Macy's has gotten torched over the last six months - since November 2024, its stock price has dropped 29.5% to $11.60 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Macy's, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Macy's Will Underperform?

Despite the more favorable entry price, we're cautious about Macy's. Here are three reasons why M doesn't excite us and a stock we'd rather own.

1. Shrinking Same-Store Sales Indicate Waning Demand

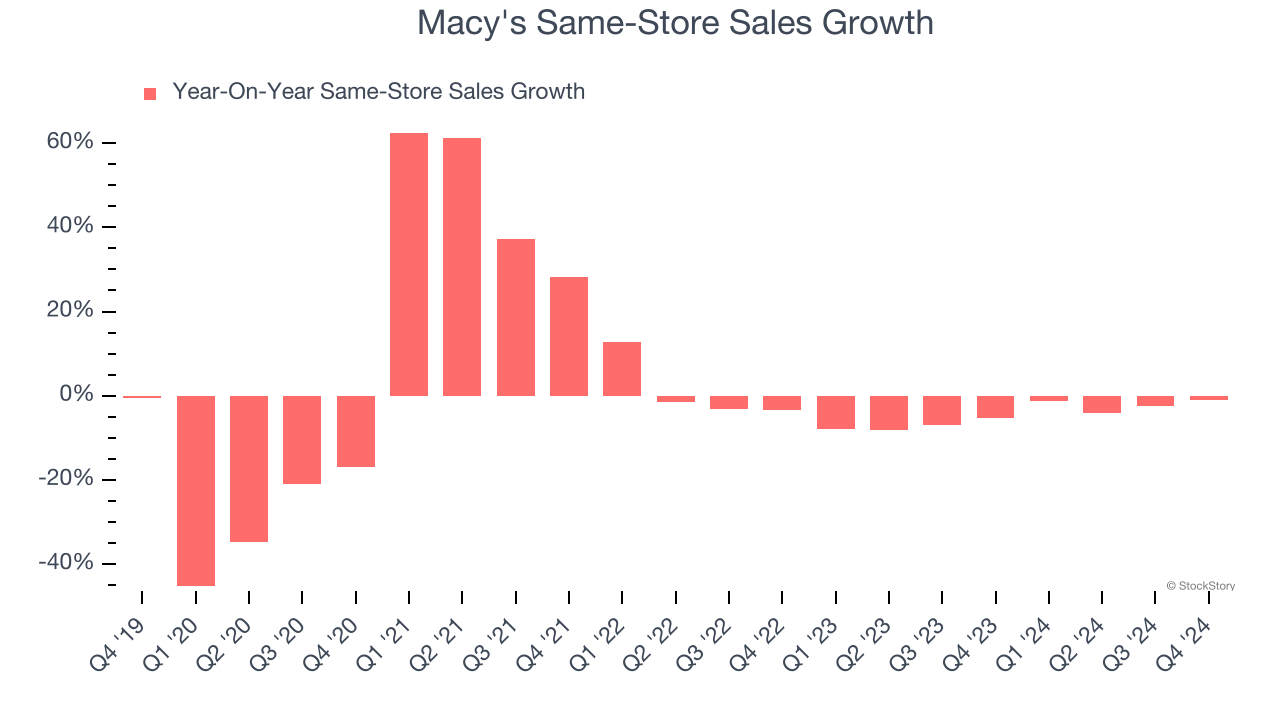

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Macy’s demand has been shrinking over the last two years as its same-store sales have averaged 4.7% annual declines.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Macy’s revenue to drop by 5.6%, a decrease from its 1.9% annualized declines for the past five years. This projection doesn't excite us and indicates its products will face some demand challenges.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Macy's historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.4%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

Final Judgment

We see the value of companies helping consumers, but in the case of Macy's, we’re out. After the recent drawdown, the stock trades at 5× forward P/E (or $11.60 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks That Overcame Trump’s 2018 Tariffs

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today.