Financial holding company Hilltop Holdings (NYSE: HTH) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 9.3% year on year to $329.9 million. Its GAAP profit of $0.69 per share was 99% above analysts’ consensus estimates.

Is now the time to buy Hilltop Holdings? Find out by accessing our full research report, it’s free.

Hilltop Holdings (HTH) Q4 CY2025 Highlights:

- Net Interest Income: $112.5 million vs analyst estimates of $112.1 million (6.7% year-on-year growth, in line)

- Net Interest Margin: 3% vs analyst estimates of 3.1% (in line)

- Revenue: $329.9 million vs analyst estimates of $301.5 million (9.3% year-on-year growth, 9.4% beat)

- Efficiency Ratio: 54.1% vs analyst estimates of 86.6% (3,252.5 basis point beat)

- EPS (GAAP): $0.69 vs analyst estimates of $0.35 (99% beat)

- Tangible Book Value per Share: $36.42 vs analyst estimates of $31.70 (23.5% year-on-year growth, 14.9% beat)

- Market Capitalization: $2.23 billion

Company Overview

Transformed from a residential communities business to a financial services powerhouse in 2007, Hilltop Holdings (NYSE: HTH) is a Texas-based financial holding company that provides banking, broker-dealer, and mortgage origination services.

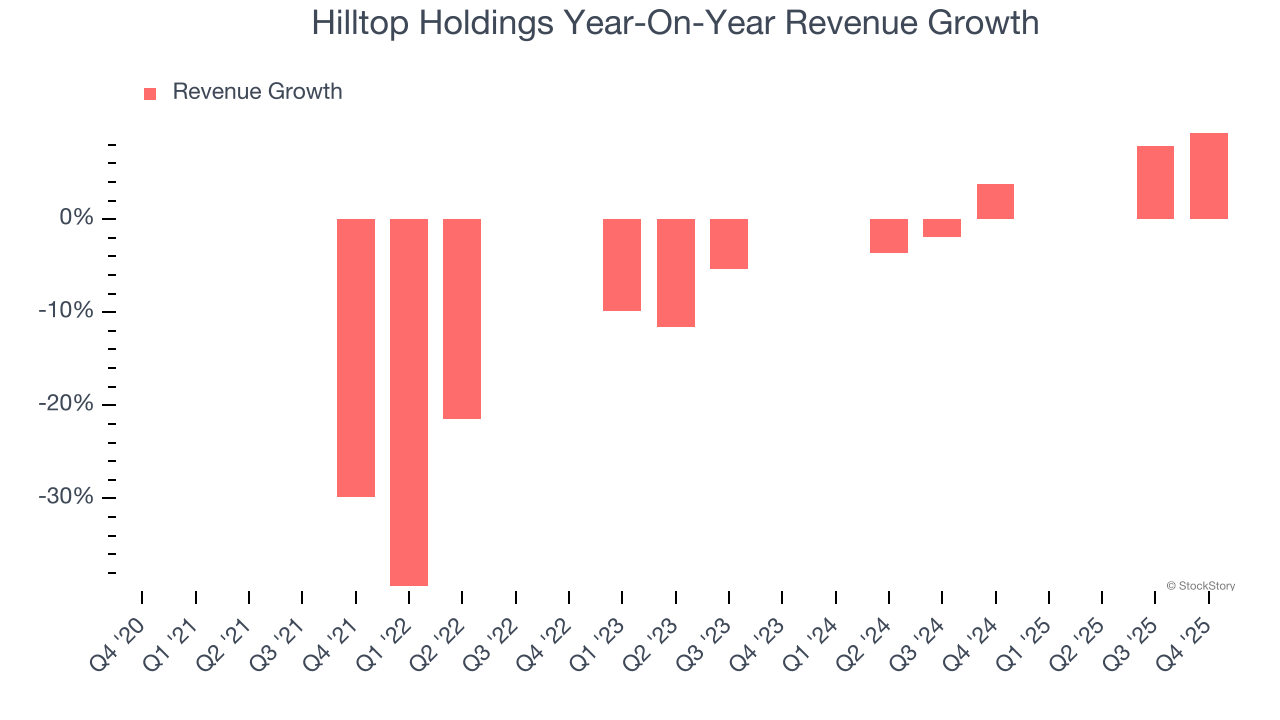

Sales Growth

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities. Hilltop Holdings’s demand was weak over the last five years as its revenue fell at a 10.1% annual rate. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Hilltop Holdings’s annualized revenue growth of 1.8% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Hilltop Holdings reported year-on-year revenue growth of 9.3%, and its $329.9 million of revenue exceeded Wall Street’s estimates by 9.4%.

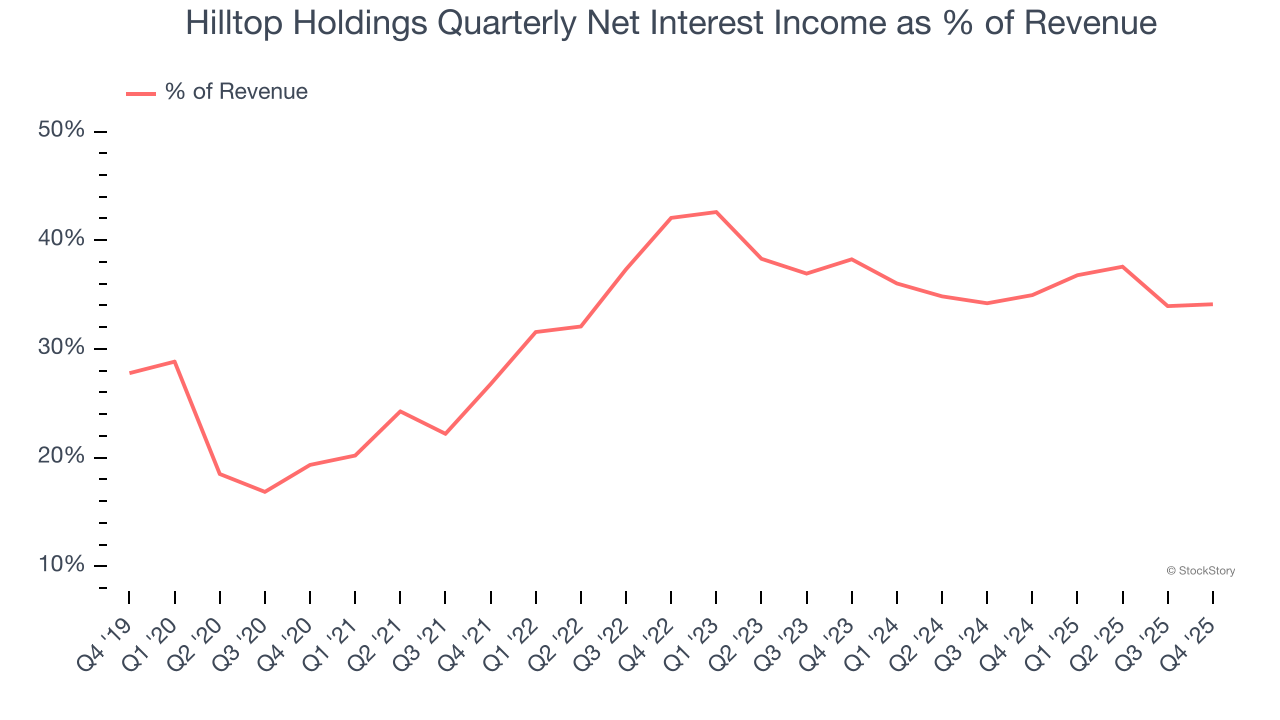

Net interest income made up 33.7% of the company’s total revenue during the last five years, meaning Hilltop Holdings is well diversified and has a variety of income streams driving its overall growth. Nevertheless, net interest income is critical to analyze for banks because they’re considered a higher-quality, more recurring revenue source by investors.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

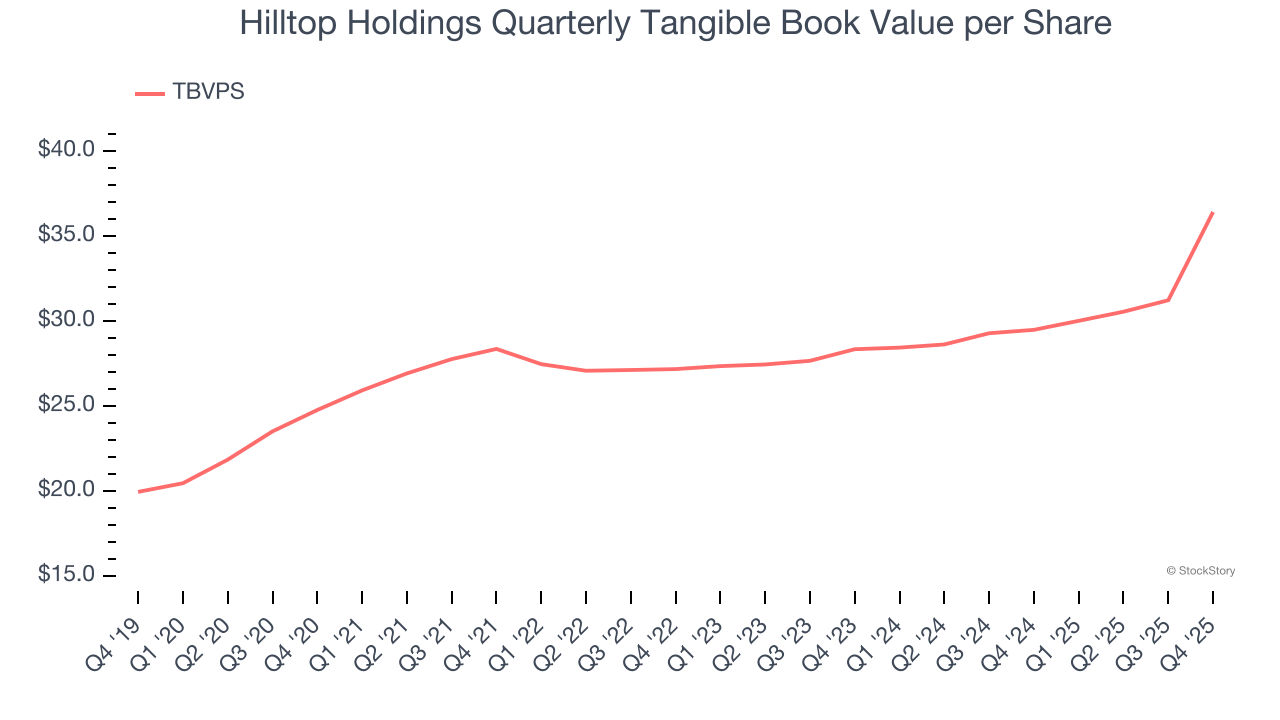

Tangible Book Value Per Share (TBVPS)

Banks profit by intermediating between depositors and borrowers, making them fundamentally balance sheet-driven enterprises. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these institutions.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark. By excluding intangible assets with uncertain liquidation values, this metric captures real, liquid net worth per share. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

Hilltop Holdings’s TBVPS grew at an excellent 8% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 13.3% annually over the last two years from $28.35 to $36.42 per share.

Over the next 12 months, Consensus estimates call for Hilltop Holdings’s TBVPS to shrink by 9.5% to $32.94, a sour projection.

Key Takeaways from Hilltop Holdings’s Q4 Results

While net interest income and net interest margin were both in line, revenue and EPS both beat convincingly. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $36.76 immediately following the results.

Is Hilltop Holdings an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).