Holding company and industrial conglomerate Icahn (NYSE: IEP) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 19.1% year on year to $2.00 billion. Its GAAP loss of $0.79 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Icahn Enterprises? Find out by accessing our full research report, it’s free.

Icahn Enterprises (IEP) Q1 CY2025 Highlights:

- Revenue: $2.00 billion vs analyst estimates of $2.63 billion (19.1% year-on-year decline, 23.8% miss)

- EPS (GAAP): -$0.79 vs analyst estimates of $0.19 (significant miss)

- Adjusted EBITDA Margin: -14.3%, down from 5.4% in the same quarter last year

- Market Capitalization: $4.56 billion

Company Overview

Founded in 1987, Icahn Enterprises (NASDAQ: IEP) is a diversified holding company primarily engaged in investment and asset management across various sectors.

Sales Growth

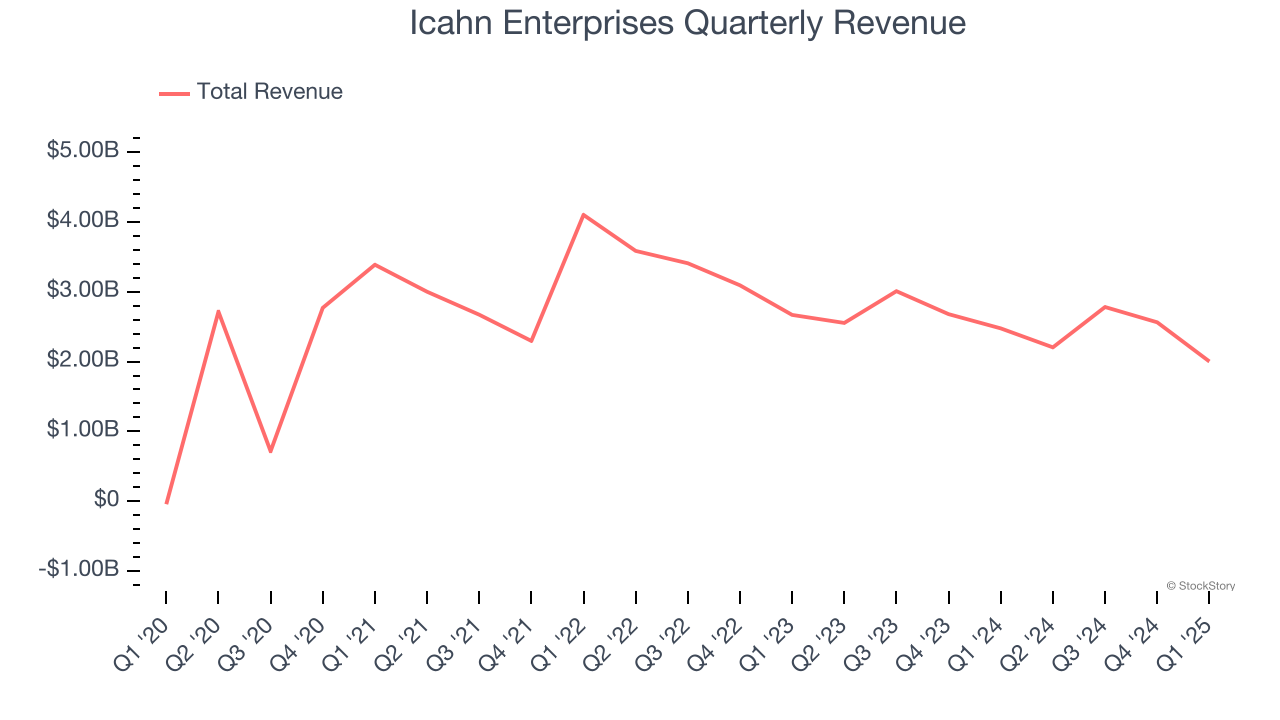

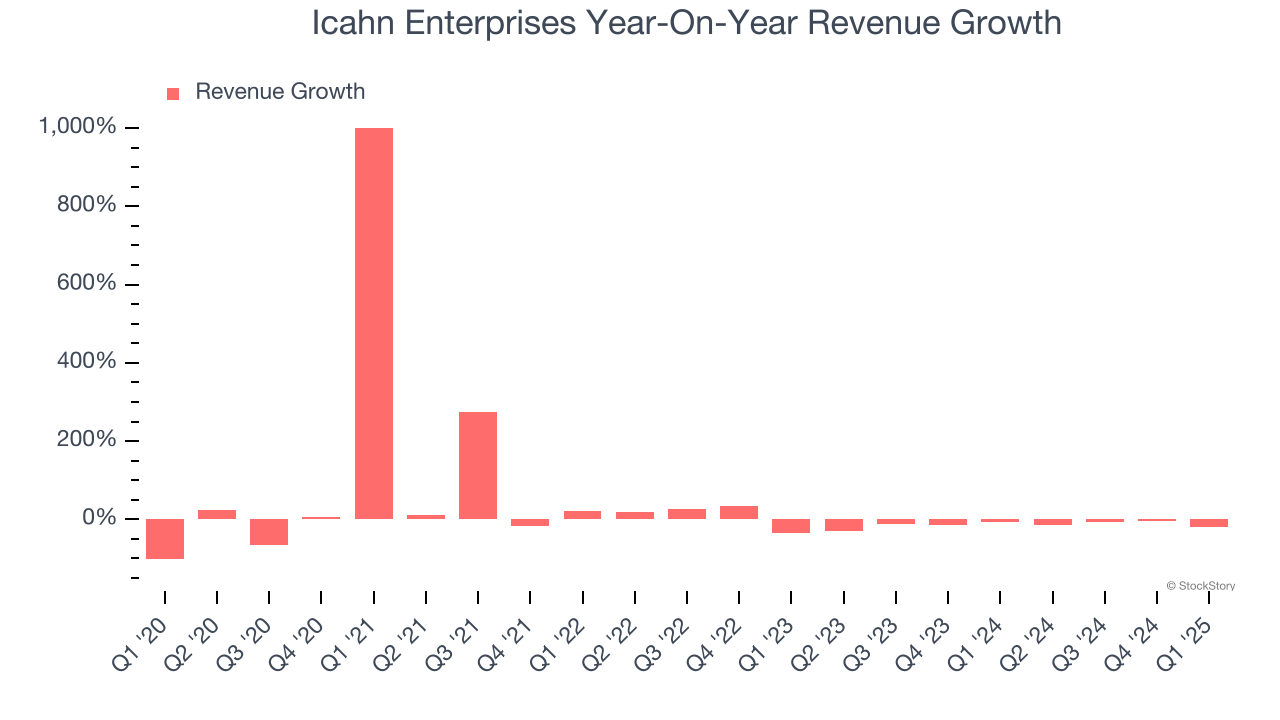

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Icahn Enterprises’s sales grew at a mediocre 6.9% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Icahn Enterprises’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 13.5% annually.

This quarter, Icahn Enterprises missed Wall Street’s estimates and reported a rather uninspiring 19.1% year-on-year revenue decline, generating $2.00 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7.4% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

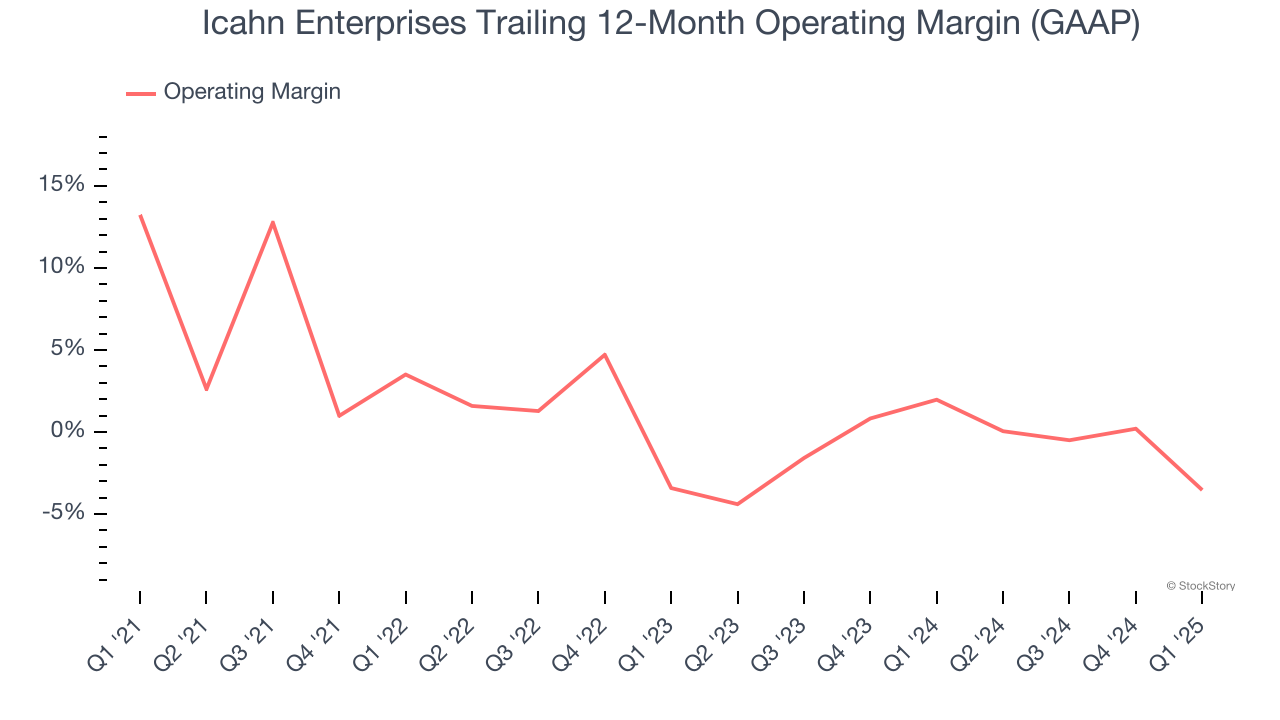

Icahn Enterprises was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.1% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Icahn Enterprises’s operating margin decreased by 16.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Icahn Enterprises’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Icahn Enterprises generated an operating profit margin of negative 10.7%, down 16.5 percentage points year on year. Since Icahn Enterprises’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

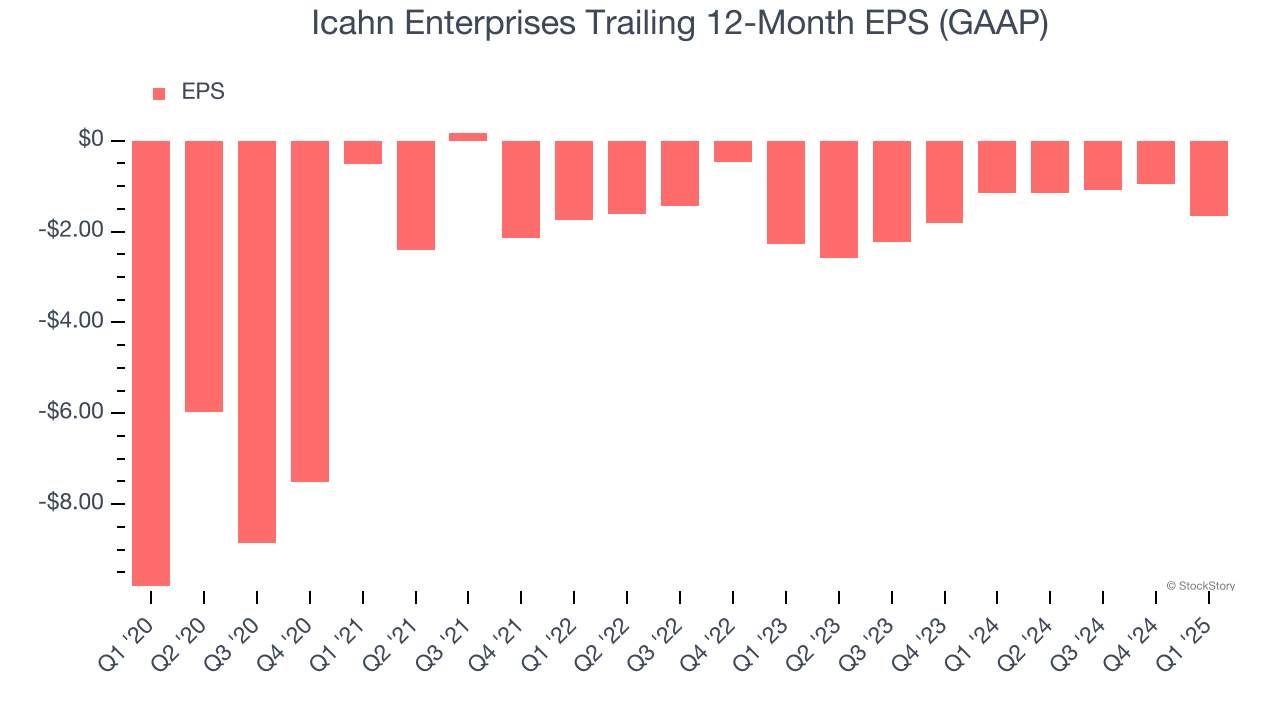

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Icahn Enterprises’s full-year earnings are still negative, it reduced its losses and improved its EPS by 30% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Icahn Enterprises, its two-year annual EPS growth of 14.7% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q1, Icahn Enterprises reported EPS at negative $0.79, down from negative $0.09 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Icahn Enterprises’s full-year EPS of negative $1.65 will flip to positive $0.74.

Key Takeaways from Icahn Enterprises’s Q1 Results

We struggled to find many positives in these results. Its revenue missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.6% to $8.59 immediately after reporting.

The latest quarter from Icahn Enterprises’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.