Over the past six months, BJ’s shares (currently trading at $93.80) have posted a disappointing 17.8% loss, well below the S&P 500’s 18.6% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in BJ's, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is BJ's Not Exciting?

Despite the more favorable entry price, we're cautious about BJ's. Here are three reasons there are better opportunities than BJ and a stock we'd rather own.

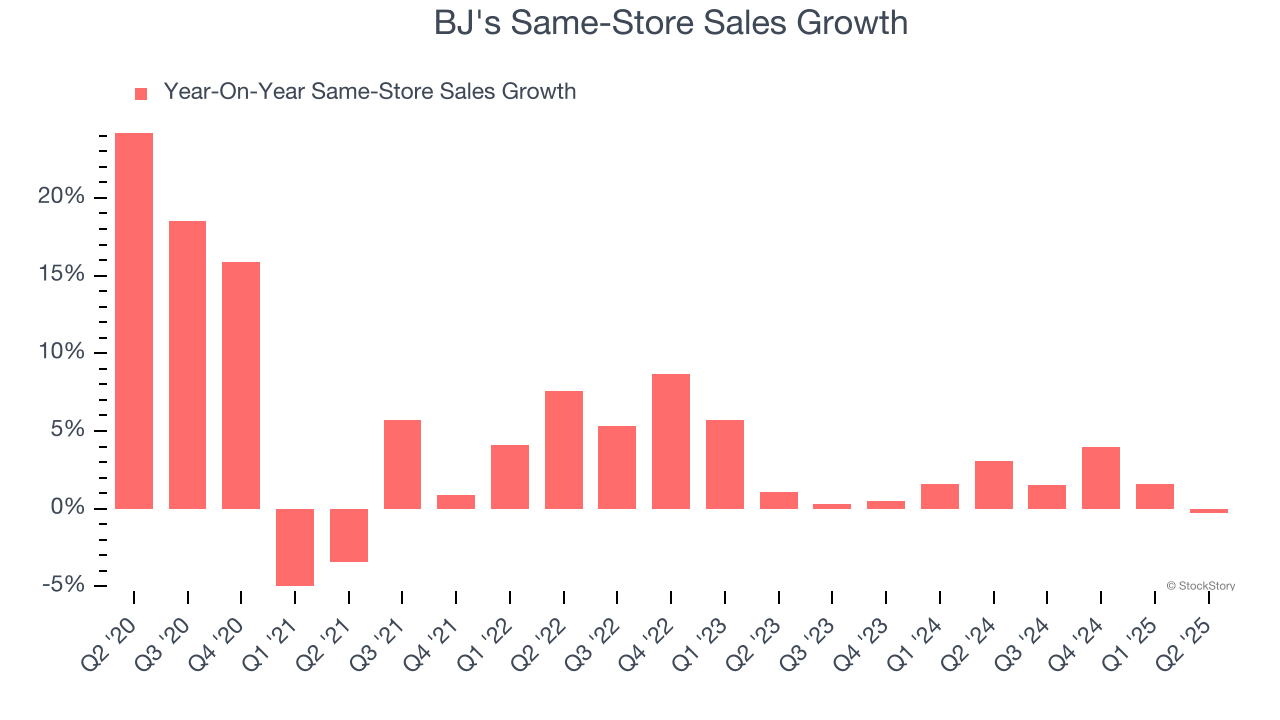

1. Same-Store Sales Falling Behind Peers

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

BJ’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.5% per year.

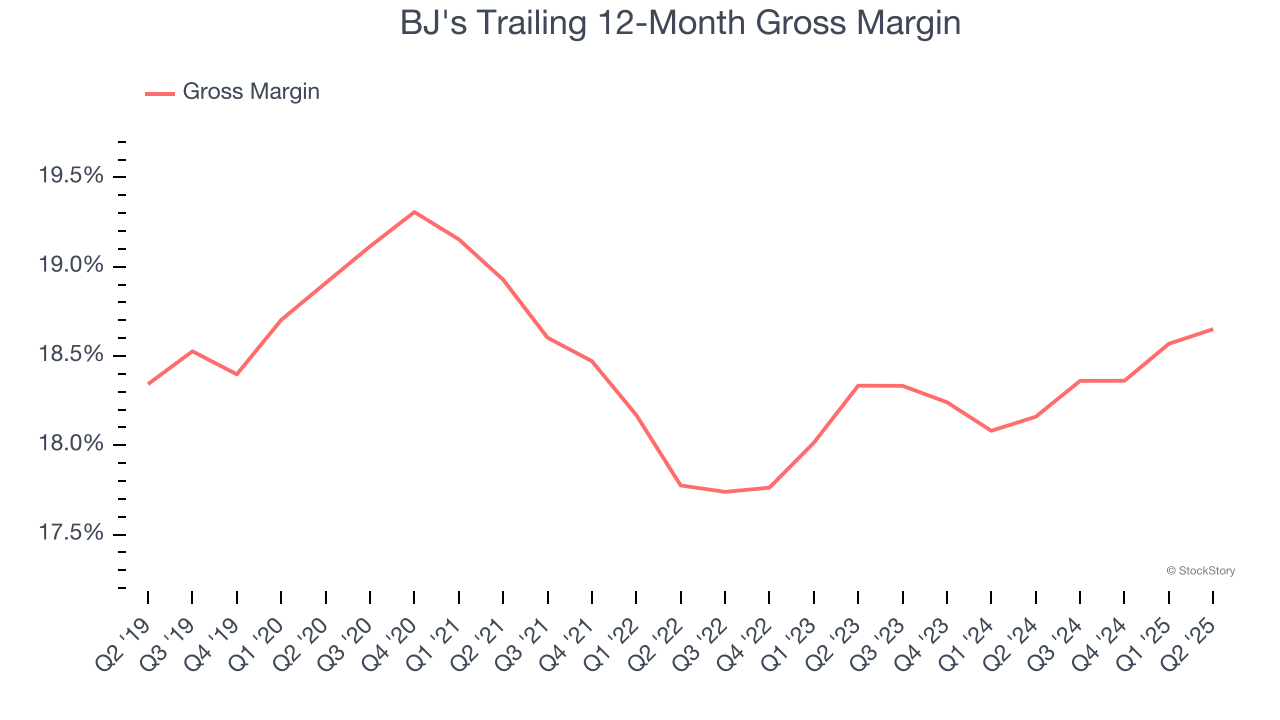

2. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

BJ's has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 18.4% gross margin over the last two years. That means BJ's paid its suppliers a lot of money ($81.59 for every $100 in revenue) to run its business.

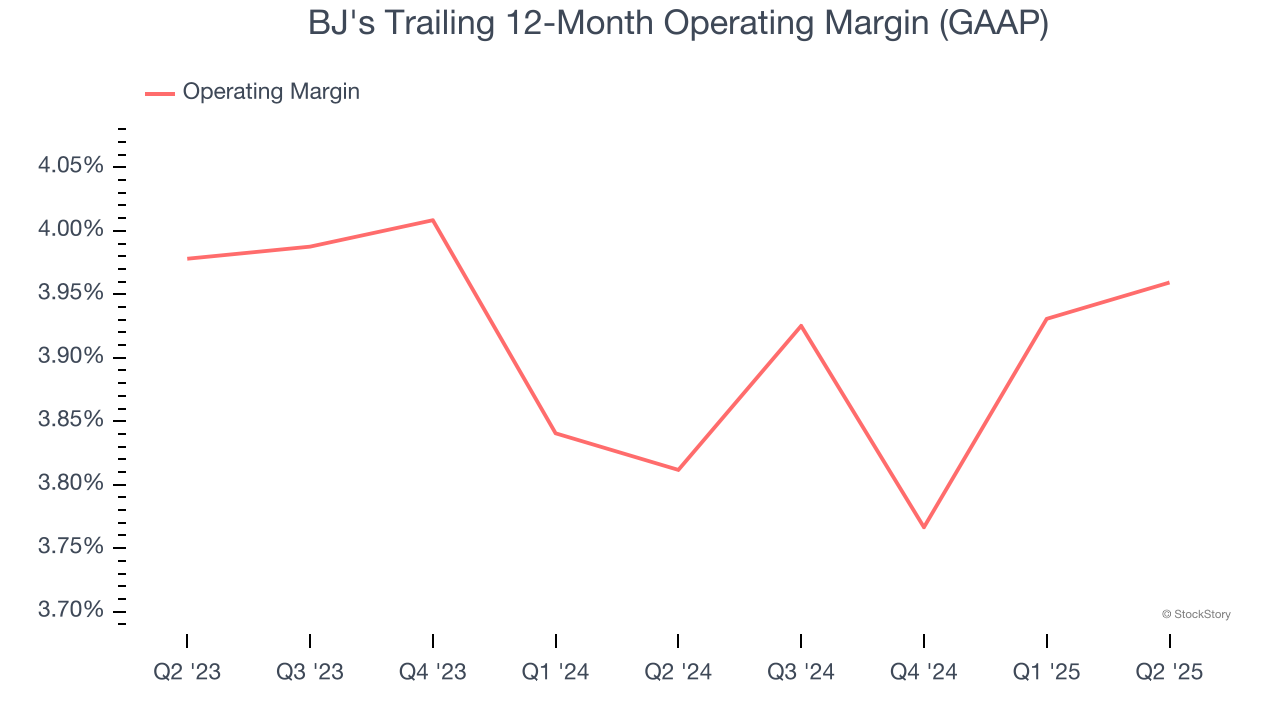

3. Weak Operating Margin Could Cause Trouble

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

BJ’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 3.9% over the last two years. This profitability was lousy for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Final Judgment

BJ's isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 21.1× forward P/E (or $93.80 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.