Looking back on consumer internet stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Expedia (NASDAQ: EXPE) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 50 consumer internet stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 29.6% since the latest earnings results.

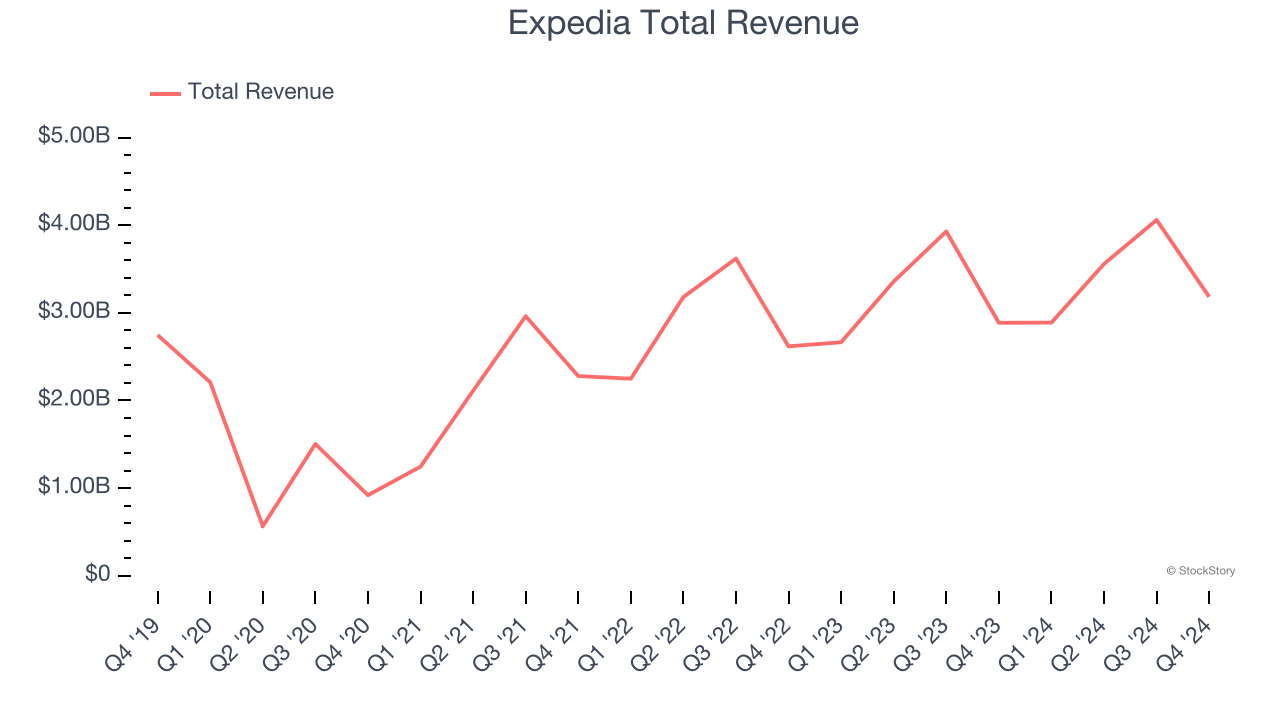

Expedia (NASDAQ: EXPE)

Originally founded as a part of Microsoft, Expedia (NASDAQ: EXPE) is one of the world’s leading online travel agencies.

Expedia reported revenues of $3.18 billion, up 10.3% year on year. This print exceeded analysts’ expectations by 3.5%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ number of room nights booked estimates.

“Our fourth quarter results exceeded our expectations and reflect continued strong execution and better-than-expected travel demand. All three of our core consumer brands achieved bookings growth and we further accelerated growth in our B2B business. These results contributed to a solid full year 2024 for us," said Ariane Gorin, CEO of Expedia Group.

The stock is down 21.6% since reporting and currently trades at $135.42.

Is now the time to buy Expedia? Access our full analysis of the earnings results here, it’s free.

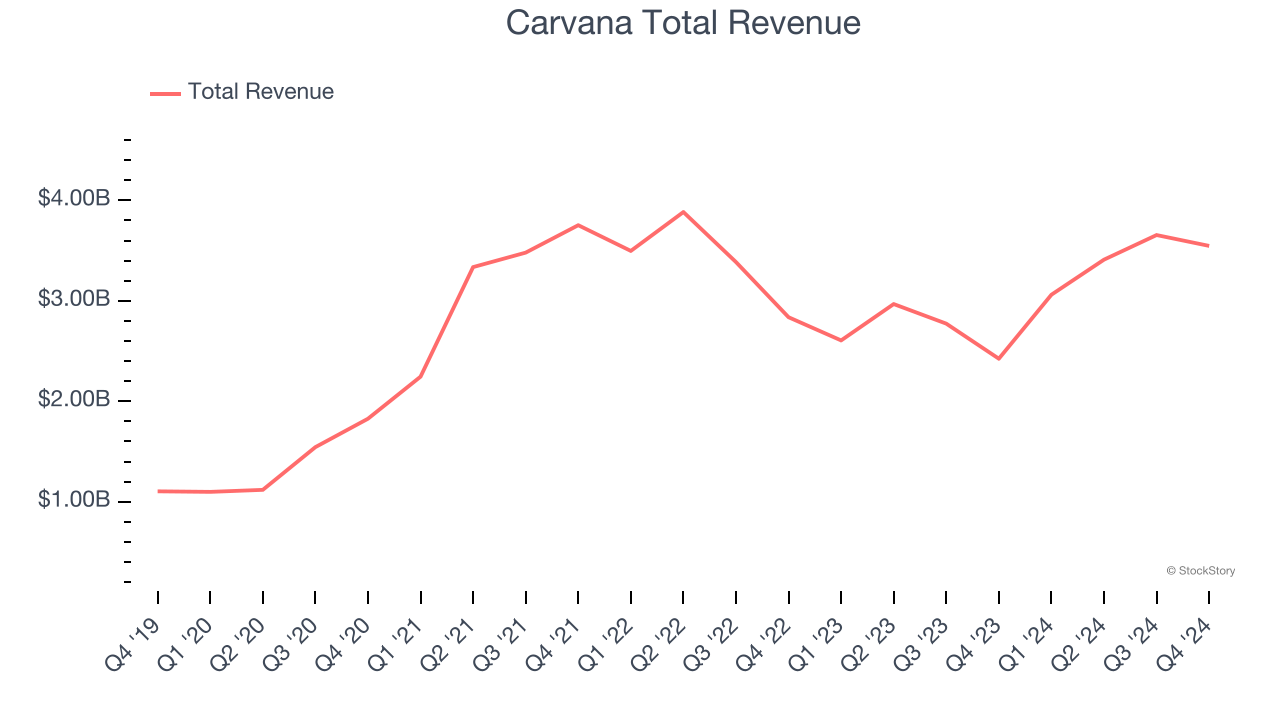

Best Q4: Carvana (NYSE: CVNA)

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $3.55 billion, up 46.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and impressive growth in its units.

The stock is down 46.2% since reporting. It currently trades at $151.55.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Skillz (NYSE: SKLZ)

Taking a new twist at video gaming, Skillz (NYSE: SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $20.37 million, down 34.5% year on year, falling short of analysts’ expectations by 18.7%. It was a disappointing quarter as it posted a decline in its user base.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 110,000 monthly active users, down 19.7% year on year. As expected, the stock is down 25.7% since the results and currently trades at $3.79.

Read our full analysis of Skillz’s results here.

Airbnb (NASDAQ: ABNB)

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $2.48 billion, up 11.8% year on year. This print topped analysts’ expectations by 2.5%. It was a strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ number of nights and experiences booked estimates.

The company reported 111 million nights booked, up 12.3% year on year. The stock is down 27.7% since reporting and currently trades at $101.90.

Read our full, actionable report on Airbnb here, it’s free.

Take-Two (NASDAQ: TTWO)

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ: TTWO) is one of the world’s largest video game publishers.

Take-Two reported revenues of $1.36 billion, flat year on year. This result came in 2.1% below analysts' expectations. Overall, it was a slower quarter as it also logged full-year EBITDA guidance missing analysts’ expectations.

The stock is up 2.7% since reporting and currently trades at $187.99.

Read our full, actionable report on Take-Two here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.