Industrial manufacturer Standex (NYSE: SXI) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 16.6% year on year to $221.3 million. Its non-GAAP profit of $2.08 per share was 4.7% above analysts’ consensus estimates.

Is now the time to buy Standex? Find out by accessing our full research report, it’s free.

Standex (SXI) Q4 CY2025 Highlights:

- Revenue: $221.3 million vs analyst estimates of $219.7 million (16.6% year-on-year growth, 0.7% beat)

- Adjusted EPS: $2.08 vs analyst estimates of $1.99 (4.7% beat)

- Operating Margin: 16.1%, up from 13.6% in the same quarter last year

- Free Cash Flow Margin: 5.9%, up from 1.1% in the same quarter last year

- Market Capitalization: $2.93 billion

Commenting on the quarter's results, President and Chief Executive Officer David Dunbar said, "We delivered strong top-line results and operating performance in the fiscal second quarter. Our sales increased 16.6% year-on-year to $221.3 million driven by 7% contribution from new products and 28% contribution from sales into fast growth markets. We recorded 6.4% organic growth and book to bill of 1.04, led by our Electronics segment which grew 11.1% organically with book to bill of 1.08. We are well positioned to deliver mid-to-high single digit organic growth in the fiscal third quarter, primarily driven by new product launches, strong tailwinds in the electrical grid, defense and aviation end markets, and improving general industrial markets. Sales from fast growth markets totaled approximately $61 million in the fiscal second quarter and are expected to exceed $270 million in fiscal year 2026.

Company Overview

Holding over 500 patents globally, Standex (NYSE: SXI) is a manufacturer and distributor of industrial components for various sectors.

Revenue Growth

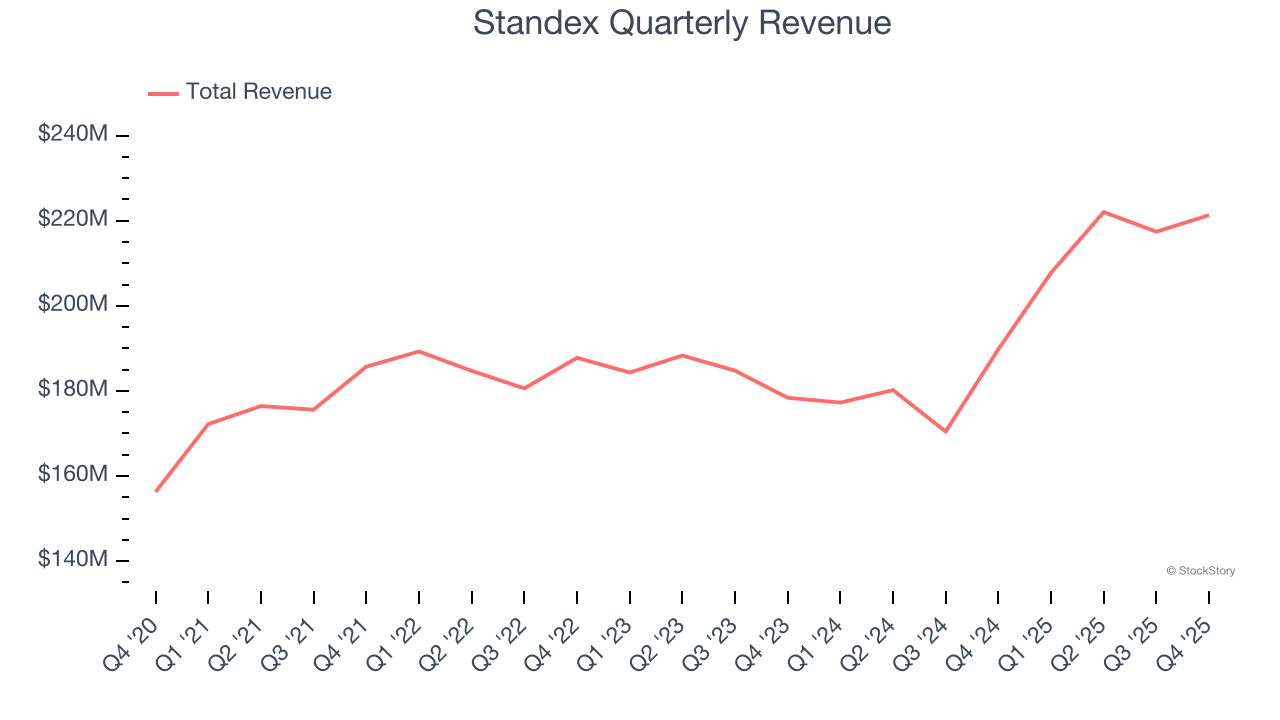

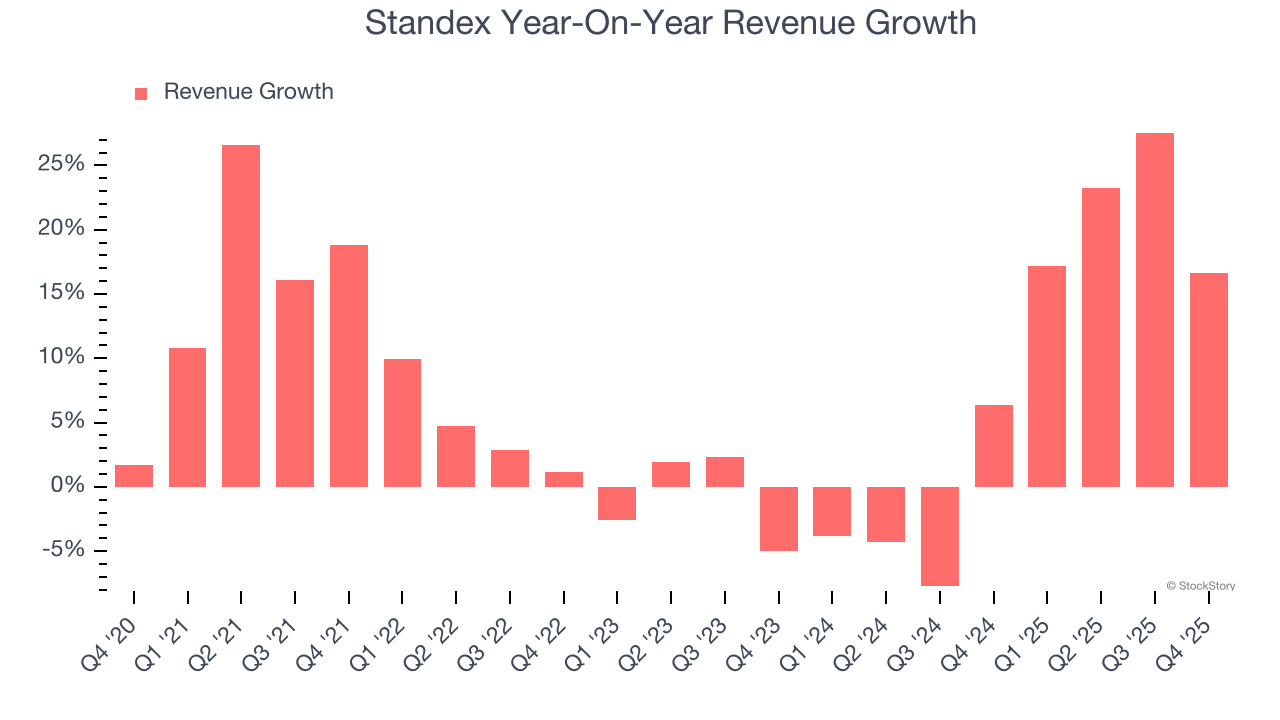

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Standex grew its sales at a decent 7.6% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Standex’s annualized revenue growth of 8.6% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Standex reported year-on-year revenue growth of 16.6%, and its $221.3 million of revenue exceeded Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 7.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its products and services will face some demand challenges.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

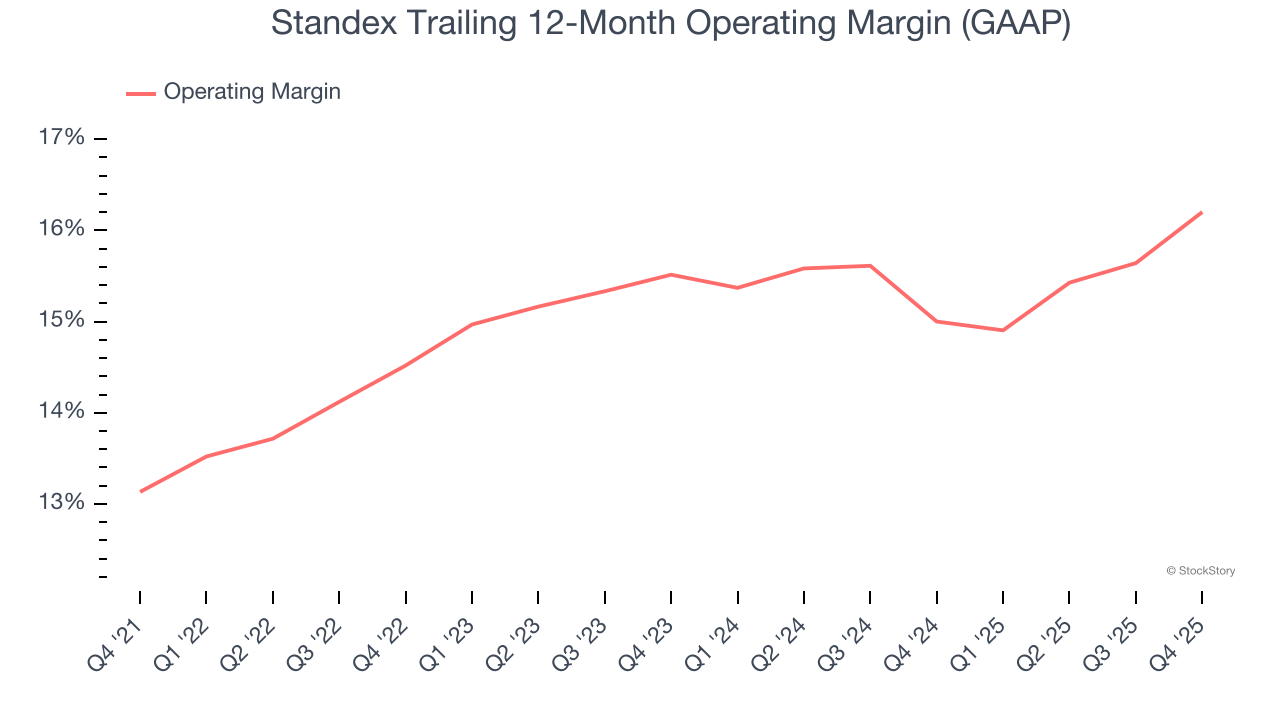

Standex has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Standex’s operating margin rose by 3.1 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Standex generated an operating margin profit margin of 16.1%, up 2.5 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

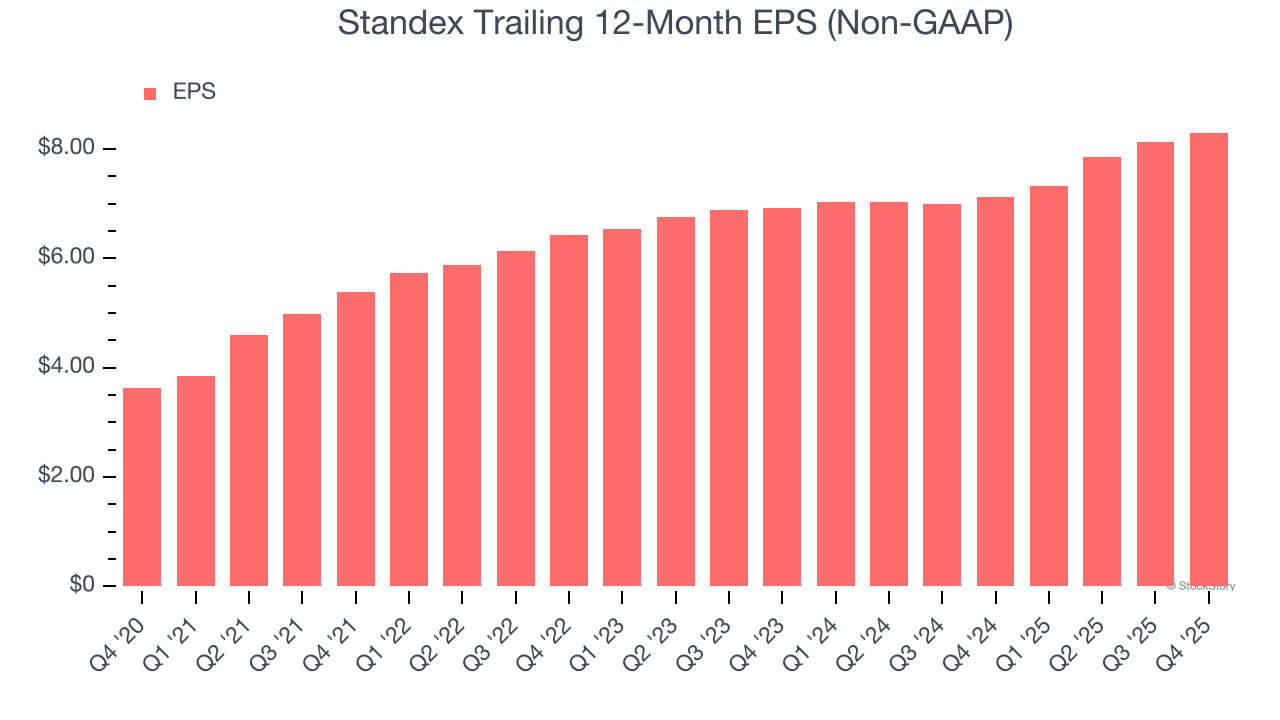

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Standex’s EPS grew at an astounding 18.1% compounded annual growth rate over the last five years, higher than its 7.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

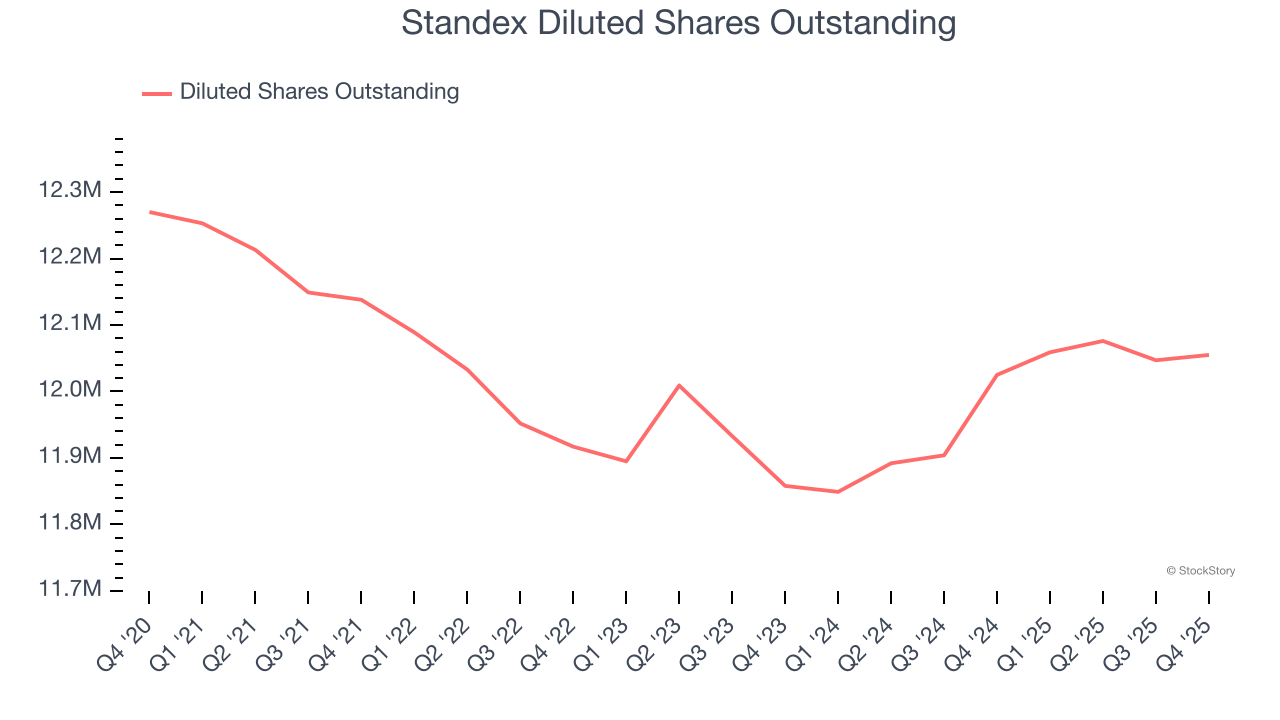

Diving into the nuances of Standex’s earnings can give us a better understanding of its performance. As we mentioned earlier, Standex’s operating margin expanded by 3.1 percentage points over the last five years. On top of that, its share count shrank by 1.8%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Standex, its two-year annual EPS growth of 9.4% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Standex reported adjusted EPS of $2.08, up from $1.91 in the same quarter last year. This print beat analysts’ estimates by 4.7%. Over the next 12 months, Wall Street expects Standex’s full-year EPS of $8.30 to grow 10.2%.

Key Takeaways from Standex’s Q4 Results

It was good to see Standex narrowly top analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Finally, it was encouraging that both operating and free cash flow margin rose year on year. Overall, this was a solid quarter. The stock remained flat at $246.19 immediately following the results.

So should you invest in Standex right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).