What a brutal six months it’s been for Compass Diversified. The stock has dropped 21.4% and now trades at a new 52-week low of $5.52, rattling many shareholders. This might have investors contemplating their next move.

Is now the time to buy Compass Diversified, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is Compass Diversified Not Exciting?

Even though the stock has become cheaper, we're cautious about Compass Diversified. Here are three reasons we avoid CODI and a stock we'd rather own.

1. Lackluster Revenue Growth

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Compass Diversified’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

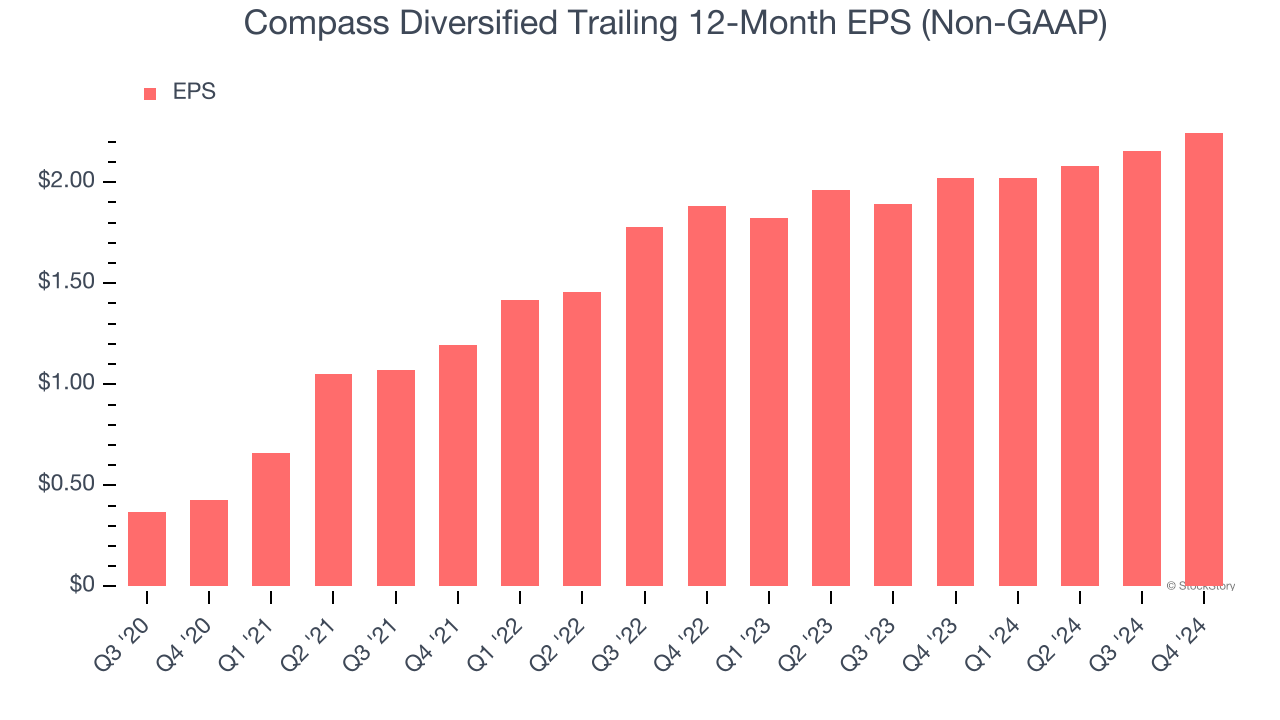

2. Recent EPS Growth Below Our Standards

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Compass Diversified’s EPS grew at an unimpressive 9.2% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 1.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

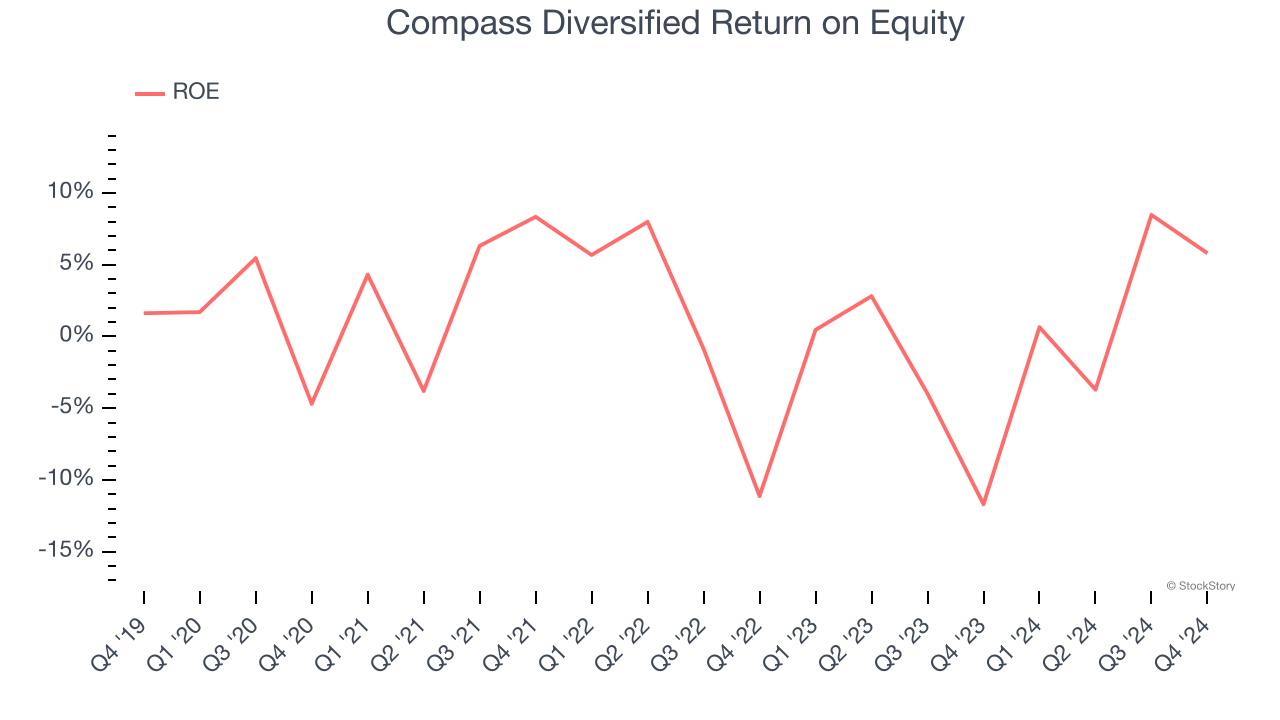

3. Previous Growth Initiatives Haven’t Paid Off Yet

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Compass Diversified has averaged an ROE of 1%, uninspiring for a company operating in a sector where the average shakes out around 10%.

Final Judgment

Compass Diversified isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 2.3× forward P/E (or $5.52 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Compass Diversified

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.