Safety and specialty services provider APi (NYSE: APG) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 7.4% year on year to $1.72 billion. The company’s full-year revenue guidance of $7.5 billion at the midpoint came in 1.5% above analysts’ estimates. Its non-GAAP profit of $0.37 per share was in line with analysts’ consensus estimates.

Is now the time to buy APi? Find out by accessing our full research report, it’s free.

APi (APG) Q1 CY2025 Highlights:

- Revenue: $1.72 billion vs analyst estimates of $1.64 billion (7.4% year-on-year growth, 4.7% beat)

- Adjusted EPS: $0.37 vs analyst estimates of $0.36 (in line)

- Adjusted EBITDA: $193 million vs analyst estimates of $190.5 million (11.2% margin, 1.3% beat)

- The company lifted its revenue guidance for the full year to $7.5 billion at the midpoint from $7.4 billion, a 1.4% increase

- EBITDA guidance for the full year is $1.01 billion at the midpoint, above analyst estimates of $988 million

- Operating Margin: 4.9%, down from 6.2% in the same quarter last year

- Free Cash Flow was $50 million, up from -$15 million in the same quarter last year

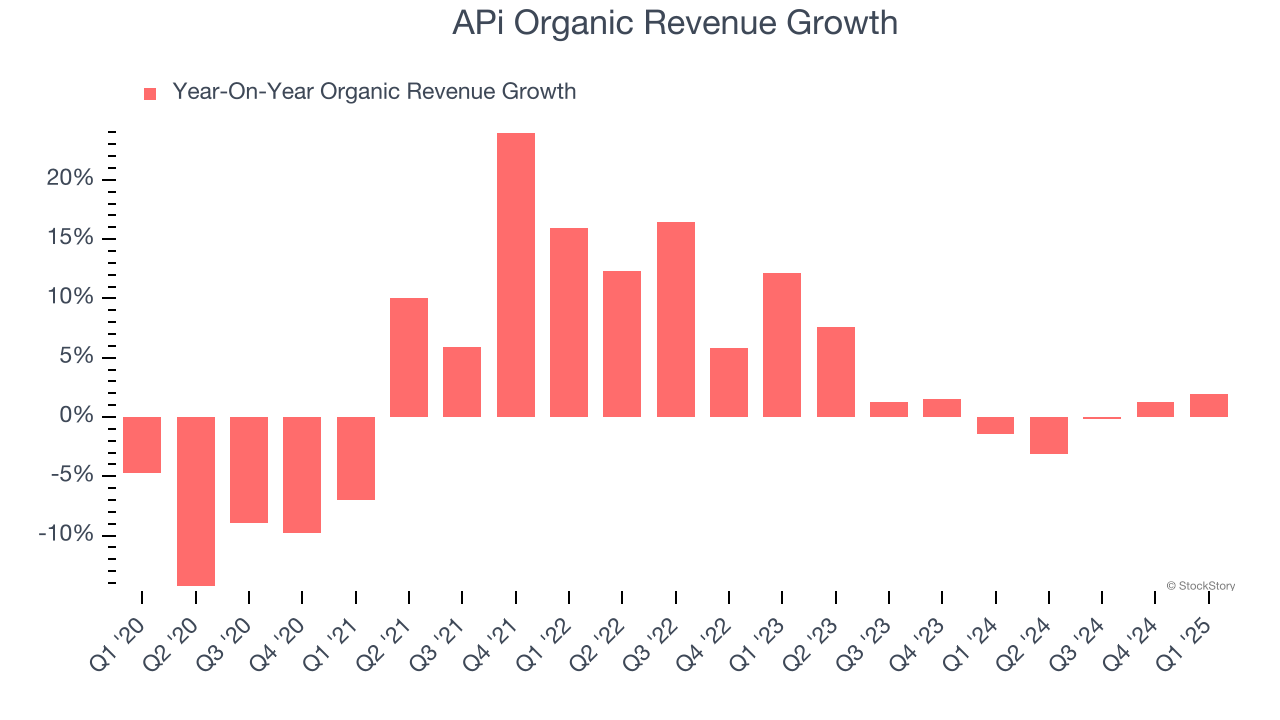

- Organic Revenue rose 1.9% year on year (-1.4% in the same quarter last year)

- Market Capitalization: $10.45 billion

Russ Becker, APi’s President and Chief Executive Officer stated: “We are off to a strong start in 2025, with a return to traditional levels of organic growth after our thoughtful and selective pruning of certain customer accounts in 2024. We've also continued to expand margins and deploy capital on M&A and share repurchases to drive shareholder value. Our robust backlog, variable cost structure, the statutorily-driven demand for our services, and the diversity of the global end markets we serve combine to provide a protective moat around the business. We believe this positions us well to navigate the dynamic tariff variables in the marketplace.

Company Overview

Started in 1926 as an insulation contractor, APi (NYSE: APG) provides life safety solutions and specialty services for buildings and infrastructure.

Sales Growth

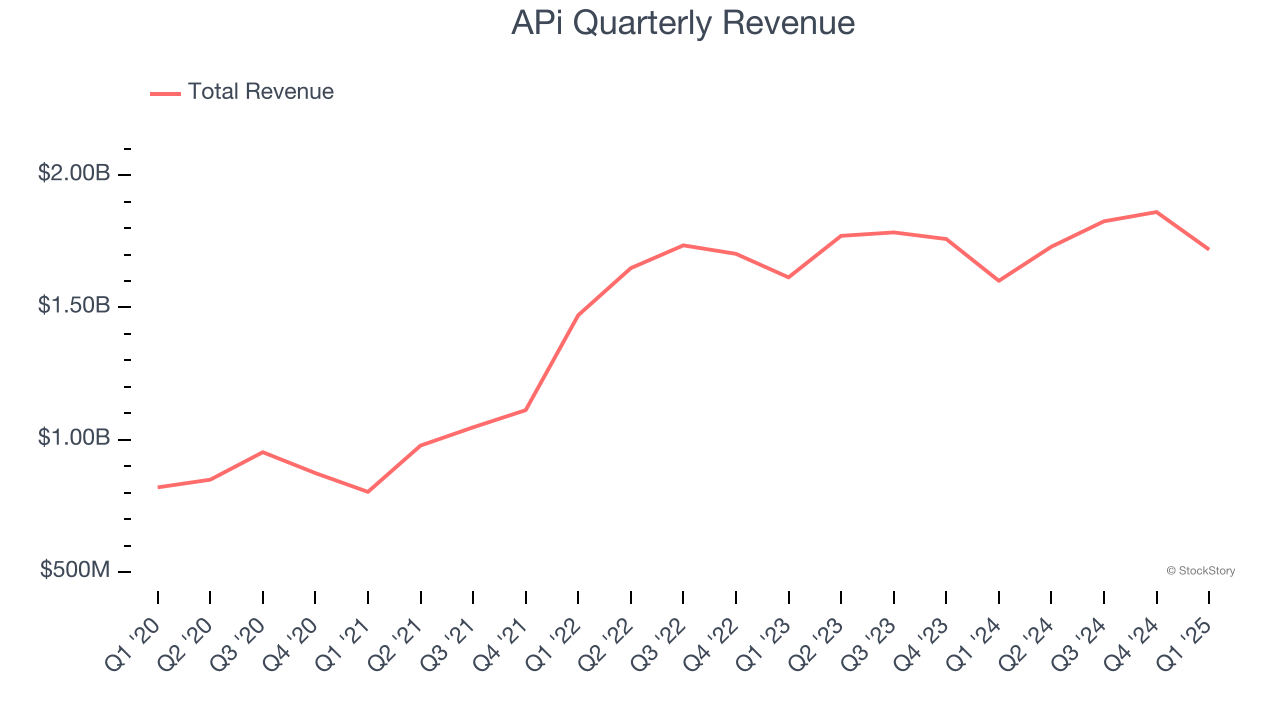

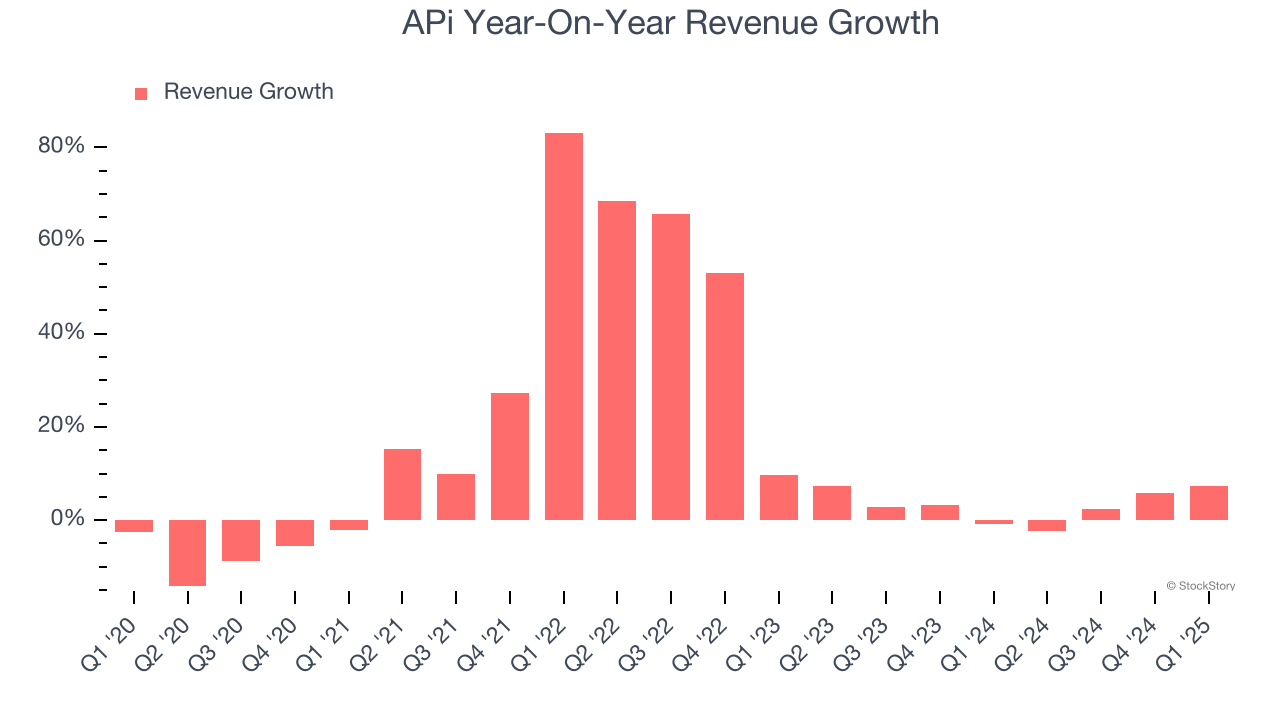

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, APi grew its sales at an exceptional 13.5% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. APi’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.2% over the last two years was well below its five-year trend.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, APi’s organic revenue averaged 1.1% year-on-year growth. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, APi reported year-on-year revenue growth of 7.4%, and its $1.72 billion of revenue exceeded Wall Street’s estimates by 4.7%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

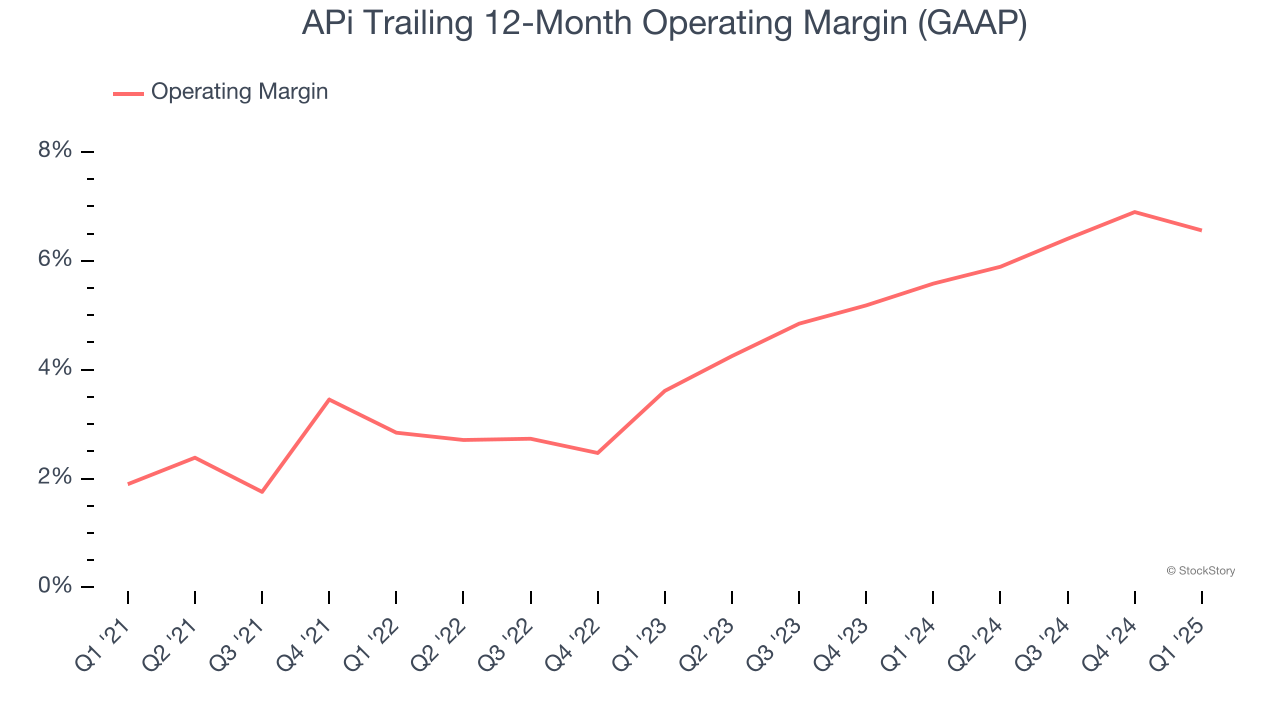

APi was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.5% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, APi’s operating margin rose by 4.7 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, APi generated an operating profit margin of 4.9%, down 1.4 percentage points year on year. Since APi’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

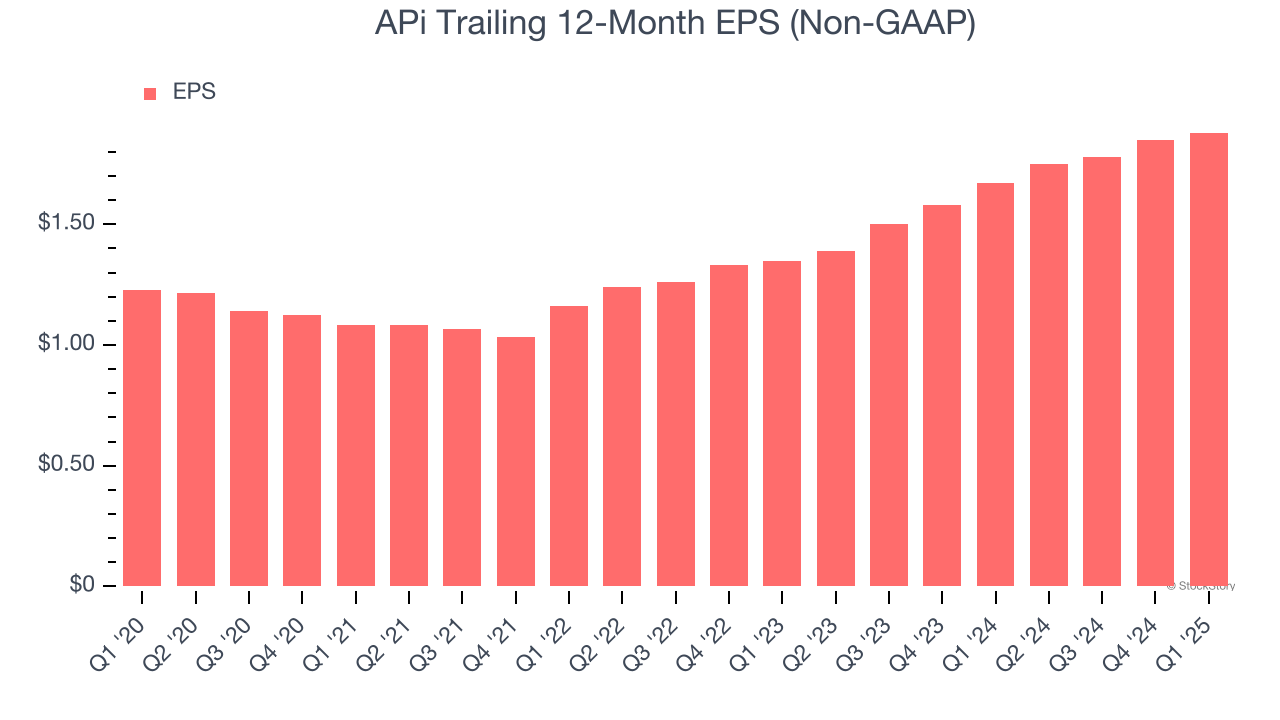

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

APi’s EPS grew at a decent 8.9% compounded annual growth rate over the last five years. Despite its operating margin expansion during that time, this performance was lower than its 13.5% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

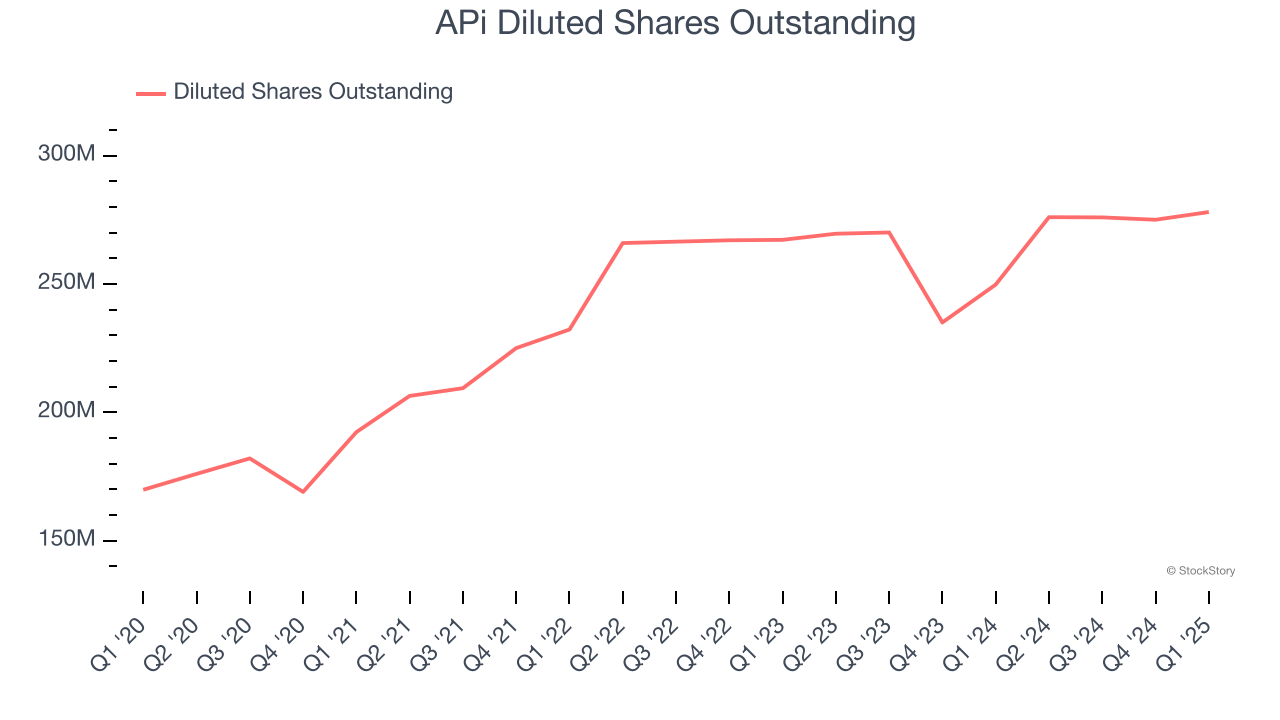

Diving into the nuances of APi’s earnings can give us a better understanding of its performance. A five-year view shows APi has diluted its shareholders, growing its share count by 63.7%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For APi, its two-year annual EPS growth of 18% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q1, APi reported EPS at $0.37, up from $0.34 in the same quarter last year. This print beat analysts’ estimates by 2.6%. Over the next 12 months, Wall Street expects APi’s full-year EPS of $1.88 to grow 12.5%.

Key Takeaways from APi’s Q1 Results

We were impressed by how significantly APi blew past analysts’ organic revenue expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 5.7% to $39.95 immediately after reporting.

Sure, APi had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.