Not every opportunity shows up as a breakout. Sometimes it shows up the other way around: when stocks go into oversold territory, not because the business is broken, but because it's a symptom of something else.

That’s the kind of setup I watch closely. Dividend stocks, whether they are Aristocrats, Kings, or newer income names, can offer a comfortable balance between downside support and upside potential, especially when they trade near their recent lows. The tricky part is finding the stocks that fit this narrative.

With that in mind, I ran a screen focused on oversold dividend stocks while still meeting basic quality and income standards.

How I came up with the following stocks

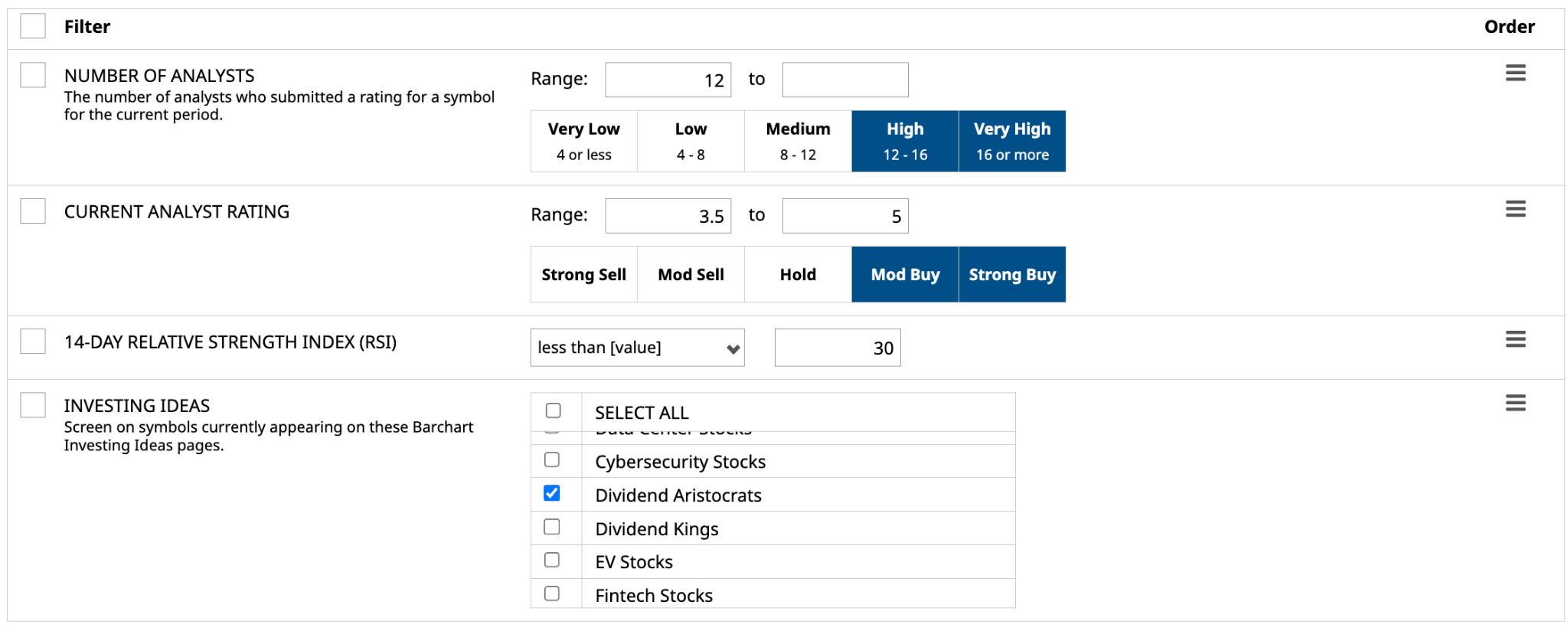

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- 14-Day Relative Strength Index (RSI): Less than 30. RSI below this level suggests that the stock is “oversold”.

- Number of Analysts: 12 or more. The more analysts, the stronger the confidence in the consensus.

- Current Analyst Rating: Moderate to Strong Buy.

- Dividend Investing Ideas: Dividend Aristocrats

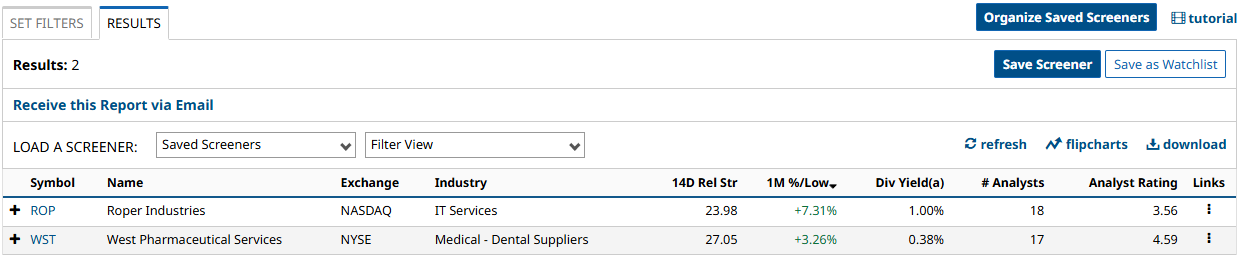

I ran the screen and got 2 results. I will cover the company that’s most oversold- it also has the highest annual forward dividend yield of the group.

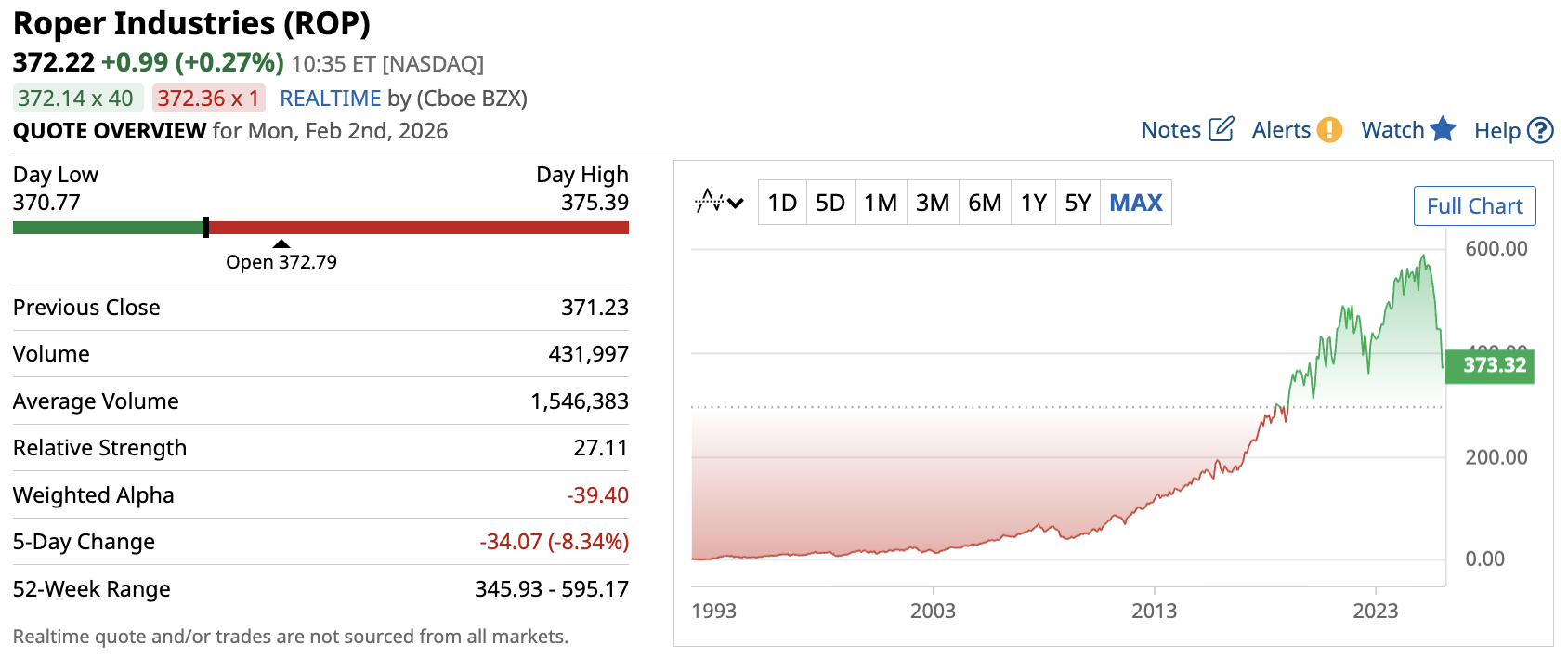

Roper Industries (ROP)

Roper Industries is a technology company known for its diversification, in that it acquires software and other tech companies. Think of it less as a manufacturer like Apple and Tesla, and more of a conglomerate like Berkshire Hathaway, but focused on niche software.

Like many companies today, Roper is expanding its footprint through AI-driven enhancements across its portfolio. I’ll get to that in more detail later.

Roper Industries stock trades with an RSI of 23.98, which firmly places it in “oversold” territory (below 30). Even so, the stock has rebounded 7.31% from its one-month low, and to me, this looks like a stock where selling pressure is starting to cool off, and a bullish reversal may be taking shape.

Meanwhile, the company’s most recent quarterly financials reported that sales rose 14% to $2 billion. Its net income was also up 8% to $399 million.

Roper Industries is a Dividend Aristocrat that has paid consistently increasing dividends for 33 consecutive years. Today, it pays a forward annual dividend of $3.64, yielding approximately 1%. For me, the appeal is not just the dependable dividend but also the potential upside, given where the stock is trading and what may be ahead.

Speaking of what’s next, I am sure you’ve already heard of the hype around companies adopting AI, and Roper is certainly one of them. Instead of chasing headlines, the company is taking a practical approach by integrating AI into the software its customers already rely on- every single day. It's called vertical AI, where tools are designed for specific industries like healthcare, logistics, and niche business software, areas where Roper already has experience and long-standing customer relationships. So you could say Roper is leveraging AI as a way to make its products more valuable and harder to replace, quietly supporting growth over time.

But here comes the bigger risk: execution. The company’s success depends on continuing to deploy capital wisely, integrate acquisitions effectively, and ensure AI enhancements actually deliver value rather than adding complexity across its portfolio.

Despite this, 18 analysts rate the stock a consensus “Moderate Buy,” and it has as much as 48% upside potential over the next year should it reach its high target of $550.

Final thoughts

There you have it, the most oversold Dividend Stock on my list. This kind of stock is something I keep on my radar: coming off oversold levels, the business fundamentals remain solid, and the dividend provides some comfort while waiting for sentiment to shift, exactly where I see opportunity lies.

But again, this is not about calling a bottom or predicting a straight move higher. It is about recognizing when quality companies trade at levels that deserve a closer look. Roper Industries fits that narrative right now.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart