Since September 2024, Pure Storage has been in a holding pattern, posting a small return of 3.9% while floating around $51.77.

Is now the time to buy PSTG? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Is PSTG a Good Business?

Founded in 2009 as a pioneer in enterprise all-flash storage technology, Pure Storage (NYSE: PSTG) provides all-flash data storage hardware and software that helps organizations manage their data more efficiently across on-premises and cloud environments.

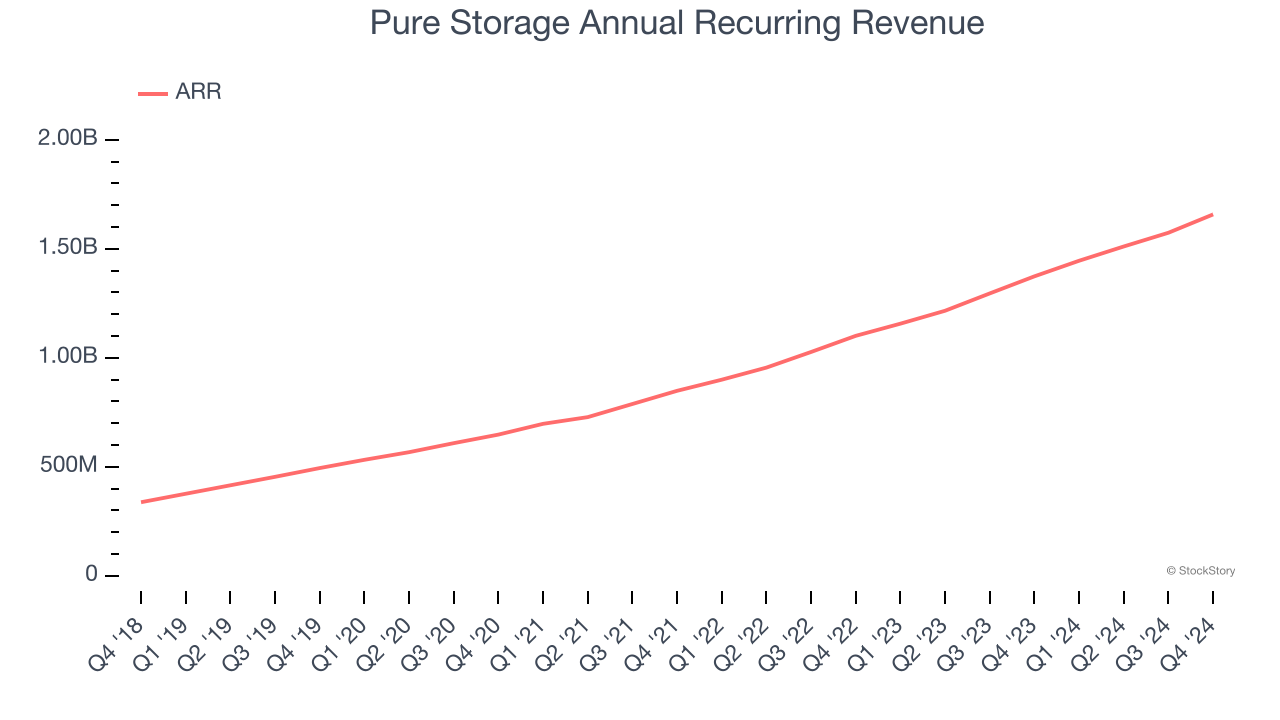

1. ARR Surges as Recurring Revenue Flows In

We can better understand Hardware & Infrastructure companies by analyzing their ARR, or annual recurring revenue. This metric shows how much Pure Storage expects to collect from its existing customer base in the next 12 months, giving visibility into its future revenue streams.

Pure Storage’s ARR punched in at $1.66 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 24.8%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s product offerings. Its growth also makes Pure Storage a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

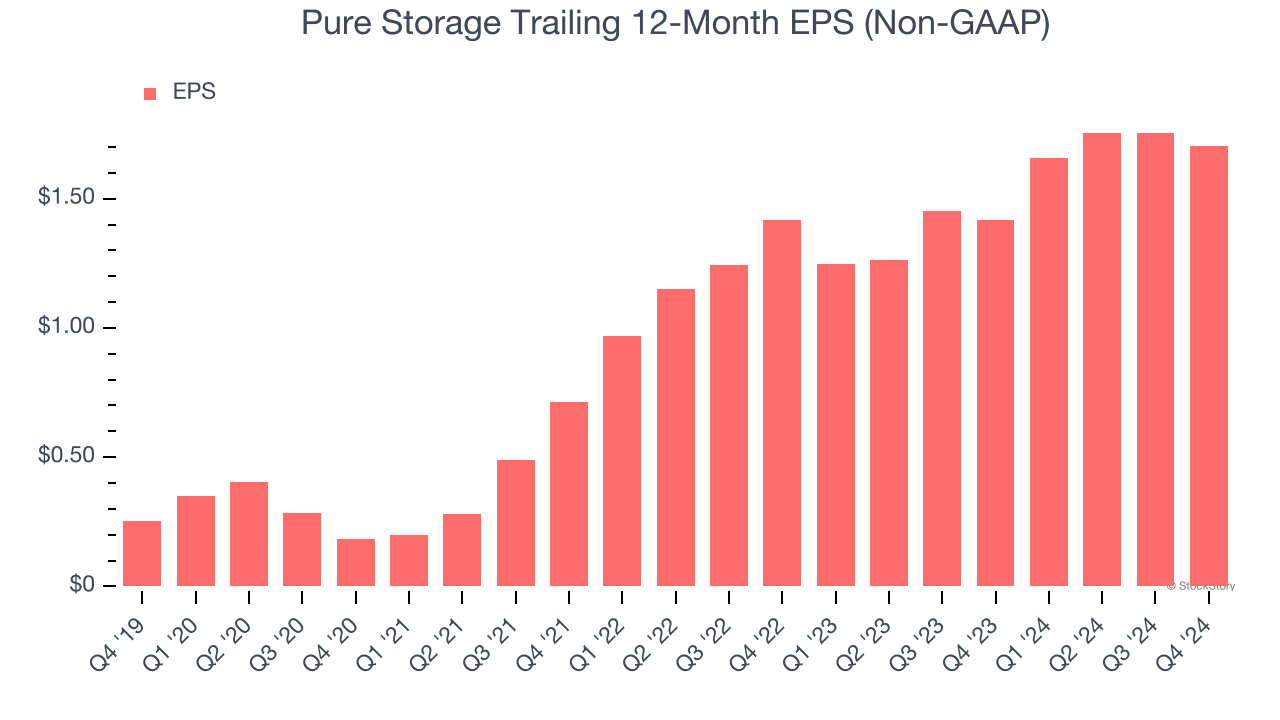

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Pure Storage’s EPS grew at an astounding 46.4% compounded annual growth rate over the last five years, higher than its 14% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

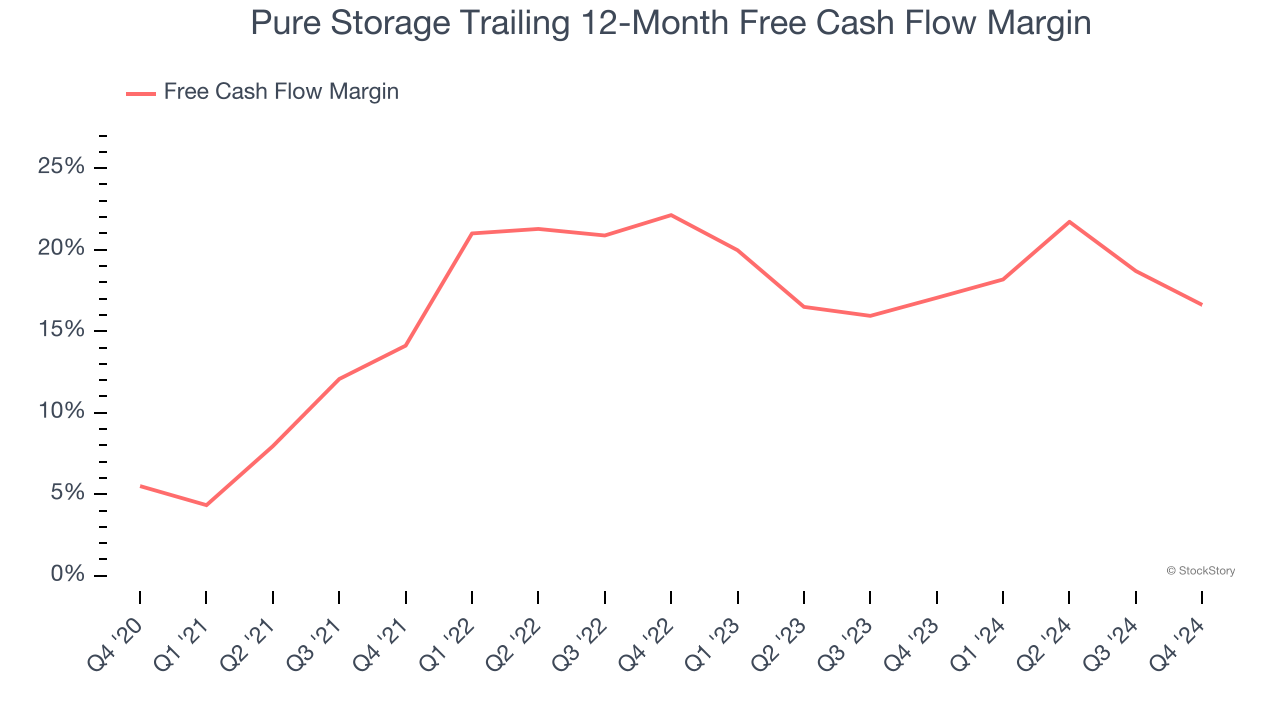

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Pure Storage has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 16% over the last five years.

Final Judgment

These are just a few reasons Pure Storage is a high-quality business worth owning, but at $51.77 per share (or 29× forward price-to-earnings), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Pure Storage

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.