Over the past six months, Hanesbrands’s shares (currently trading at $6.03) have posted a disappointing 10% loss while the S&P 500 was down 1.4%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Hanesbrands, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why we avoid HBI and a stock we'd rather own.

Why Do We Think Hanesbrands Will Underperform?

A classic American staple founded in 1901, Hanesbrands (NYSE: HBI) is a clothing company known for its array of basic apparel including innerwear and activewear.

1. Declining Constant Currency Revenue, Demand Takes a Hit

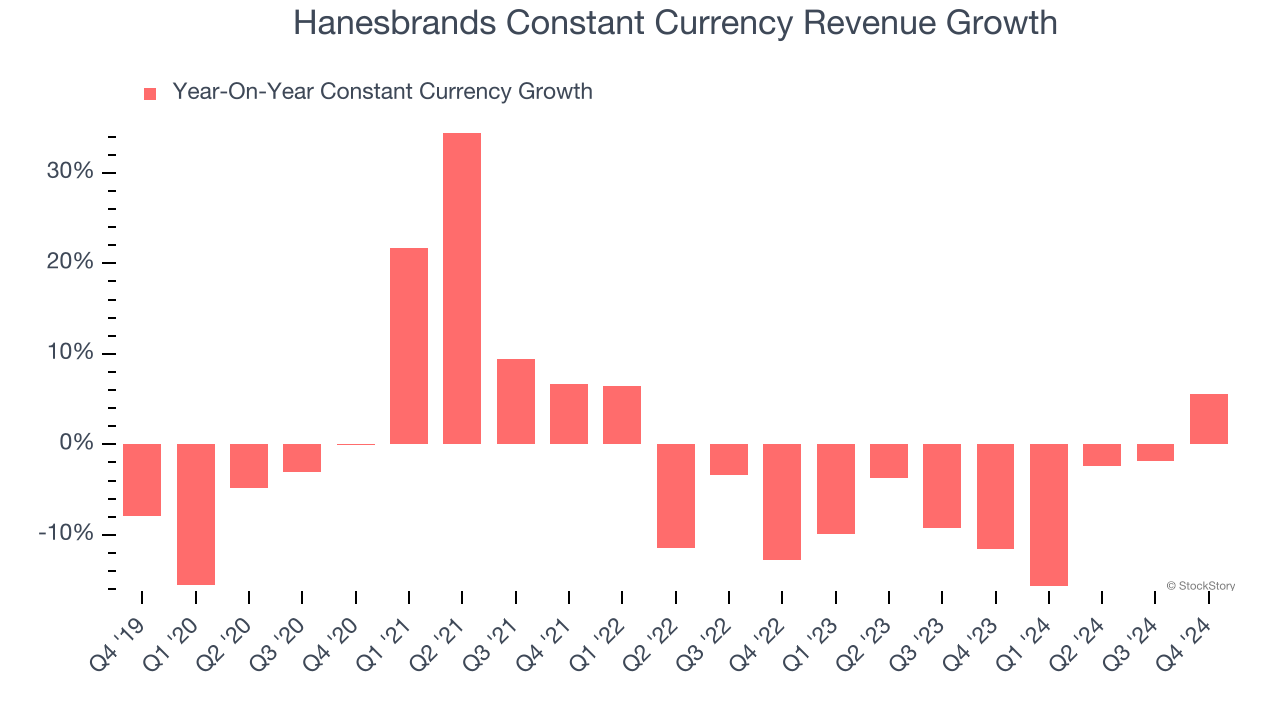

Investors interested in Apparel and Accessories companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Hanesbrands’s control and are not indicative of underlying demand.

Over the last two years, Hanesbrands’s constant currency revenue averaged 6.1% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Hanesbrands might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. EPS Trending Down

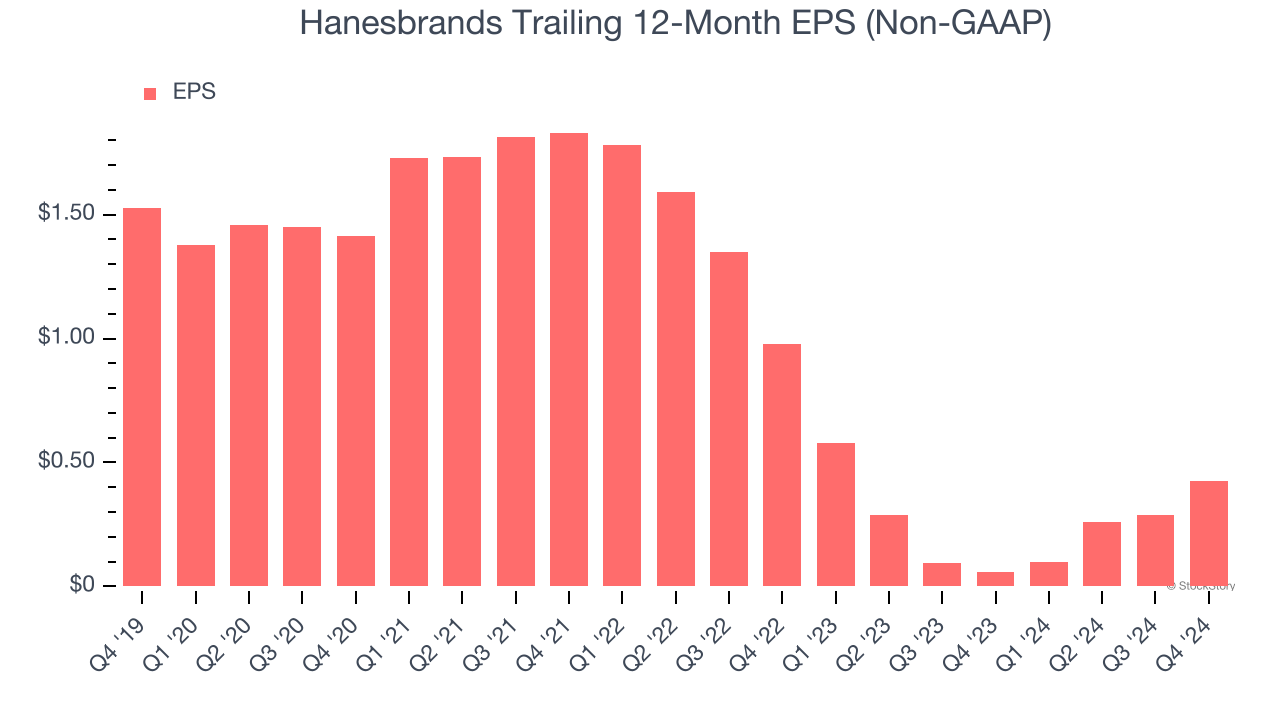

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Hanesbrands, its EPS declined by 22.5% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Hanesbrands’s ROIC averaged 4.1 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Hanesbrands falls short of our quality standards. Following the recent decline, the stock trades at 11× forward price-to-earnings (or $6.03 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Hanesbrands

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.