Pangaea Logistics (NASDAQ: PANL) missed Wall Street’s revenue expectations in Q1 CY2025, but sales rose 17.2% year on year to $122.8 million. Its non-GAAP loss of $0.03 per share was 74.3% above analysts’ consensus estimates.

Is now the time to buy Pangaea? Find out by accessing our full research report, it’s free.

Pangaea (PANL) Q1 CY2025 Highlights:

- Revenue: $122.8 million vs analyst estimates of $128.5 million (17.2% year-on-year growth, 4.4% miss)

- Adjusted EPS: -$0.03 vs analyst estimates of -$0.12 (74.3% beat)

- Adjusted EBITDA: $14.77 million vs analyst estimates of $9.24 million (12% margin, 59.9% beat)

- Operating Margin: 2.4%, down from 10.5% in the same quarter last year

- Free Cash Flow was -$4.76 million, down from $8.80 million in the same quarter last year

- Market Capitalization: $263.2 million

"We showed disciplined execution during the first quarter, maintaining our cargo-focused strategy and delivering consistent premium TCE rates supported by our portfolio of long-term contracts," stated Mark Filanowski, Chief Executive Officer of Pangaea Logistics Solutions.

Company Overview

Established in 1996, Pangaea Logistics (NASDAQ: PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

Sales Growth

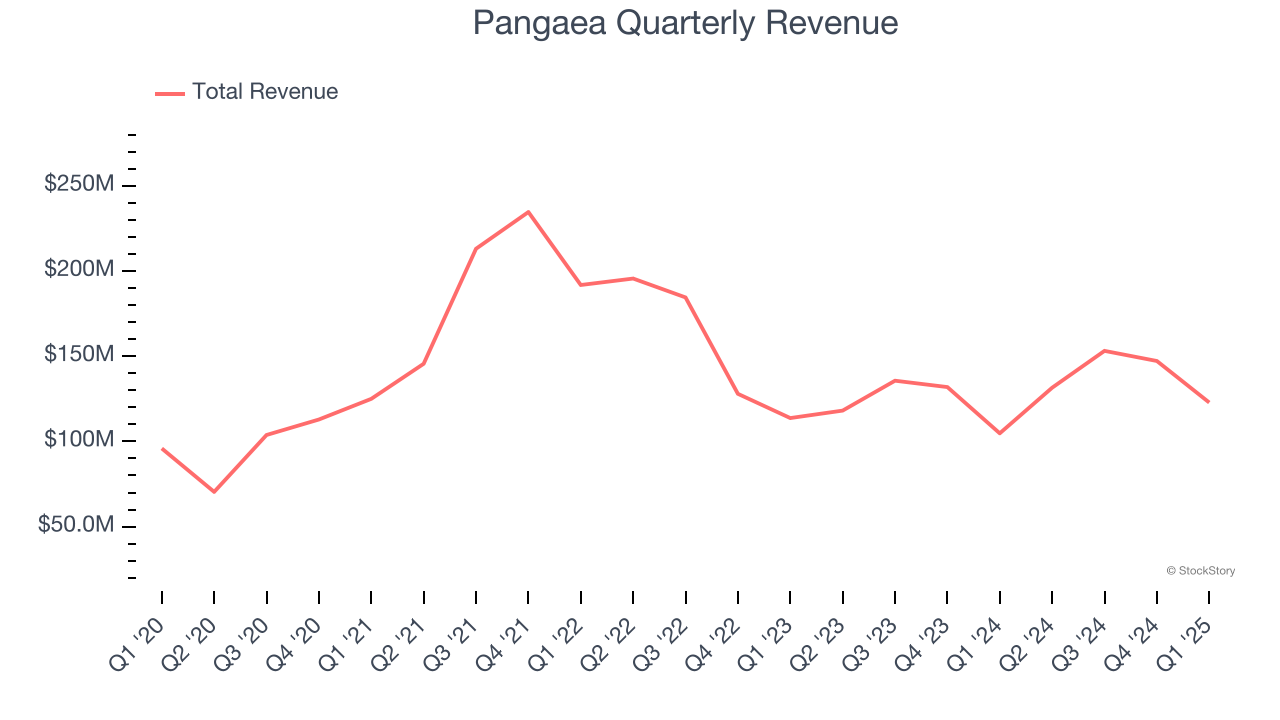

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Pangaea’s 5.3% annualized revenue growth over the last five years was tepid. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Pangaea’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.5% annually. Pangaea isn’t alone in its struggles as the Marine Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Pangaea’s revenue grew by 17.2% year on year to $122.8 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 10.5% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

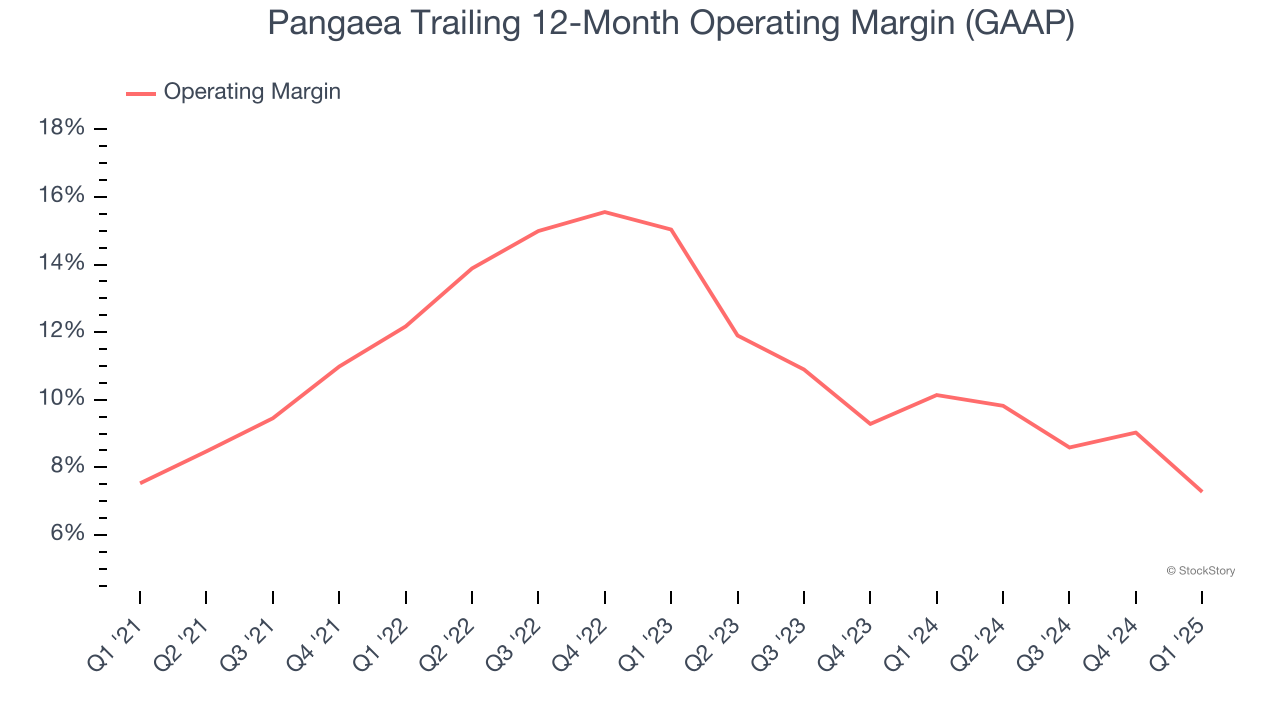

Pangaea has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.8%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Pangaea’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Pangaea generated an operating profit margin of 2.4%, down 8.1 percentage points year on year. Since Pangaea’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Earnings Per Share

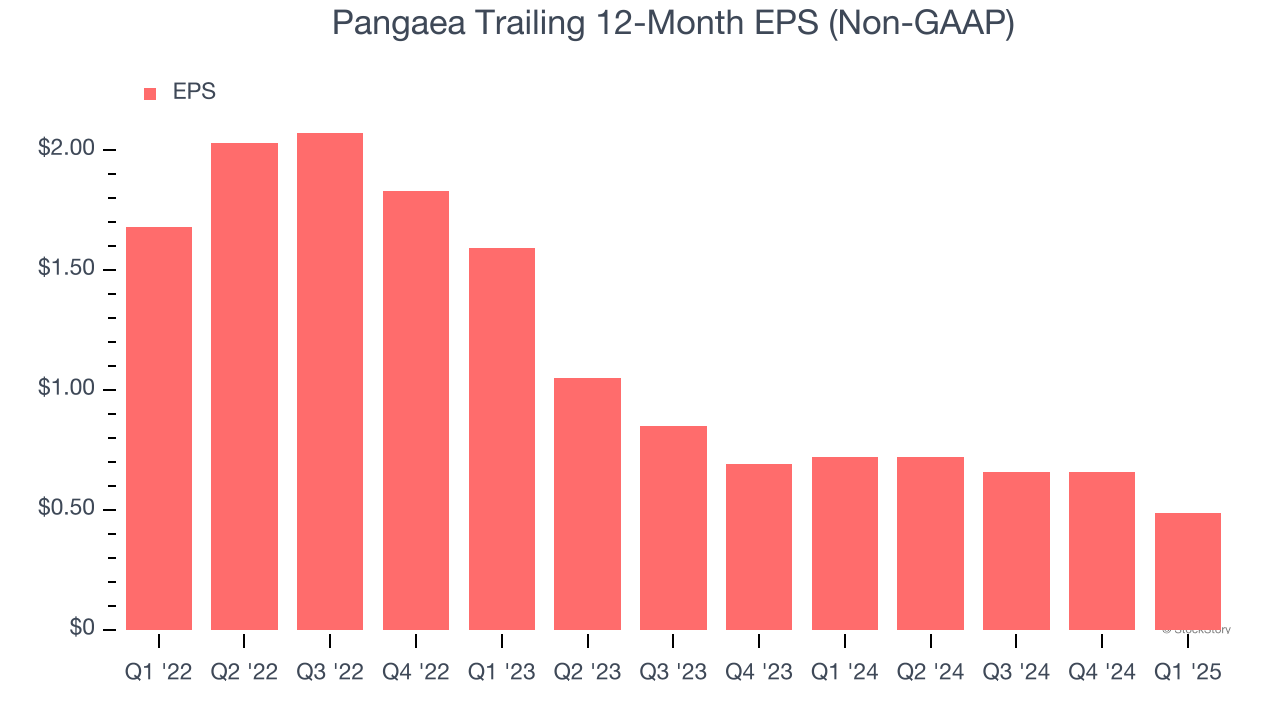

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Pangaea, its EPS declined by more than its revenue over the last two years, dropping 44.8%. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

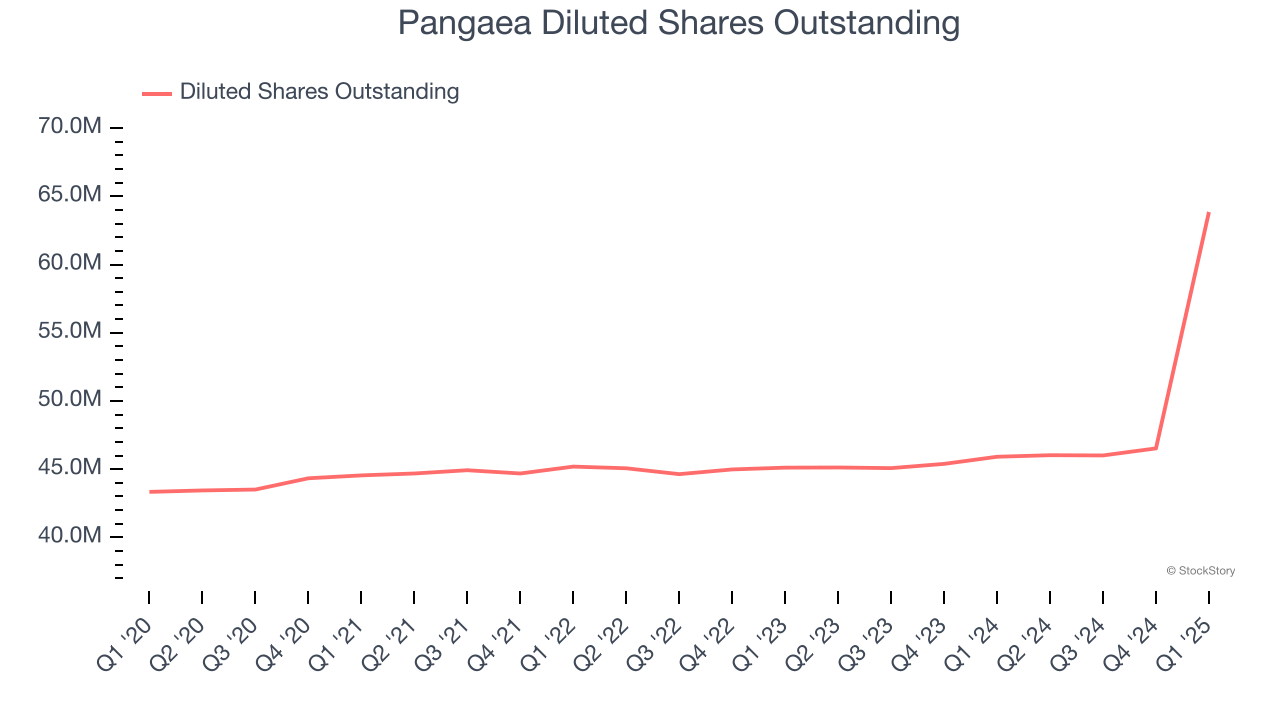

Diving into the nuances of Pangaea’s earnings can give us a better understanding of its performance. Pangaea’s operating margin has declined by 4.4 percentage points over the last two yearswhile its share count has grown 41.5%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q1, Pangaea reported EPS at negative $0.03, down from $0.14 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Pangaea’s full-year EPS of $0.48 to grow 12.8%.

Key Takeaways from Pangaea’s Q1 Results

We were impressed by how significantly Pangaea blew past analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue missed significantly. Overall, we think this was a decent quarter with some key metrics above expectations. The market seemed to be hoping for more, and the stock traded down 3.5% to $4.27 immediately after reporting.

Big picture, is Pangaea a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.