Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Veeva Systems (NYSE: VEEV) and the best and worst performers in the vertical software industry.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 3.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 18.1% since the latest earnings results.

Veeva Systems (NYSE: VEEV)

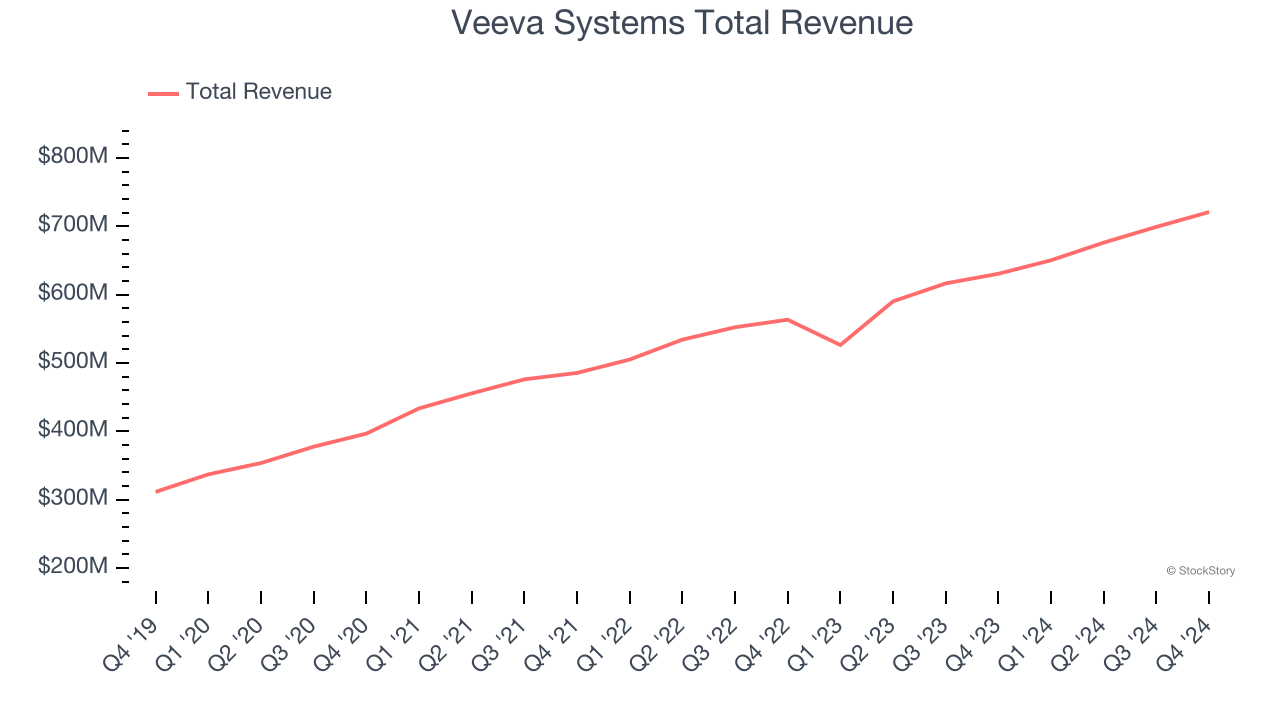

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE: VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Veeva Systems reported revenues of $720.9 million, up 14.3% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a strong quarter for the company with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

"It was an outstanding quarter and year of execution and innovation in software, data, and business consulting," said CEO Peter Gassner.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $220.

Is now the time to buy Veeva Systems? Access our full analysis of the earnings results here, it’s free.

Best Q4: Upstart (NASDAQ: UPST)

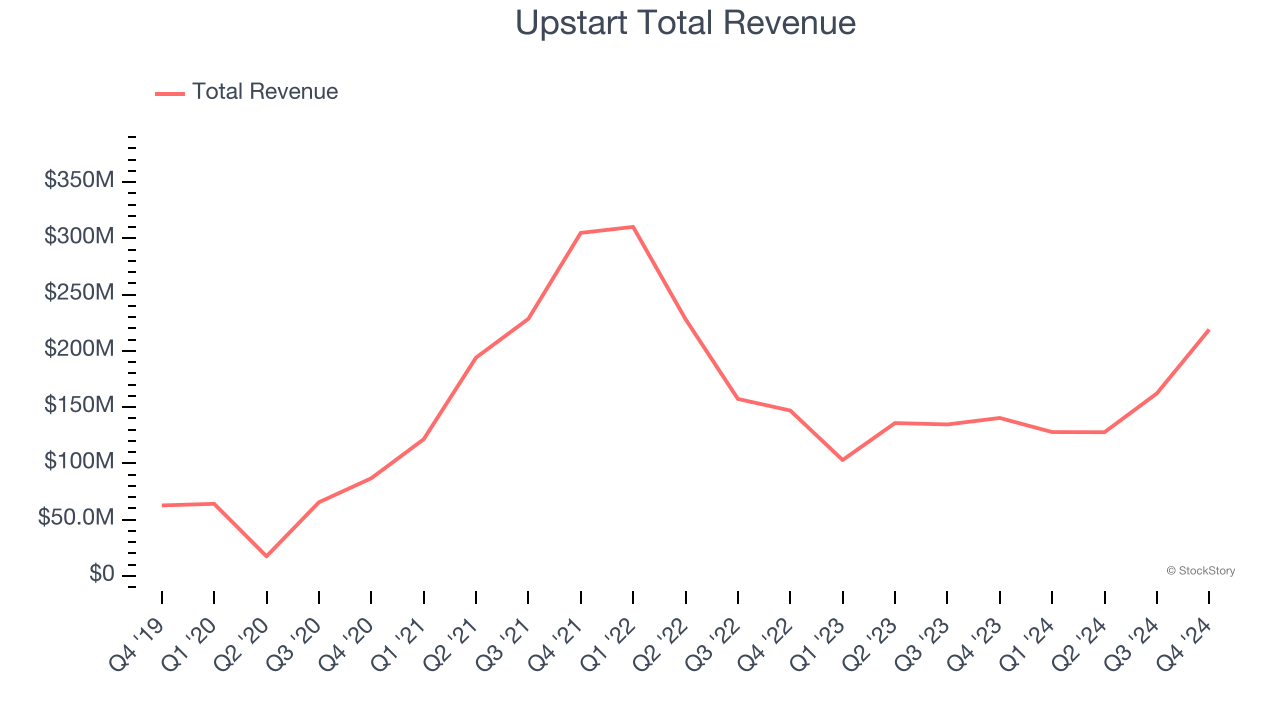

Founded by the former head of Google's enterprise business, Upstart (NASDAQ: UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

Upstart reported revenues of $219 million, up 56.1% year on year, outperforming analysts’ expectations by 20.1%. The business had an exceptional quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

Upstart scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 40.8% since reporting. It currently trades at $39.84.

Is now the time to buy Upstart? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: PTC (NASDAQ: PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ: PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.

PTC reported revenues of $565.1 million, up 2.7% year on year, exceeding analysts’ expectations by 1.9%. Still, it was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations.

As expected, the stock is down 23.1% since the results and currently trades at $145.68.

Read our full analysis of PTC’s results here.

Unity (NYSE: U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE: U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $457.1 million, down 25% year on year. This number beat analysts’ expectations by 5.9%. Taking a step back, it was a satisfactory quarter as it also logged an impressive beat of analysts’ billings estimates but revenue guidance for next quarter missing analysts’ expectations.

Unity had the slowest revenue growth among its peers. The stock is down 13.9% since reporting and currently trades at $18.52.

Read our full, actionable report on Unity here, it’s free.

Doximity (NYSE: DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading social network for U.S. medical professionals.

Doximity reported revenues of $168.6 million, up 24.6% year on year. This print topped analysts’ expectations by 9.6%. It was a very strong quarter as it also recorded EBITDA guidance for next quarter exceeding analysts’ expectations.

The stock is down 9.7% since reporting and currently trades at $52.77.

Read our full, actionable report on Doximity here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.