As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the internet of things industry, including Vontier (NYSE: VNT) and its peers.

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

The 6 internet of things stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, internet of things stocks have performed well with share prices up 25% on average since the latest earnings results.

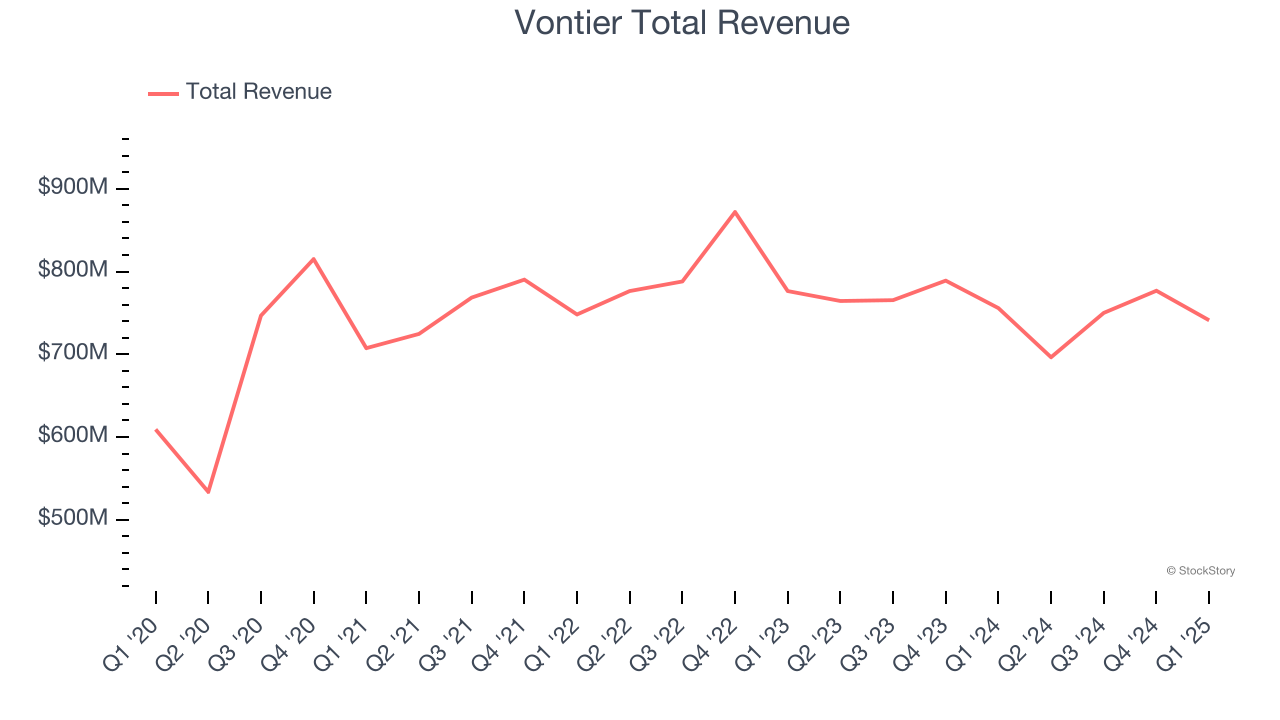

Vontier (NYSE: VNT)

A spin-off of a spin-off, Vontier (NYSE: VNT) provides electronic products and systems to the transportation, automotive, and manufacturing sectors.

Vontier reported revenues of $741.1 million, down 1.9% year on year. This print exceeded analysts’ expectations by 2.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ adjusted operating income and organic revenue estimates.

Vontier delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 22.3% since reporting and currently trades at $38.84.

Is now the time to buy Vontier? Access our full analysis of the earnings results here, it’s free.

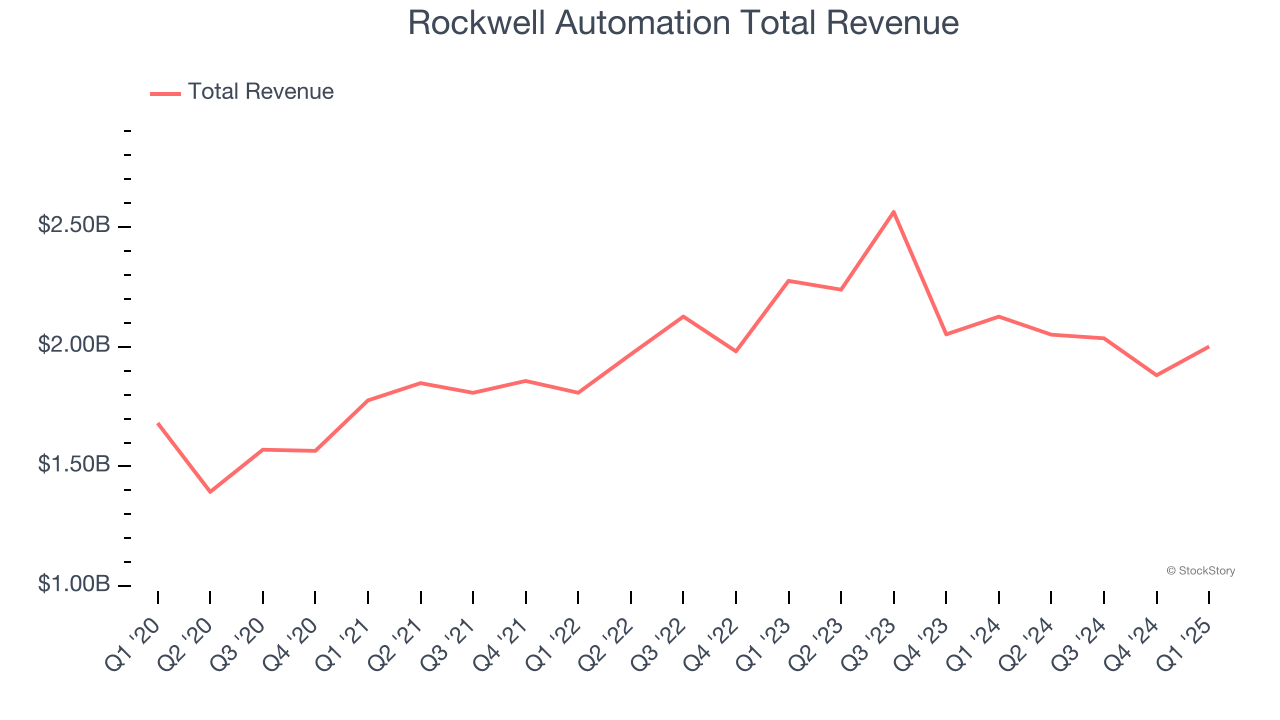

Best Q1: Rockwell Automation (NYSE: ROK)

One of the first companies to address industrial automation, Rockwell Automation (NYSE: ROK) sells products that help customers extract more efficiency from their machinery.

Rockwell Automation reported revenues of $2.00 billion, down 5.9% year on year, outperforming analysts’ expectations by 1.1%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 42.4% since reporting. It currently trades at $360.

Is now the time to buy Rockwell Automation? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SmartRent (NYSE: SMRT)

Founded by an employee at a real estate rental company, SmartRent (NYSE: SMRT) provides smart home devices and software for multifamily residential properties, single-family rental homes, and student housing communities.

SmartRent reported revenues of $41.34 million, down 18.1% year on year, exceeding analysts’ expectations by 3.1%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

SmartRent delivered the slowest revenue growth in the group. Interestingly, the stock is up 13.3% since the results and currently trades at $1.02.

Read our full analysis of SmartRent’s results here.

Emerson Electric (NYSE: EMR)

Founded in 1890, Emerson Electric (NYSE: EMR) is a multinational technology and engineering company providing solutions in the industrial, commercial, and residential markets.

Emerson Electric reported revenues of $4.43 billion, up 1.3% year on year. This result surpassed analysts’ expectations by 1.1%. It was a strong quarter as it also logged full-year EPS guidance slightly topping analysts’ expectations and a decent beat of analysts’ EBITDA estimates.

Emerson Electric scored the fastest revenue growth among its peers. The stock is up 35.1% since reporting and currently trades at $145.

Read our full, actionable report on Emerson Electric here, it’s free.

Trimble (NASDAQ: TRMB)

Playing a role in the construction of the Paris Grand, Trimble (NASDAQ: TRMB) offers geospatial devices and technology to the agriculture, construction, transportation, and logistics industries.

Trimble reported revenues of $840.6 million, down 11.8% year on year. This number beat analysts’ expectations by 3.8%. Zooming out, it was a satisfactory quarter as it also logged a solid beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

Trimble achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 31.1% since reporting and currently trades at $83.

Read our full, actionable report on Trimble here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.