Shoals has gotten torched over the last six months - since October 2024, its stock price has dropped 30.9% to $3.38 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Shoals, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why SHLS doesn't excite us and a stock we'd rather own.

Why Is Shoals Not Exciting?

Started in Huntsville, Alabama, Shoals (NASDAQ: SHLS) designs and manufactures products that make solar energy systems work more efficiently.

1. Backlog Is Unchanged, Sales Pipeline Stalls

Investors interested in Renewable Energy companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Shoals’s future revenue streams.

Over the last two years, Shoals failed to grow its backlog, which came in at $634.7 million in the latest quarter. This performance was underwhelming and shows the company faced challenges in winning new orders. It also suggests there may be increasing competition or market saturation.

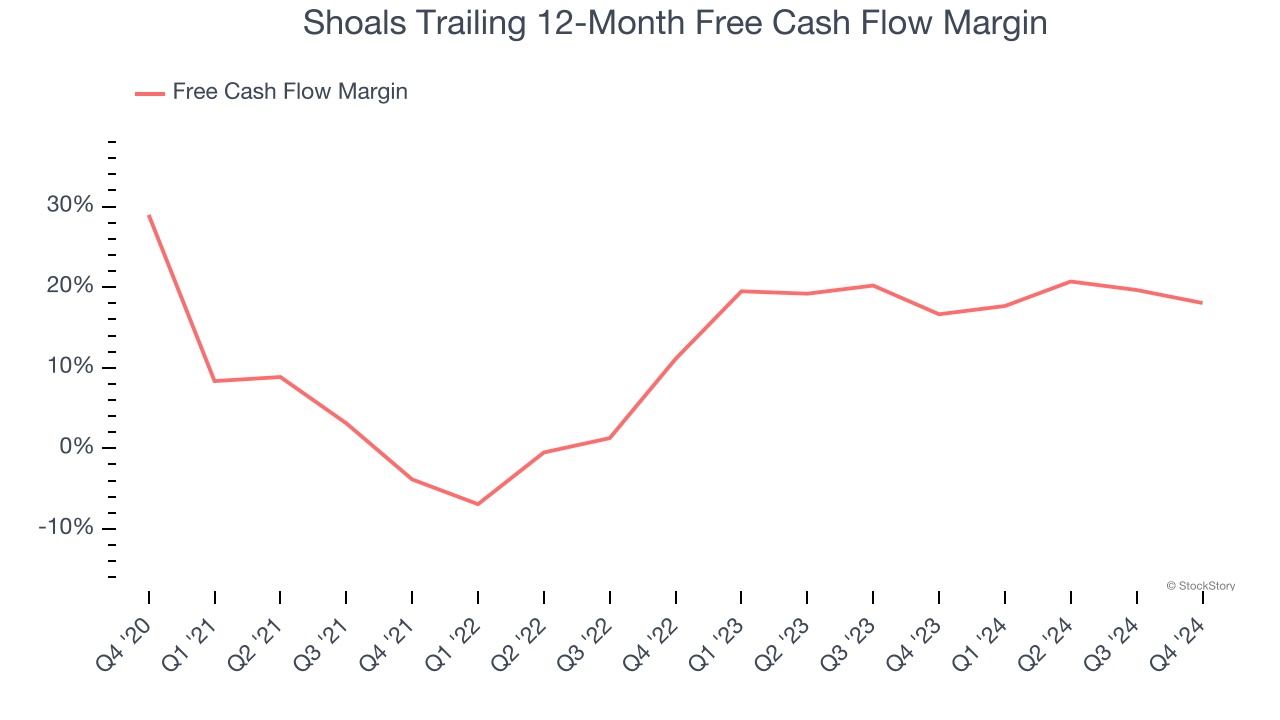

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Shoals’s margin dropped by 10.9 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Shoals’s free cash flow margin for the trailing 12 months was 18%.

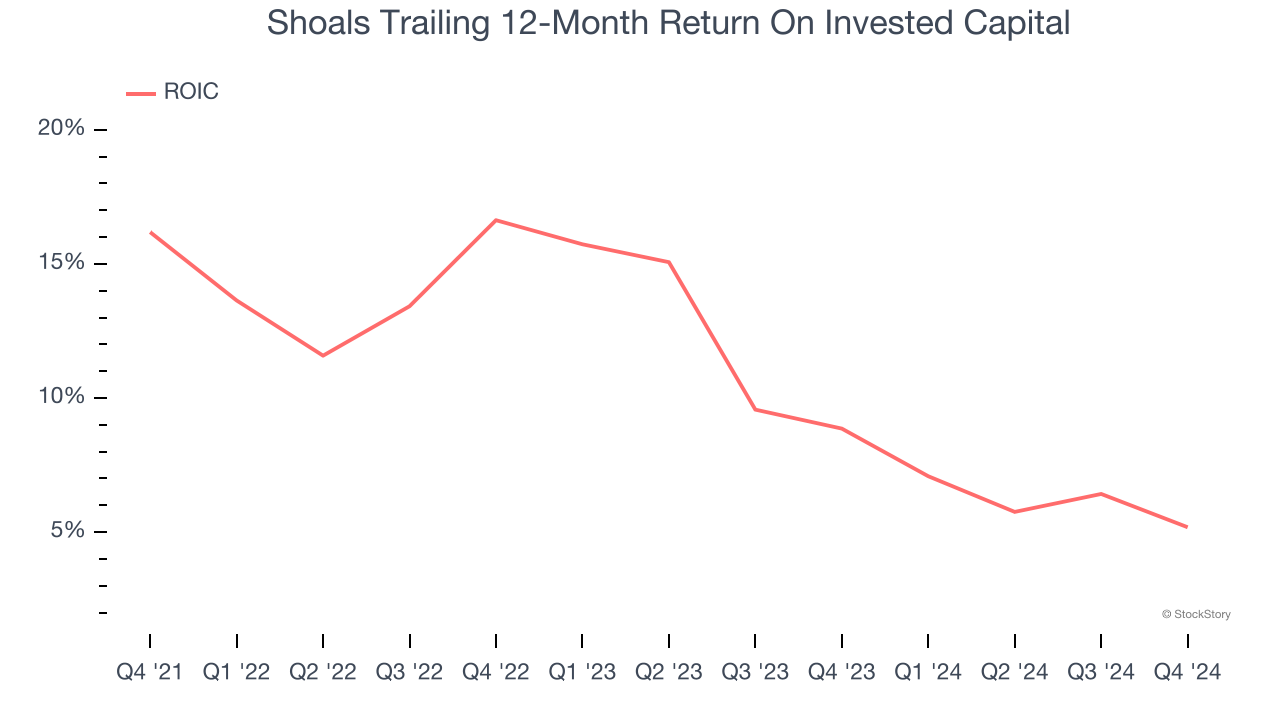

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Shoals’s ROIC has unfortunately decreased. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Shoals isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 7.6× forward price-to-earnings (or $3.38 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Shoals

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.