The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how department store stocks fared in Q4, starting with Dillard's (NYSE: DDS).

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

The 4 department store stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 0.6%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 21.2% since the latest earnings results.

Best Q4: Dillard's (NYSE: DDS)

With stores located largely in the Southern and Western US, Dillard’s (NYSE: DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

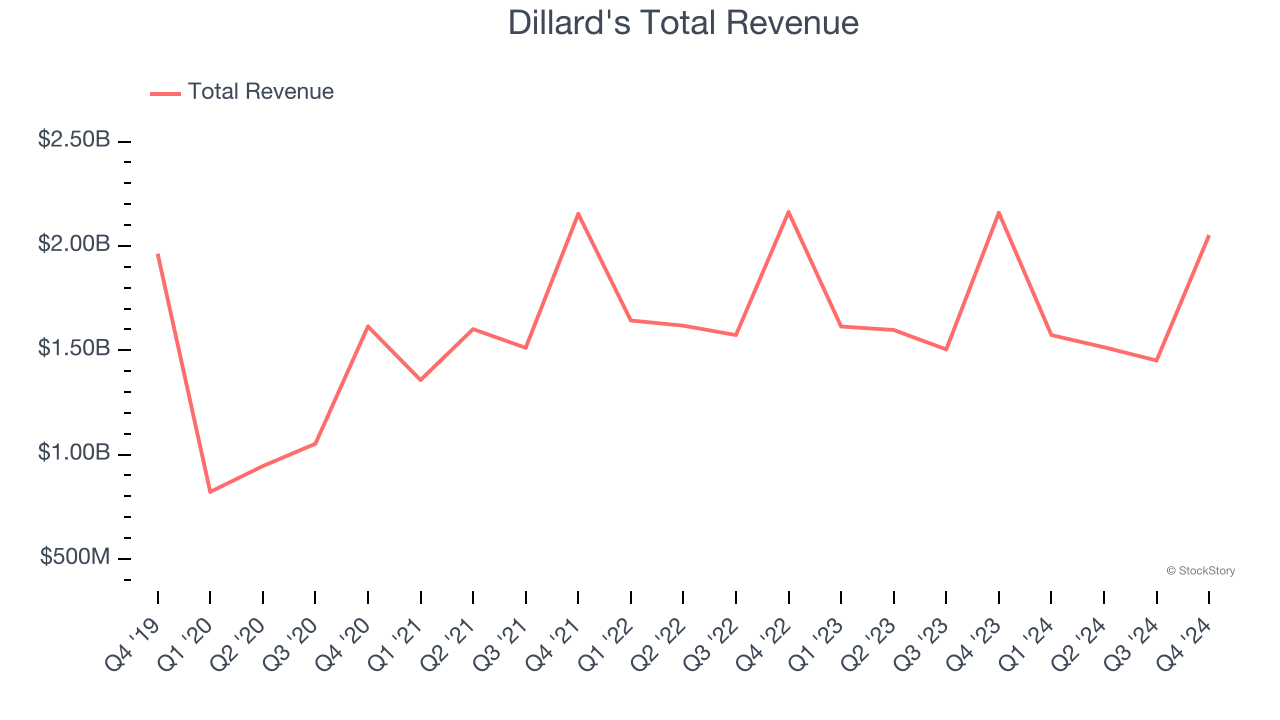

Dillard's reported revenues of $2.05 billion, down 5% year on year. This print exceeded analysts’ expectations by 1%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Dillard's achieved the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 24.1% since reporting and currently trades at $346.66.

Is now the time to buy Dillard's? Access our full analysis of the earnings results here, it’s free.

Macy's (NYSE: M)

With a storied history that began with its 1858 founding, Macy’s (NYSE: M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

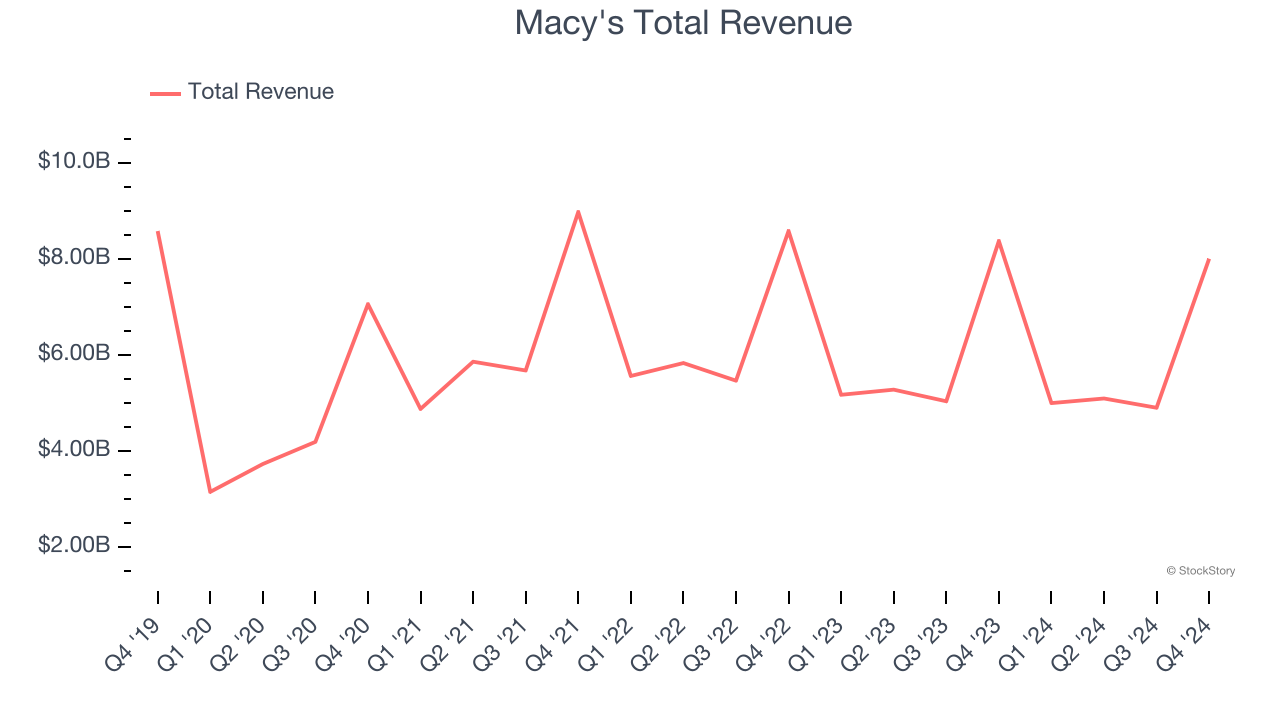

Macy's reported revenues of $8.01 billion, down 4.4% year on year, in line with analysts’ expectations. The business had a satisfactory quarter with a solid beat of analysts’ EBITDA estimates.

The stock is down 15.8% since reporting. It currently trades at $11.20.

Is now the time to buy Macy's? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Kohl's (NYSE: KSS)

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE: KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Kohl's reported revenues of $5.40 billion, down 9.4% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

Kohl's delivered the slowest revenue growth in the group. As expected, the stock is down 44.3% since the results and currently trades at $6.71.

Read our full analysis of Kohl’s results here.

Nordstrom (NYSE: JWN)

Known for its exceptional customer service that features a ‘no questions asked’ return policy, Nordstrom (NYSE: JWN) is a high-end department store chain.

Nordstrom reported revenues of $4.32 billion, down 2.2% year on year. This result beat analysts’ expectations by 0.6%. More broadly, it was a mixed quarter as it also recorded an impressive beat of analysts’ gross margin estimates but a miss of analysts’ EBITDA estimates.

Nordstrom pulled off the fastest revenue growth among its peers. The stock is flat since reporting and currently trades at $24.14.

Read our full, actionable report on Nordstrom here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.