While the broad oil-and-gas industry continues to rally, Targa Resources Corp. (NYSE: TRGP), Chesapeake Energy Corp. (NASDAQ: CHK), and EQT Corp. (NYSE: EQT) are standouts when it comes to institutional buying. All three recently increased their dividends, giving investors some extra incentive on top of rising share prices.

The energy sector has easily been the best performer over the past 12 months, with the

Energy Select Sector SPDR Fund (NYSEARCA: XLE) returning 12.35% on a one-year basis. It’s the only sector with a positive one-year return. Although energy stocks as a whole skidded slightly over the past month, the uptrend doesn’t appear to be over, with the broad sector returning 8.83% in the past week, given a boost by OPEC+'s surprise announcement that it would cut oil production.

For any stock to notch significant price gains, it’s imperative that institutional investors are buying. Even a well-heeled individual investor can’t generally buy enough shares in an institutional quality stock to move the needle on the price. Institutional investors including mutual funds, banks, hedge funds, university endowments, pension funds, and insurance companies, are among some of the largest buyers.

Not only is it impractical for an individual to amass a huge block of shares in any company, but federal regulation requires that any owner of more than 5% of a class of equity securities (such as common shares or preferred shares) in a publicly traded company file a report with the Securities and Exchange Commission.

High trading volume means it’s the institutions, not you or your friends and neighbors, who are pushing the price either higher or lower.

Targa Resources

Shares of the Houston-based midstream operator have been trending gradually higher in recent months, as you can see on Targa’s chart.

It’s not unusual to see a slow trajectory like this, as institutions can take days, weeks, or even months to accumulate a position in a stock. They will also add shares over time when they have conviction about the company’s prospects.

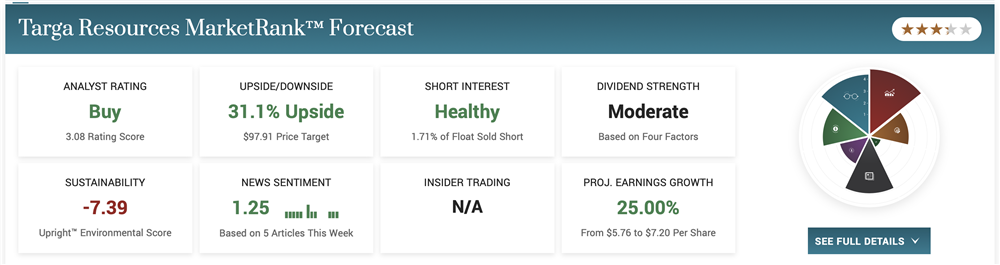

MarketBeat data on Targa’s institutional investors show that 88.29% of shares are held by institutions. 402 institutional buyers accounted for $4.58 billion in inflows in the past 12 months, versus 267 institutional sellers accounting for $2.07 billion in outflows.

Targa Resources specializes in midstream energy services, meaning the company gathers, processes, stores, and transports natural gas, crude oil, and natural gas liquids from production areas to end markets.

The company earned $3.89 a share last year, and Wall Street sees net income increasing by 40% this year and another 11% in 2024. The stock’s dividend yield is 1.88%.

Chesapeake Energy

The oil-and-gas exploration and production giant has been in rally mode since rebounding from a March 16 low of $69.68.

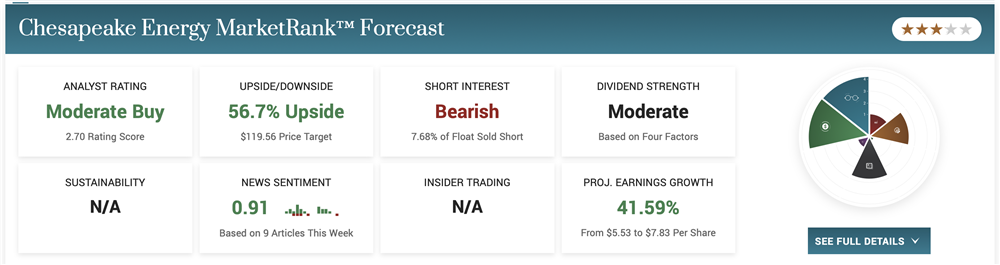

Institutional ownership figures show 379 institutions invested $6.40 billion in the stock in the past 12 months; meanwhile, 181 institutions unloaded $3.83 billion worth of shares. That’s exactly the kind of imbalance you want to see.

Chesapeake’s dividend yield is 2.86%. The company increased the payout significantly in 2022.

Oklahoma City-based Chesapeake uses advanced drilling technologies, including fracking, to extract oil and gas from underground reservoirs. Its operations are focused primarily on shale gas and oil in the Appalachian Basin. It’s made an effort to maintain safe, environmentally responsible operations, implementing measures to minimize the potential risks associated with fracking.

The company emerged from Chapter 11 bankruptcy in February 2021, when you’ll see shares beginning to trade on Chesapeake’s chart. The stock was delisted in June 2020 but began trading again after financial restructuring.

Analysts see a triumphant return for the company, with a consensus rating of “moderate buy” and a price target of $118.70, representing an upside of 55.24%.

EQT

Like Chesapeake, EQT has been rallying back from a mid-March low. Analysts expect the company to increase earnings by 12% this year and by 53% in 2024.

Pittsburgh-based EQT is a natural gas producer, focusing on exploration, development, and production in the U.S. The company operates primarily in the Appalachian Basin, one of the largest natural gas fields in the country.

The company’s dividend yield is 1.89%. In December 2021, it restored its dividend after suspending it in March 2020 to focus on paying down debt. The current quarterly dividend per share is $0.60, which was increased by 20% in July 2022.

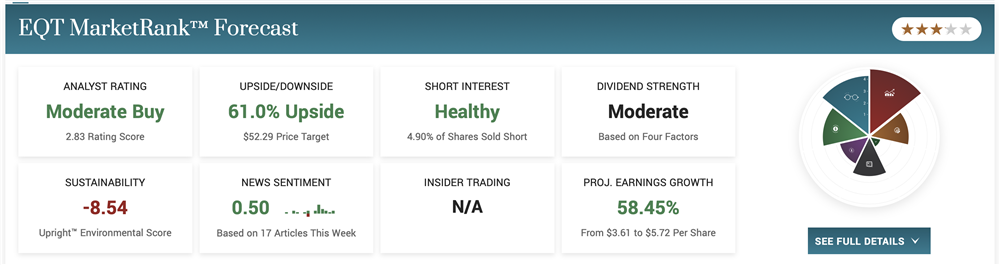

MarketBeat’s institutional ownership data for EQT show a whopping 97.60% of shares held by institutions. That’s a good sign that sophisticated investors have conviction in the stock. Management owns 1% of shares.

In the past 12 months, 461 institutions accounted for $3.30 billion in inflows, while 232 institutions accounted for $2.62 billion in outflows.

According to MarketBeat analyst data for EQT, the consensus rating on the stock is “moderate buy,” with a price target of $52.29, an upside of 62.30%.