Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Iridium (NASDAQ: IRDM) and its peers.

The sector is a tale of two cities. Satellite telecommunication is generally buoyed by rising global demand for connectivity in costly-to-connect and remote areas. On the other hand, terrestrial telecommunication companies face an uphill battle, as they mostly sell into a deflationary market, where the price of moving a bit tends to decrease over time with better technology. Despite the differences in demand drivers, companies across the entire industry must contend competition from larger telecom conglomerates and hyperscalers expanding their own networks as well as newer entrants such as SpaceX's StarLink.

The 6 telecommunication services stocks we track reported a very strong Q4. As a group, revenues beat analysts’ consensus estimates by 1.5%.

While some telecommunication services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.8% since the latest earnings results.

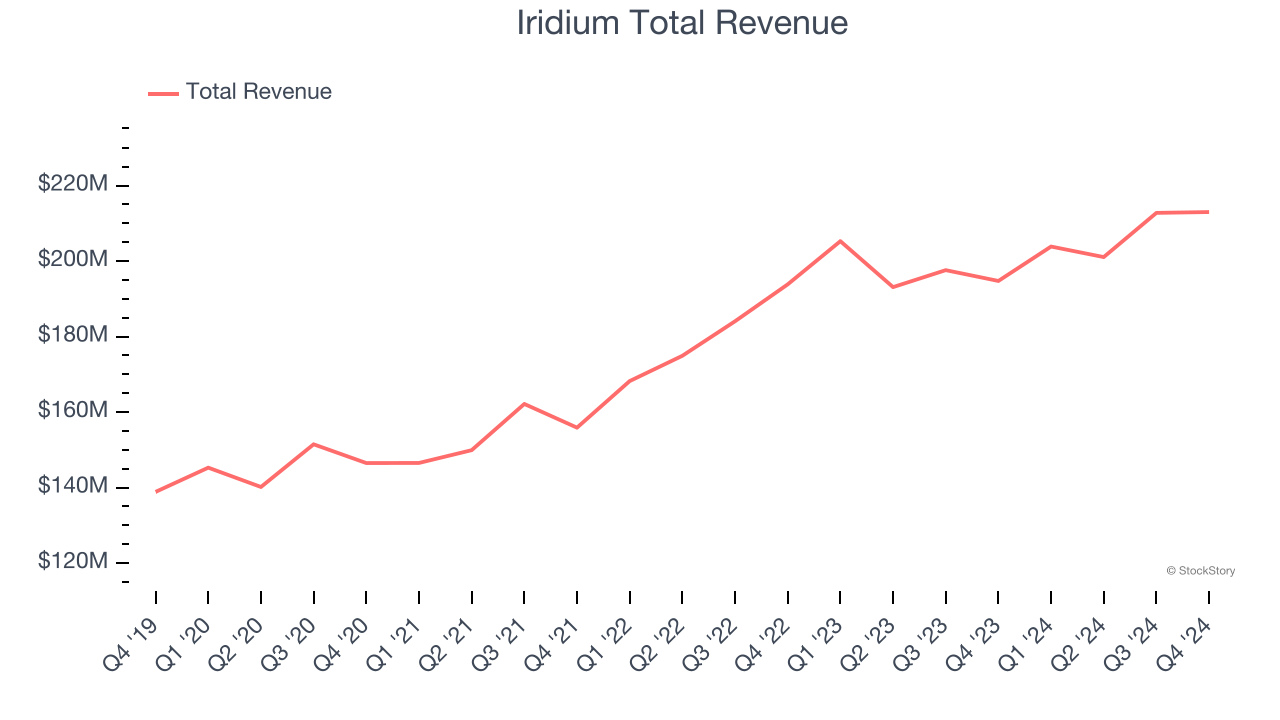

Best Q4: Iridium (NASDAQ: IRDM)

With a constellation of 66 low-earth orbit satellites providing coverage to every inch of the planet, Iridium Communications (NASDAQ: IRDM) operates a global satellite network that provides voice and data services to customers in remote areas where traditional telecommunications are unavailable.

Iridium reported revenues of $213 million, up 9.4% year on year. This print exceeded analysts’ expectations by 4.3%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ EPS estimates.

Iridium pulled off the biggest analyst estimates beat of the whole group. The stock is up 1.6% since reporting and currently trades at $28.18.

Is now the time to buy Iridium? Access our full analysis of the earnings results here, it’s free.

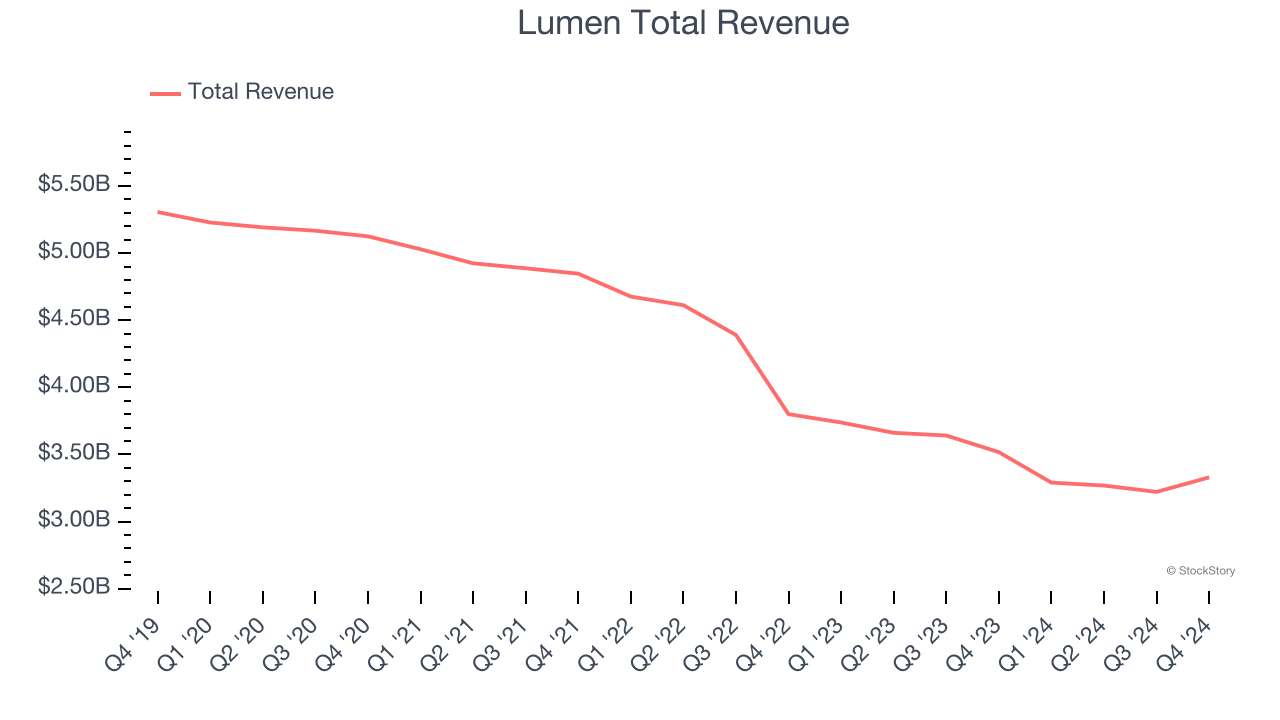

Lumen (NYSE: LUMN)

With approximately 350,000 route miles of fiber optic cable spanning North America and the Asia Pacific, Lumen Technologies (NYSE: LUMN) operates a vast fiber optic network that provides communications, cloud connectivity, security, and IT solutions to businesses and consumers.

Lumen reported revenues of $3.33 billion, down 5.3% year on year, outperforming analysts’ expectations by 4.2%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 1.1% since reporting. It currently trades at $4.97.

Is now the time to buy Lumen? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Globalstar (NASDAQ: GSAT)

Known for powering the emergency SOS feature in newer Apple iPhones, Globalstar (NASDAQ: GSAT) operates a network of low-earth orbit satellites that provide voice and data communications services in remote areas where traditional cellular networks don't reach.

Globalstar reported revenues of $61.18 million, up 16.7% year on year, exceeding analysts’ expectations by 1.6%. Still, it was a mixed quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 1.2% since the results and currently trades at $21.83.

Read our full analysis of Globalstar’s results here.

Cogent (NASDAQ: CCOI)

Operating a massive network spanning 20,000 miles of fiber optic cable and connecting to over 3,200 buildings worldwide, Cogent Communications (NASDAQ: CCOI) provides high-speed Internet access, private network services, and data center colocation to businesses and bandwidth-intensive organizations across 54 countries.

Cogent reported revenues of $252.3 million, down 7.3% year on year. This print lagged analysts' expectations by 2.5%. In spite of that, it was a satisfactory quarter as it recorded an impressive beat of analysts’ EPS estimates.

Cogent had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 15.2% since reporting and currently trades at $67.87.

Read our full, actionable report on Cogent here, it’s free.

U.S. Cellular (NYSE: USM)

Operating as a majority-owned subsidiary of Telephone and Data Systems since its founding in 1983, US Cellular (NYSE: USM) is a regional wireless telecommunications provider serving 4.6 million customers across 21 states with mobile phone, internet, and IoT services.

U.S. Cellular reported revenues of $970 million, down 3% year on year. This number topped analysts’ expectations by 0.6%. Overall, it was an exceptional quarter as it also produced a solid beat of analysts’ EPS estimates.

The stock is up 2.1% since reporting and currently trades at $68.64.

Read our full, actionable report on U.S. Cellular here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.