Freight Delivery Company ArcBest (NASDAQ: ARCB) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 6.7% year on year to $967.1 million. Its non-GAAP profit of $0.51 per share was in line with analysts’ consensus estimates.

Is now the time to buy ArcBest? Find out by accessing our full research report, it’s free.

ArcBest (ARCB) Q1 CY2025 Highlights:

- Revenue: $967.1 million vs analyst estimates of $994.2 million (6.7% year-on-year decline, 2.7% miss)

- Adjusted EPS: $0.51 vs analyst estimates of $0.52 (in line)

- Adjusted EBITDA: $49.28 million vs analyst estimates of $50.08 million (5.1% margin, 1.6% miss)

- Operating Margin: 0.7%, down from 2.2% in the same quarter last year

- Free Cash Flow was -$36.84 million compared to -$48.58 million in the same quarter last year

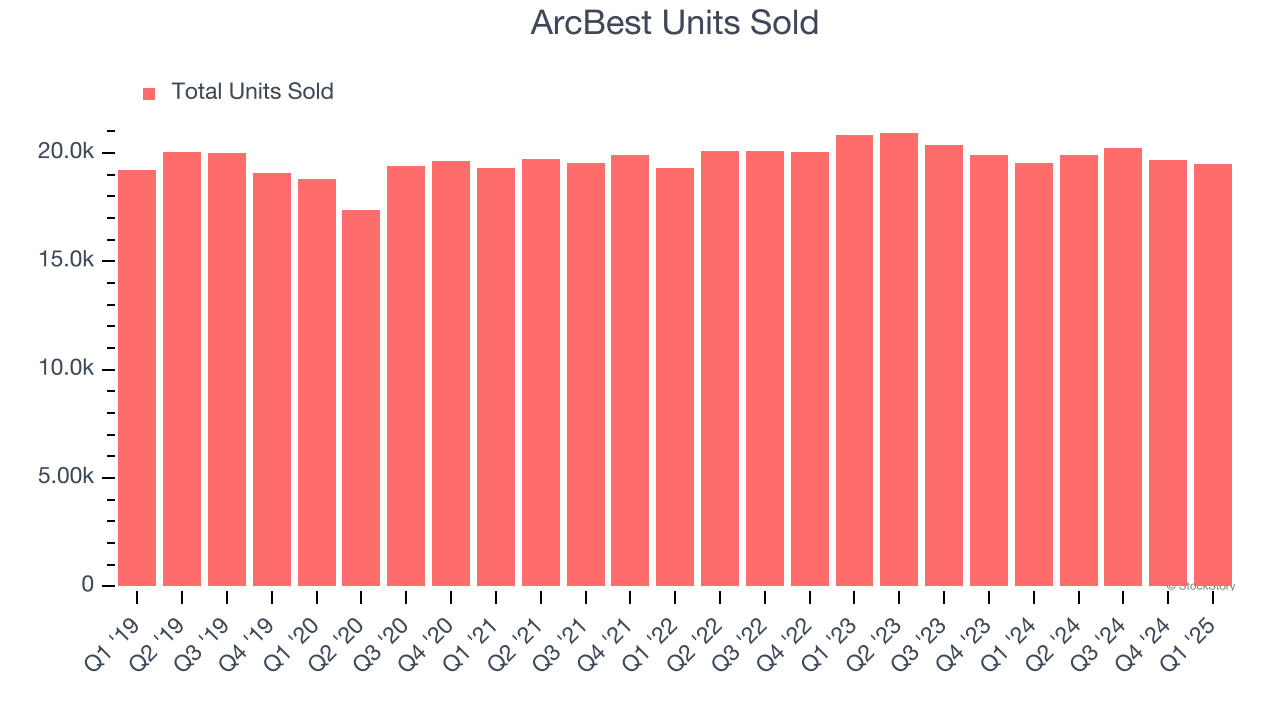

- Sales Volumes were flat year on year (-6.2% in the same quarter last year)

- Market Capitalization: $1.37 billion

"I want to thank our employees for their commitment to excellence as they serve customers,” said Judy R. McReynolds, ArcBest Chairman and CEO.

Company Overview

Historically owning furniture, banking, and other subsidiaries, ArcBest (NASDAQ: ARCB) offers full-truckload, less-than-truckload, and intermodal deliveries of freight.

Sales Growth

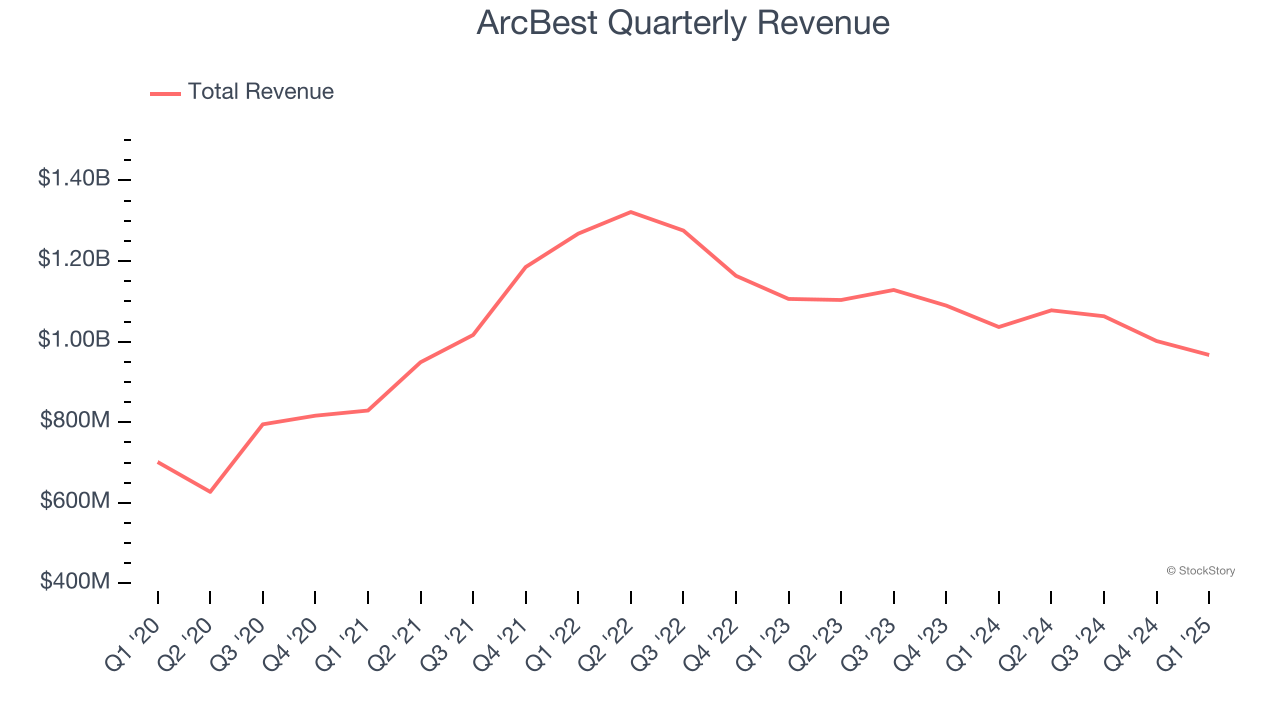

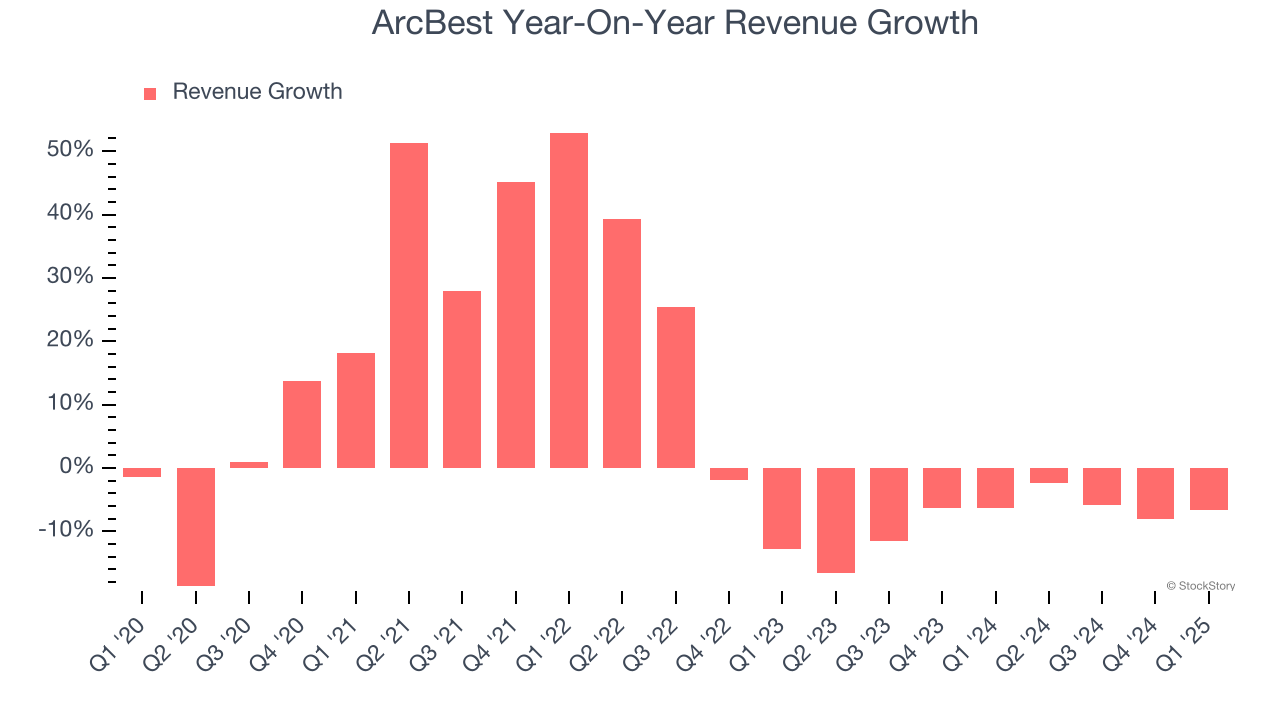

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, ArcBest’s 6.7% annualized revenue growth over the last five years was mediocre. This was below our standard for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. ArcBest’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 8.1% annually. ArcBest isn’t alone in its struggles as the Ground Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can dig further into the company’s revenue dynamics by analyzing its number of units sold, which reached 19,491 in the latest quarter. Over the last two years, ArcBest’s units sold averaged 1% year-on-year declines. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, ArcBest missed Wall Street’s estimates and reported a rather uninspiring 6.7% year-on-year revenue decline, generating $967.1 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

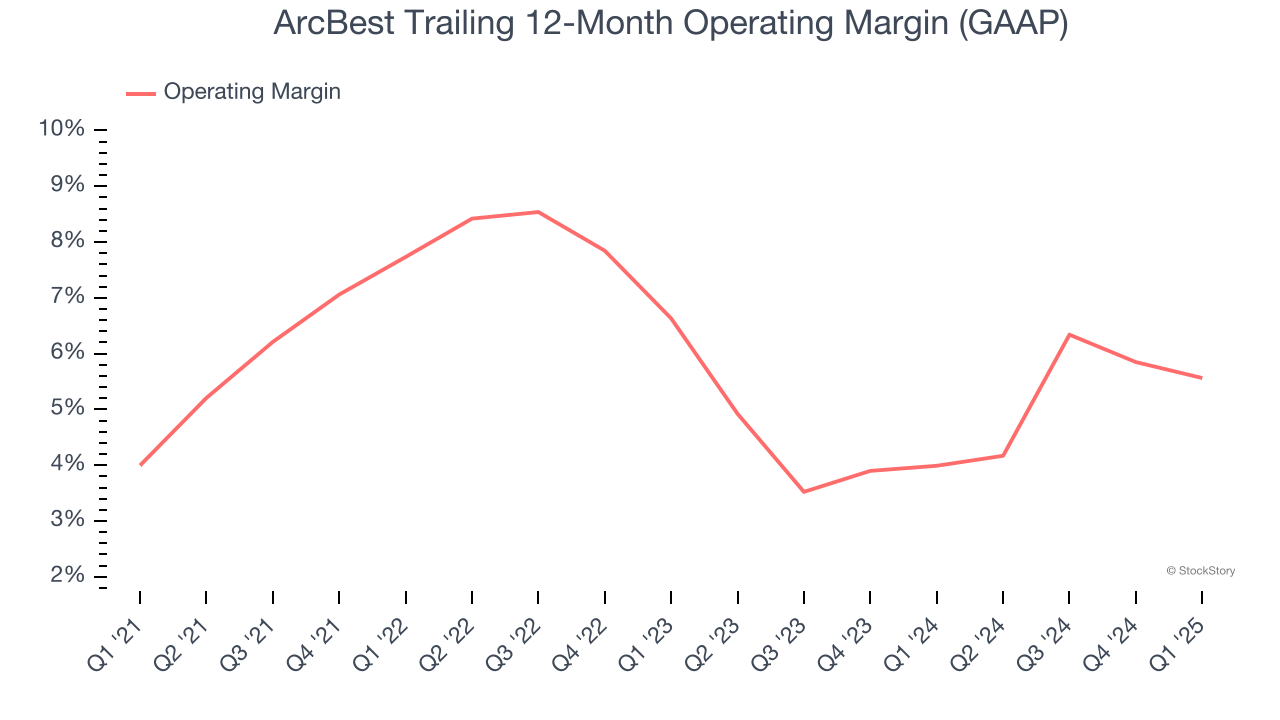

ArcBest was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, ArcBest’s operating margin rose by 1.6 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, ArcBest’s breakeven margin was down 1.5 percentage points year on year. The reduction is quite minuscule and shareholders shouldn’t weigh the results too heavily.

Earnings Per Share

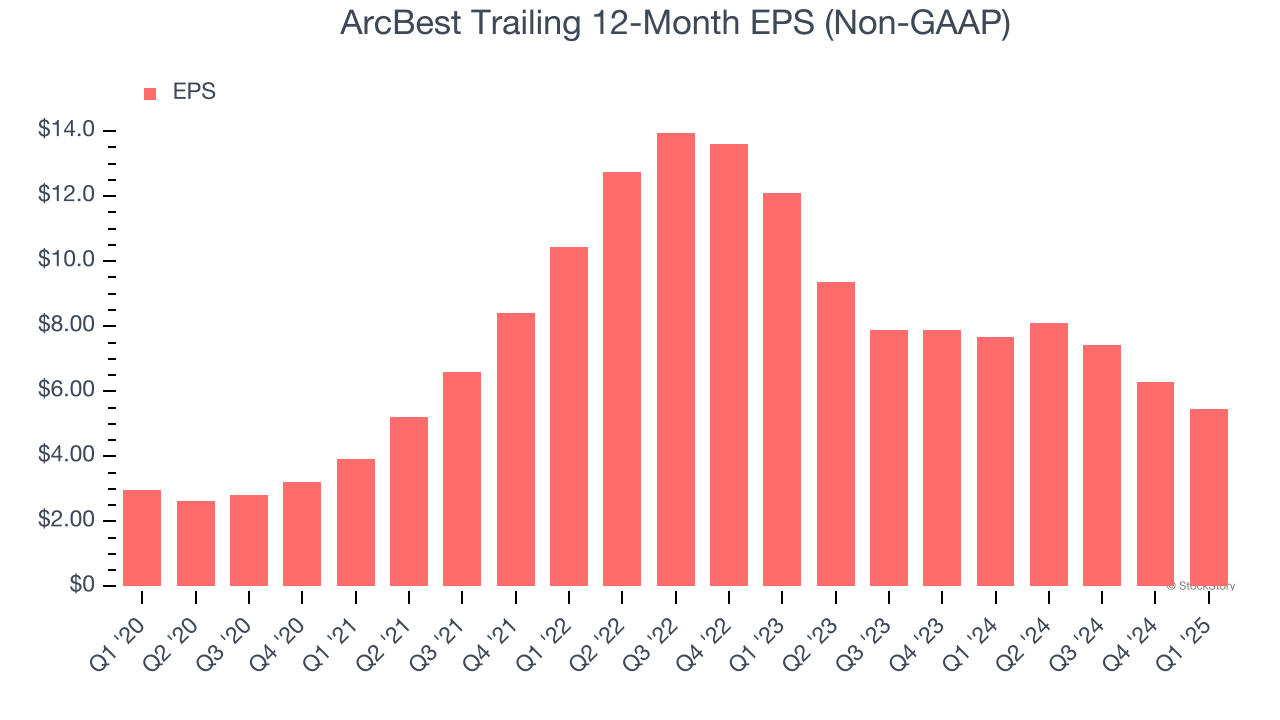

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

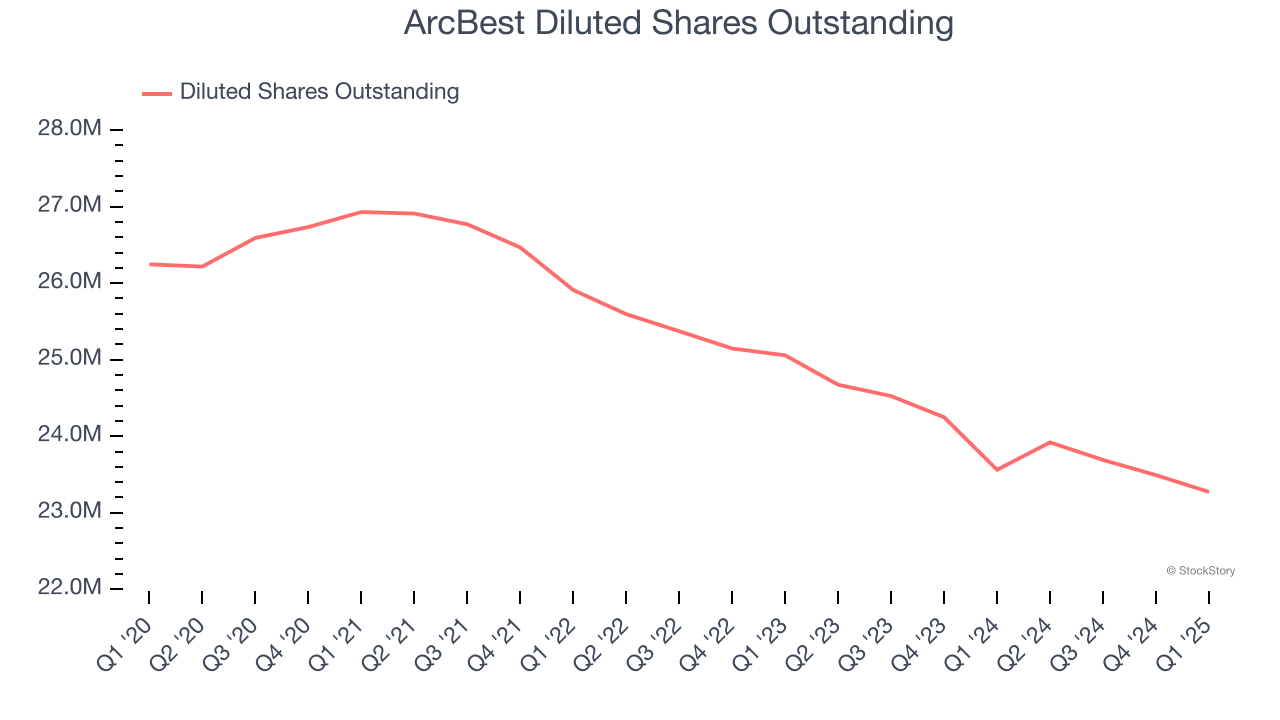

ArcBest’s EPS grew at a remarkable 12.9% compounded annual growth rate over the last five years, higher than its 6.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into ArcBest’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, ArcBest’s operating margin declined this quarter but expanded by 1.6 percentage points over the last five years. Its share count also shrank by 11.3%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For ArcBest, its two-year annual EPS declines of 32.9% mark a reversal from its (seemingly) healthy five-year trend. We hope ArcBest can return to earnings growth in the future.

In Q1, ArcBest reported EPS at $0.51, down from $1.34 in the same quarter last year. This print slightly missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects ArcBest’s full-year EPS of $5.46 to grow 16.9%.

Key Takeaways from ArcBest’s Q1 Results

It was good to see ArcBest narrowly top analysts’ sales volume expectations this quarter. On the other hand, its revenue and EBITDA missed Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 2.9% to $60.79 immediately after reporting.

Is ArcBest an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.