Insight Enterprises has gotten torched over the last six months - since October 2024, its stock price has dropped 37.3% to $134.41 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Insight Enterprises, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why we avoid NSIT and a stock we'd rather own.

Why Do We Think Insight Enterprises Will Underperform?

With over 35 years of IT expertise and partnerships with more than 8,000 technology providers, Insight Enterprises (NASDAQ: NSIT) provides end-to-end digital transformation solutions that help businesses modernize their IT infrastructure and maximize the value of technology.

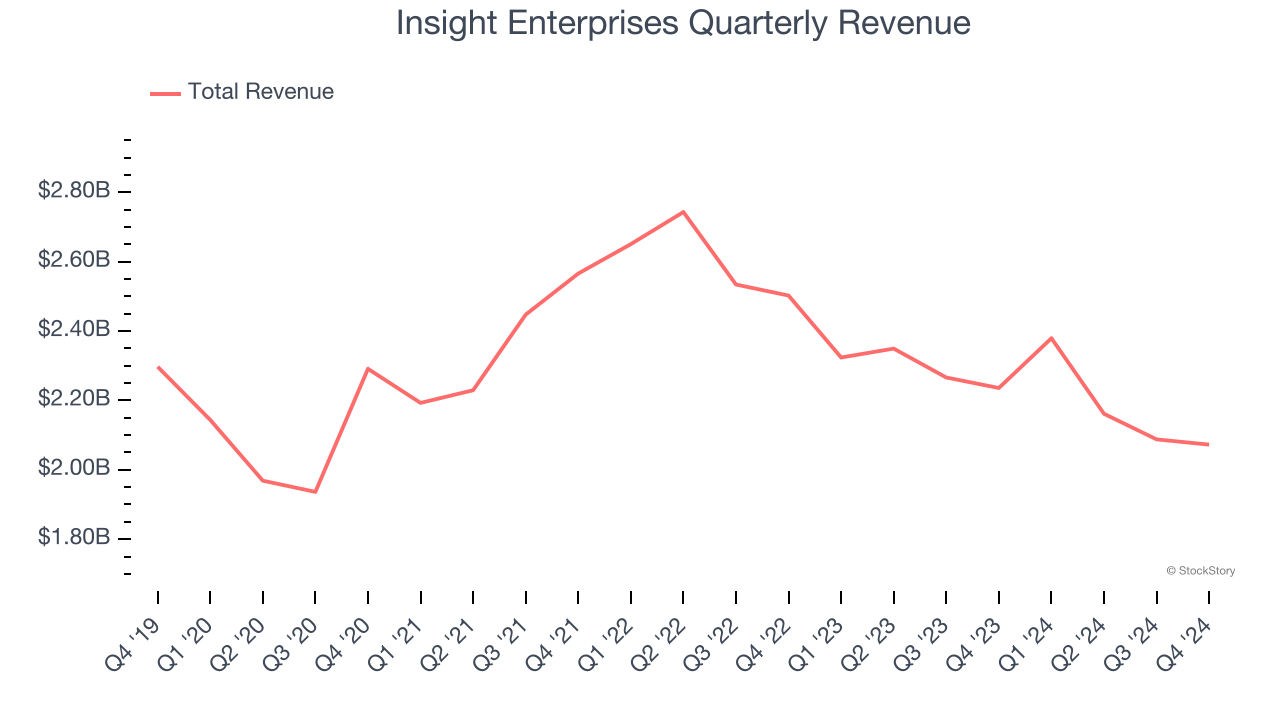

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Insight Enterprises’s sales grew at a sluggish 2.4% compounded annual growth rate over the last five years. This was below our standards.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Insight Enterprises’s revenue to rise by 1.3%. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

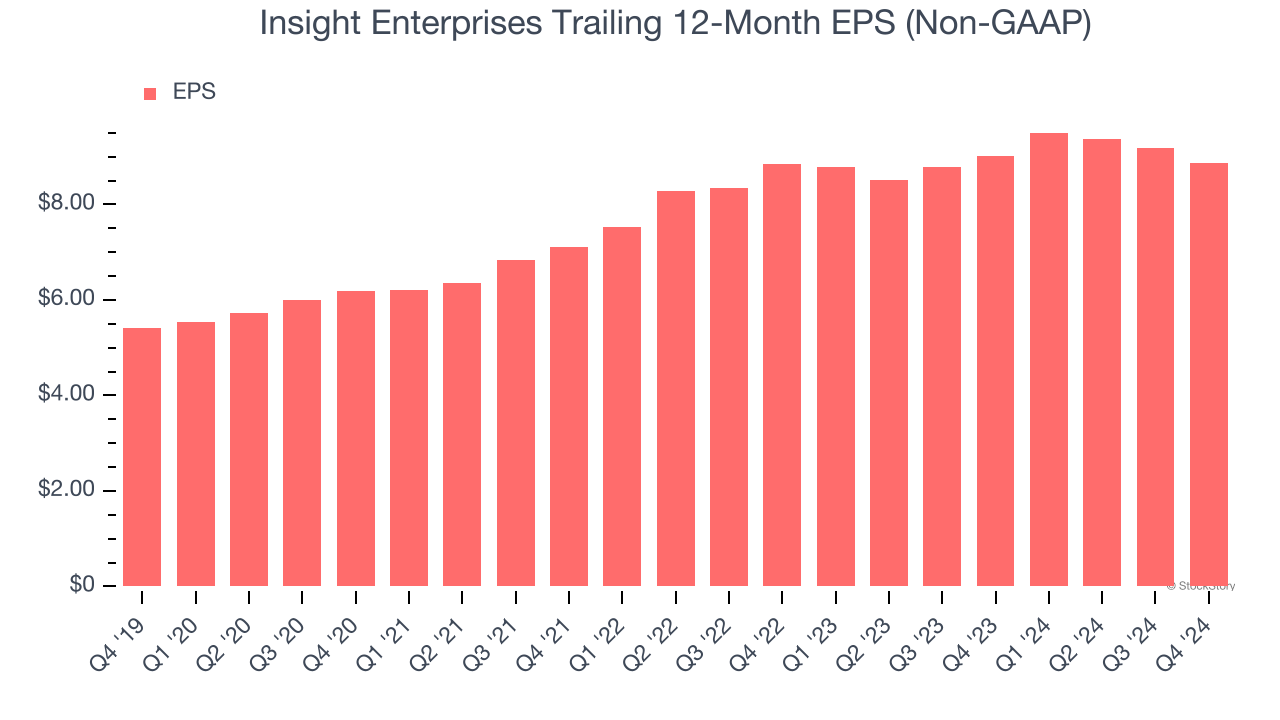

3. EPS Growth Has Stalled Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Insight Enterprises’s flat EPS over the last two years was weak. On the bright side, this performance was better than its 8.7% annualized revenue declines.

Final Judgment

Insight Enterprises falls short of our quality standards. Following the recent decline, the stock trades at 13.3× forward price-to-earnings (or $134.41 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Insight Enterprises

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.