Shareholders of Teleflex would probably like to forget the past six months even happened. The stock dropped 45.4% and now trades at $128.98. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Teleflex, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even though the stock has become cheaper, we don't have much confidence in Teleflex. Here are three reasons why TFX doesn't excite us and a stock we'd rather own.

Why Is Teleflex Not Exciting?

With a portfolio spanning from vascular access catheters to minimally invasive surgical tools, Teleflex (NYSE: TFX) designs, manufactures, and supplies single-use medical devices used in critical care and surgical procedures across hospitals worldwide.

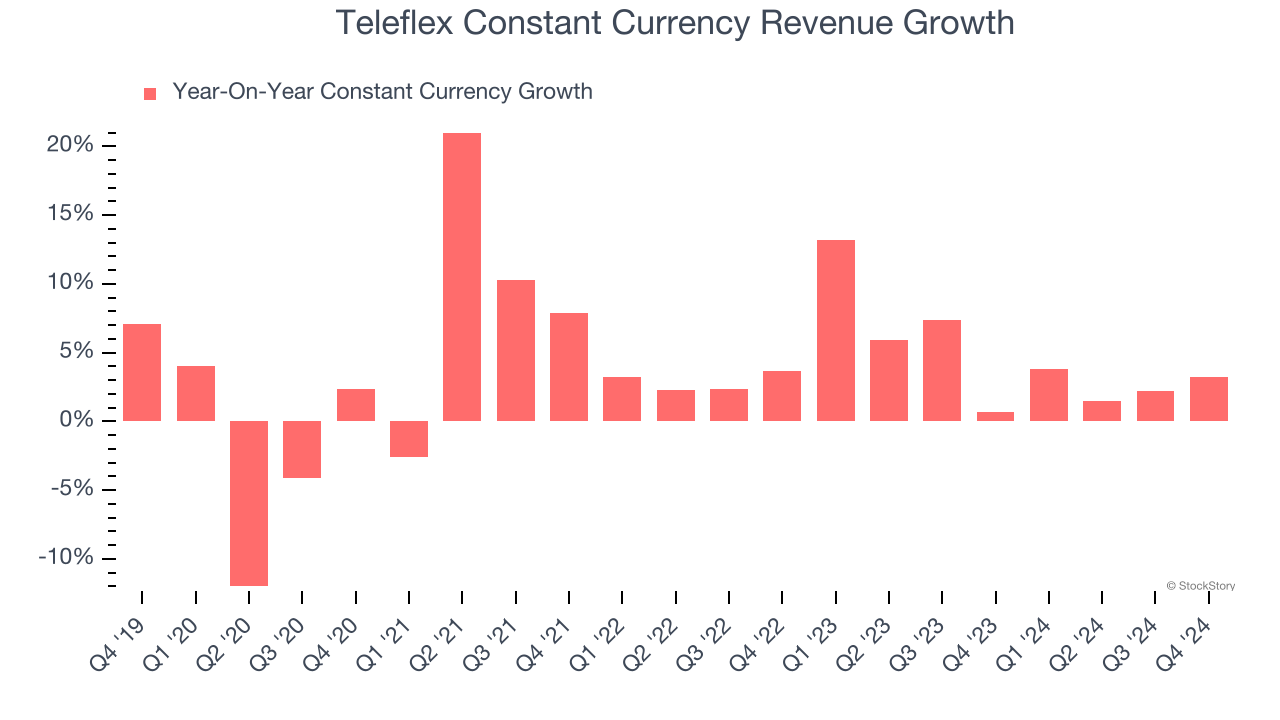

1. Weak Constant Currency Growth Points to Soft Demand

Investors interested in Surgical Equipment & Consumables - Specialty companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Teleflex’s control and are not indicative of underlying demand.

Over the last two years, Teleflex’s constant currency revenue averaged 4.7% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Teleflex’s revenue to stall, a deceleration versus its 4.7% annualized growth for the past two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

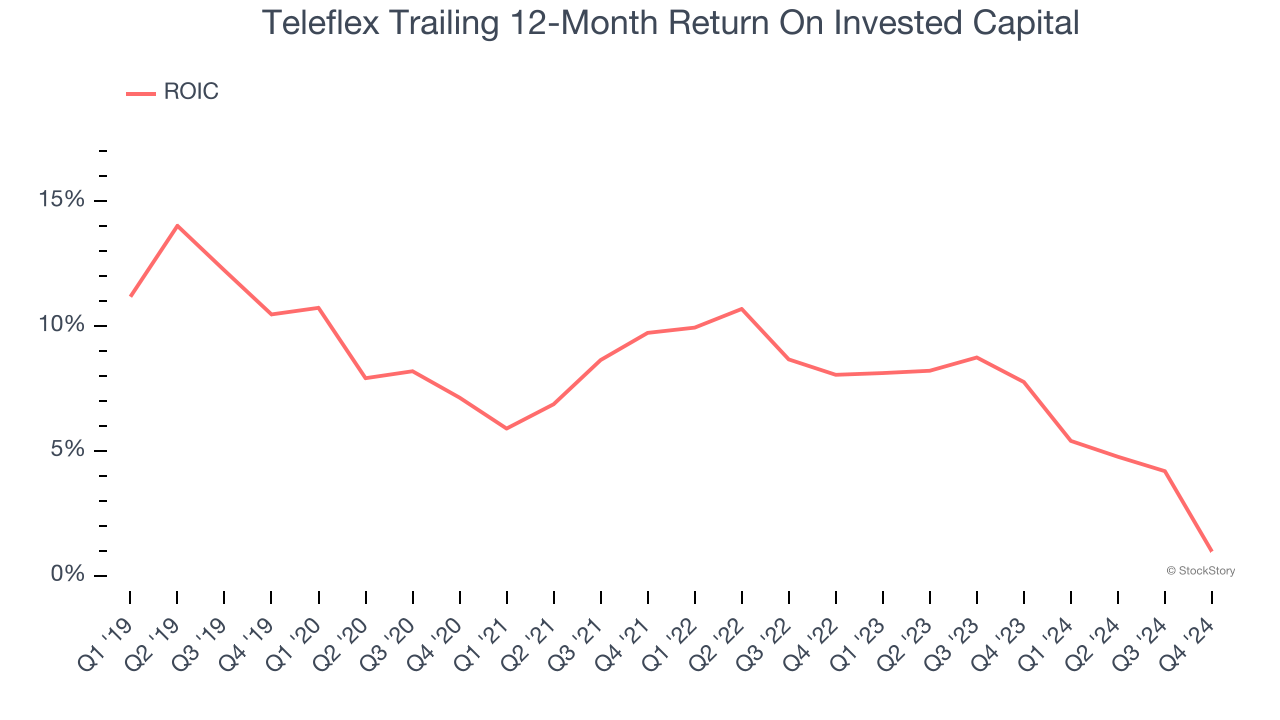

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Teleflex’s ROIC averaged 4.1 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Teleflex’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 8.5× forward price-to-earnings (or $128.98 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Teleflex

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.