The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how electrical systems stocks fared in Q4, starting with Thermon (NYSE: THR).

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 13 electrical systems stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 6.1% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 15.2% since the latest earnings results.

Thermon (NYSE: THR)

Creating the first packaged tracing systems, Thermon (NYSE: THR) is a leading provider of engineered industrial process heating solutions for process industries.

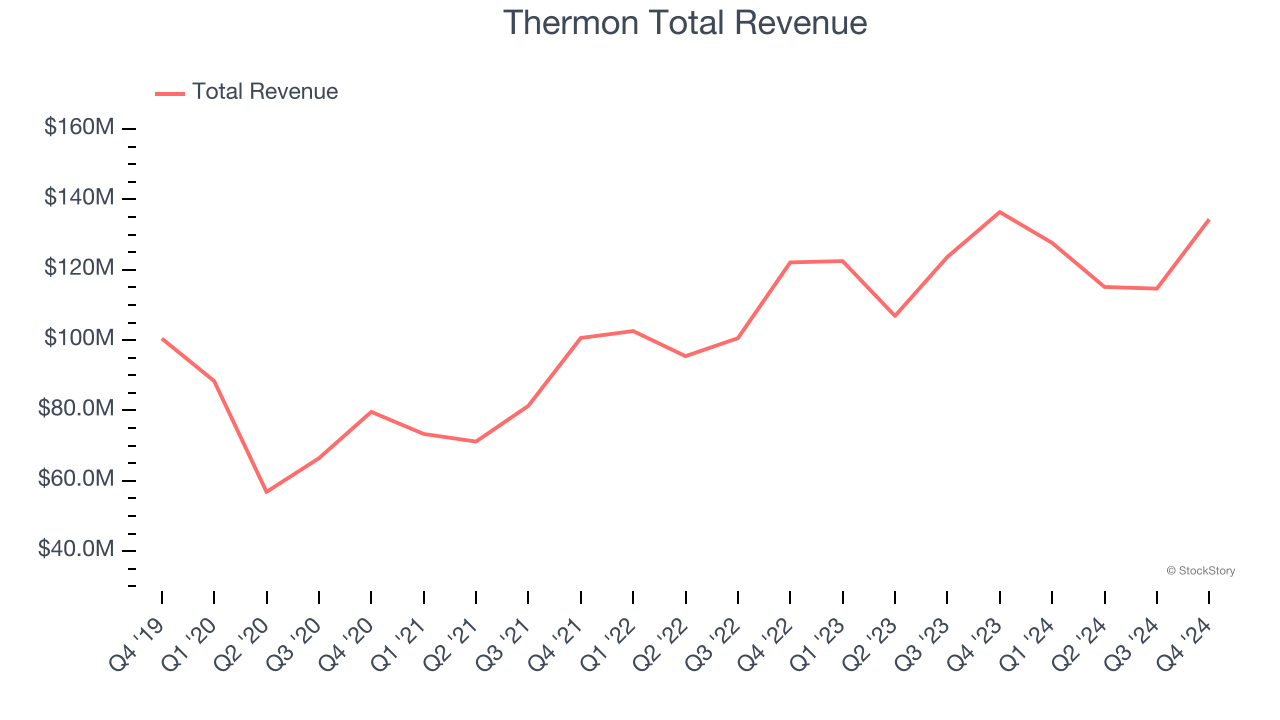

Thermon reported revenues of $134.4 million, down 1.5% year on year. This print fell short of analysts’ expectations by 3.3%. Overall, it was a mixed quarter for the company with full-year EBITDA guidance meeting analysts’ expectations.

Thermon pulled off the highest full-year guidance raise of the whole group. The stock is up 11.9% since reporting and currently trades at $30.15.

Is now the time to buy Thermon? Access our full analysis of the earnings results here, it’s free.

Best Q4: LSI (NASDAQ: LYTS)

Enhancing commercial environments, LSI (NASDAQ: LYTS) provides lighting and display solutions for businesses and retailers.

LSI reported revenues of $147.7 million, up 35.5% year on year, outperforming analysts’ expectations by 14.3%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

LSI delivered the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 11.2% since reporting. It currently trades at $17.58.

Is now the time to buy LSI? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Methode Electronics (NYSE: MEI)

Founded in 1946, Methode Electronics (NYSE: MEI) is a global supplier of custom-engineered solutions for Original Equipment Manufacturers (OEMs).

Methode Electronics reported revenues of $239.9 million, down 7.6% year on year, falling short of analysts’ expectations by 8.9%. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations.

Methode Electronics delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 35% since the results and currently trades at $6.38.

Read our full analysis of Methode Electronics’s results here.

Powell (NASDAQ: POWL)

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE: POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

Powell reported revenues of $241.4 million, up 24.4% year on year. This number surpassed analysts’ expectations by 3.8%. Aside from that, it was a satisfactory quarter as it also produced a decent beat of analysts’ EPS estimates.

The stock is down 26.6% since reporting and currently trades at $179.41.

Read our full, actionable report on Powell here, it’s free.

Acuity Brands (NYSE: AYI)

One of the pioneers of smart lights, Acuity (NYSE: AYI) designs and manufactures light fixtures and building management systems used in various industries.

Acuity Brands reported revenues of $951.6 million, up 1.8% year on year. This result came in 0.6% below analysts' expectations. Zooming out, it was a mixed quarter as it also recorded a decent beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ organic revenue estimates.

The stock is down 12.6% since reporting and currently trades at $266.

Read our full, actionable report on Acuity Brands here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.