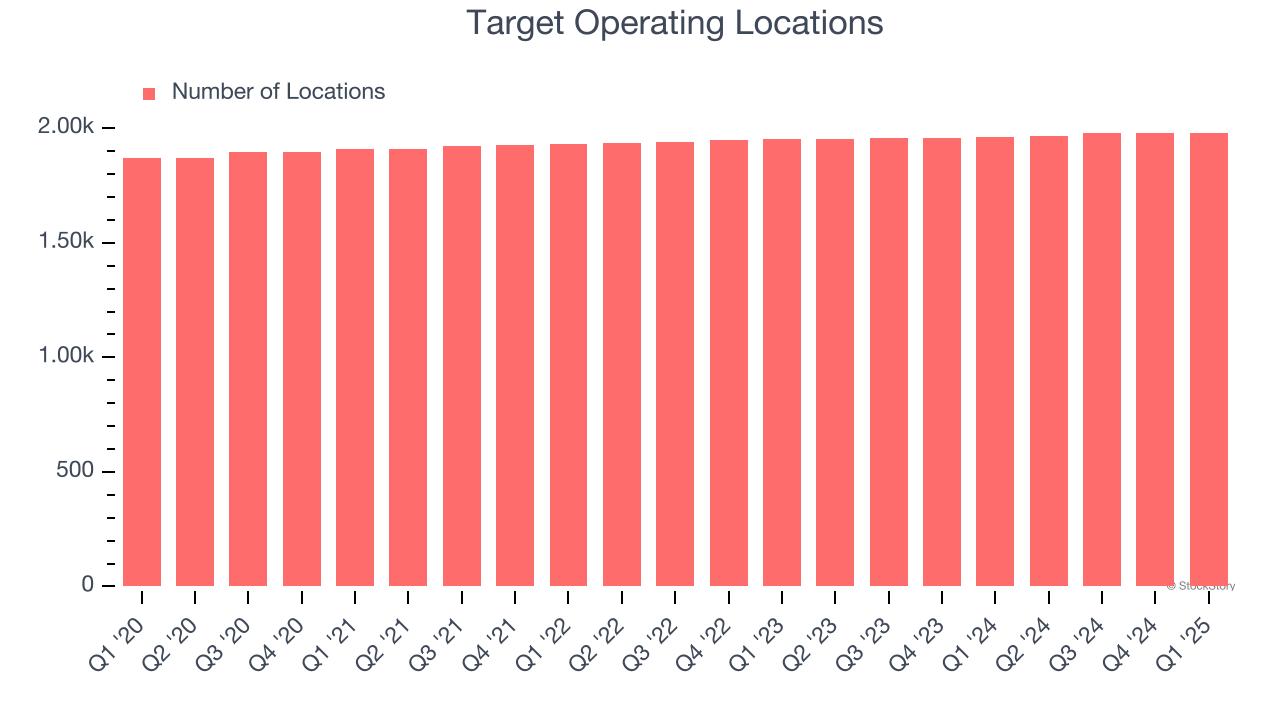

Target operated 1,981 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

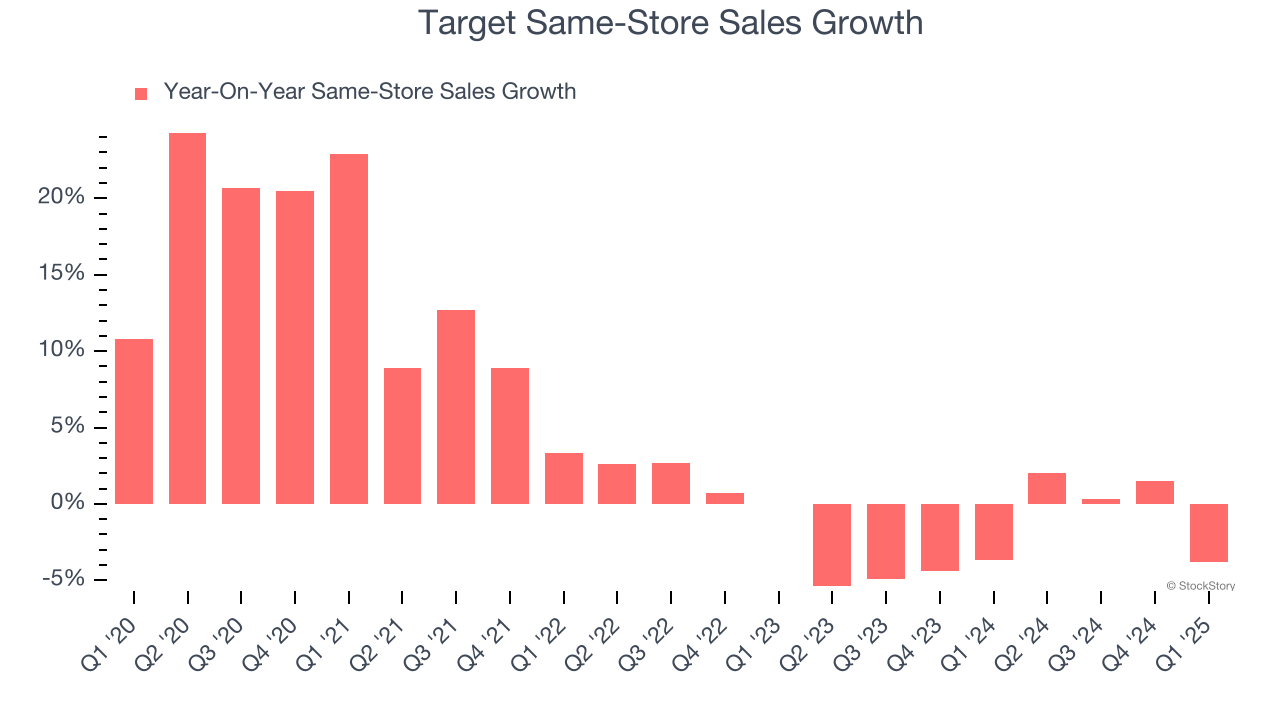

Target’s demand has been shrinking over the last two years as its same-store sales have averaged 2.3% annual declines. This performance isn’t ideal, and we’d be concerned if Target starts opening new stores to artificially boost revenue growth.

In the latest quarter, Target’s same-store sales fell by 3.8% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Target’s Q1 Results

We were impressed by how significantly Target blew past analysts’ EBITDA expectations this quarter. On the other hand, its full-year EPS guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $97.27 immediately after reporting.

Target’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.