Markets are finally widening beyond the high-flying tech crowd. Since 2026 has kicked off, cyclical areas, industrials, healthcare, and small caps have outperformed, while the tech-heavy indexes have cooled. The so-called “Magnificent Seven,” including Apple (AAPL), still account for a large share of market value and are forecast to grow earnings far faster than the rest of the index. The current rotation has investors questioning whether Apple’s premium valuation is justified.

For example, Morgan Stanley notes the S&P 500’s ($SPX) median stock P/E is 19× versus 22× for the cap-weighted index. In other words, the biggest names carry higher valuations, and recent sector strength outside tech is prompting re-evaluations.

That’s why Evercore’s upgrade of Apple to a tactical “Outperform” ahead of Q4 matters. The firm cites stronger-than-expected iPhone demand, a shift toward higher-end models, and minimal cost pressure from memory prices.

With several analysts now modeling results above consensus, Apple looks poised for a meaningful move around earnings, one way or the other.

Apple Reclaims Top Spot

Apple is a tech giant known for products like the iPhone, iPad, and Mac, alongside a vast services platform like the App Store, iCloud, etc. Its device-service ecosystem deepens customer loyalty and recurring revenue, bolstering profit margins and resilience in competitive markets.

The tech giant recently made a huge headline by reclaiming the No. 1 spot in China’s smartphone market. iPhone shipments jumped 28% year-on-year (YoY) in the holiday quarter, underscoring robust demand for its high-end phones.

Moreover, the company also announced that J.P. Morgan Chase (JPM) will take over the Apple Card from Goldman Sachs (GS), a shift expected to stabilize that payments revenue stream. These developments highlight Apple’s broad growth engines, from strong hardware sales in Asia to a deepening software/services ecosystem.

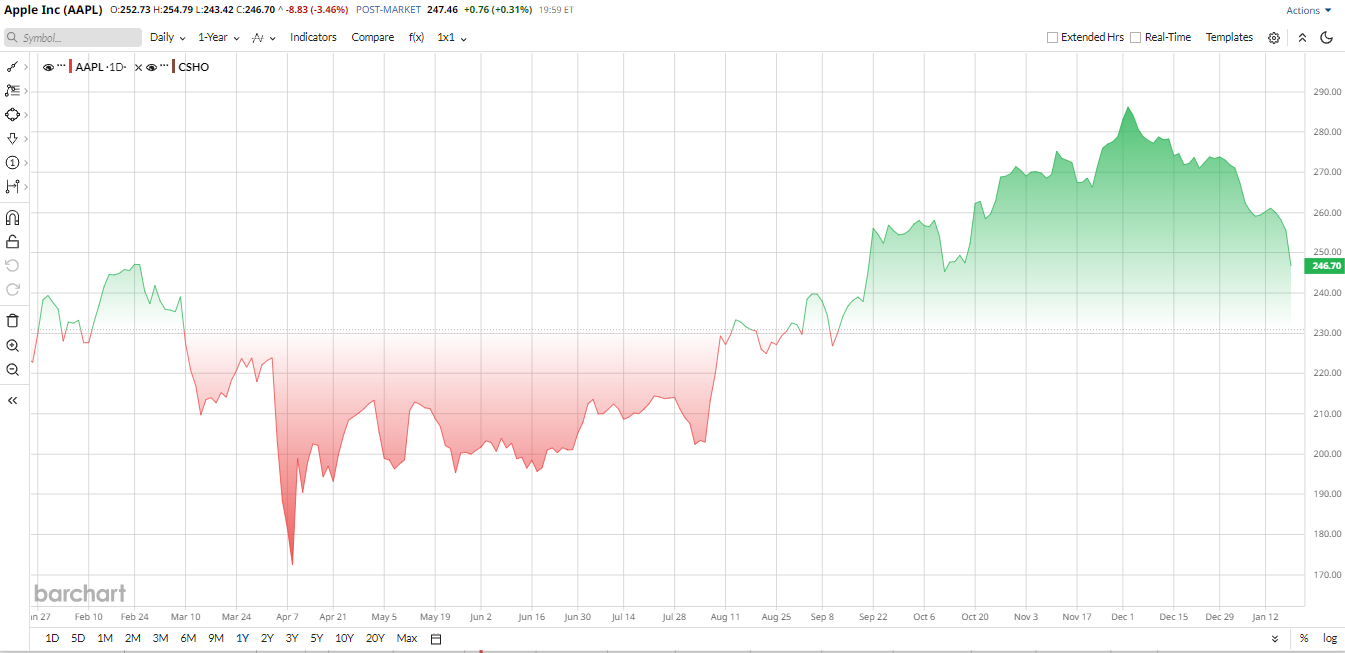

Valued at $3.75 trillion with a hefty market cap, Apple’s stock climbed only about 7% over the past year, well under the S&P 500’s 16% advance. Analysts attribute the lag to broad profit-taking in mega-cap tech and Apple’s relatively lower spending on AI projects versus some peers.

On valuation, Apple’s stock isn’t cheap. Its price-to-book ratio stands at 51, vastly higher than the sector median of 4, reflecting a very expensive stock. Additionally, its EV/Sales ratio of 9 is notably above the sector median of 4, indicating overvaluation. Apple looks fairly valued to richly priced given its growth profile and ample cash flows.

What to Expect From the Upcoming Report

Apple will report fiscal Q1 2026 results on Jan. 29 after the market closes, with Tim Cook and CFO Kevan Parekh hosting a conference call at 5 pm ET. Management had already flagged this quarter as “record-breaking.”

Investors will zero in on iPhone unit sales, especially the new iPhone 17 lineup, and services growth. Apple has also disclosed it will incur about $1.4 billion in tariffs during the quarter, so gross margins and inventory trends will be closely watched.

Because Apple no longer provides full-quarter guidance, analysts will also parse management’s commentary on-demand trends and supply-chain pressures in the Q&A for clues to the 2026 outlook.

Analysts expect Apple’s fiscal Q1 results to show about $2.65 EPS on roughly $138.3B revenue and full-year FY2026 EPS around $8.13, reflecting Services strength and iPhone-17 momentum.

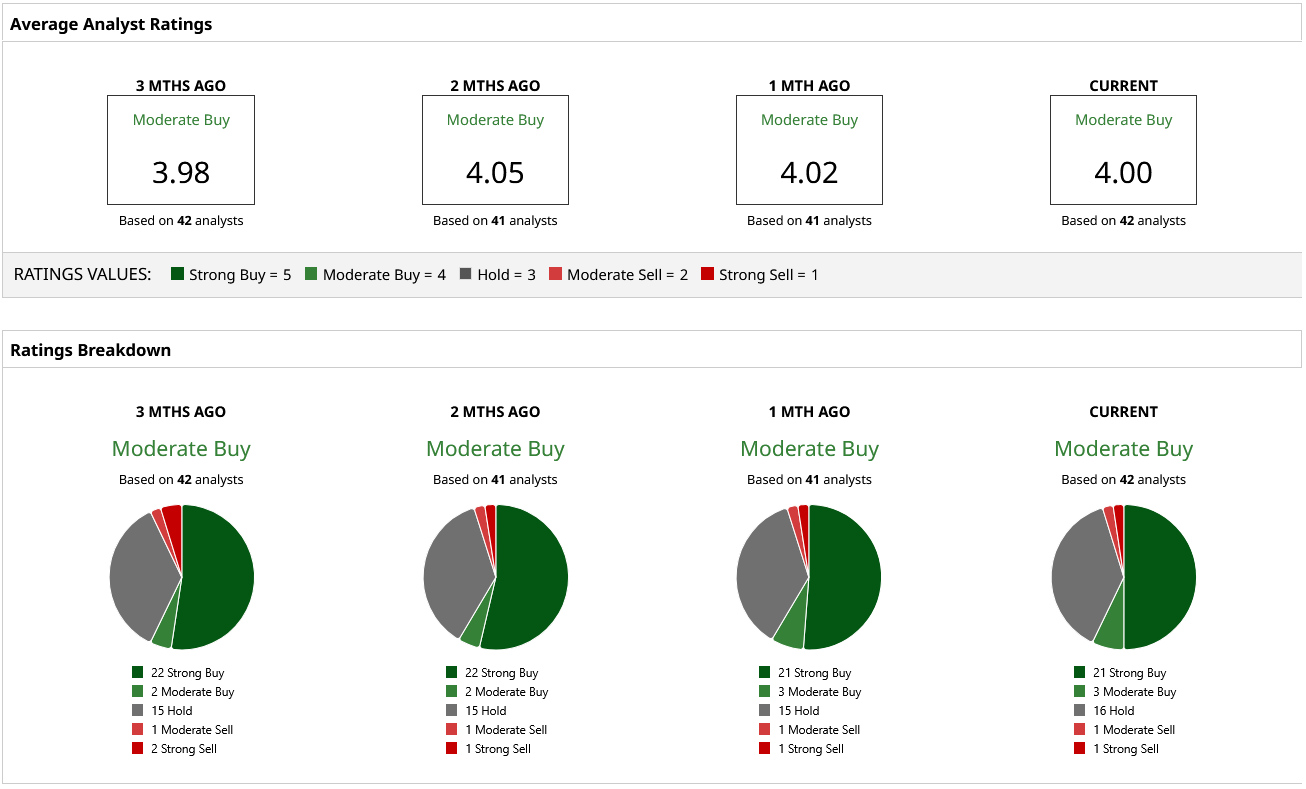

What Do Analysts Say About APPL Stock

Wall Street is still very positive on Apple, though the price targets may vary among companies. This week, Evercore ISI included the stock on its “Tactical Outperform” list before the Jan. 29 earnings announcement and made Apple its best stock of 2026 again. The firm is currently maintaining a price target of $330, demonstrating quarterly returns of approximately $140.5 billion and EPS of 2.71, both higher than Wall Street's estimates. Evercore also expects a strong cycle of products and ongoing impetus in more up-end iPhone formats and services.

On the other hand, Citi analyst Atif Malik has remained positive with a “Buy” rating and reduced the target to $315. He is still anticipating Apple to show better than expected results, even with a slight strain of increased memory prices and tariffs.

Elsewhere, Morgan Stanley increased its target to $315 and retained Apple as a core “Overweight” investment, citing growth prospects in 2026. Goldman Sachs, in turn, reiterated a “Buy” rating and a $320 target and considered the recent pullback a possible entry point ahead of further iPhone strength.

Overall, it's a consensus “Moderate Buy” with a mean price target of $290, implying almost 20% upside potential.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart