Myriad Genetics’s stock price has taken a beating over the past six months, shedding 65.1% of its value and falling to $9.99 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Myriad Genetics, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we're swiping left on Myriad Genetics for now. Here are three reasons why there are better opportunities than MYGN and a stock we'd rather own.

Why Do We Think Myriad Genetics Will Underperform?

Founded in 1991 as one of the pioneers in translating genetic discoveries into clinical applications, Myriad Genetics (NASDAQ: MYGN) develops genetic tests that assess disease risk, guide treatment decisions, and provide insights across oncology, women's health, and mental health.

1. Long-Term Revenue Growth Flatter Than a Pancake

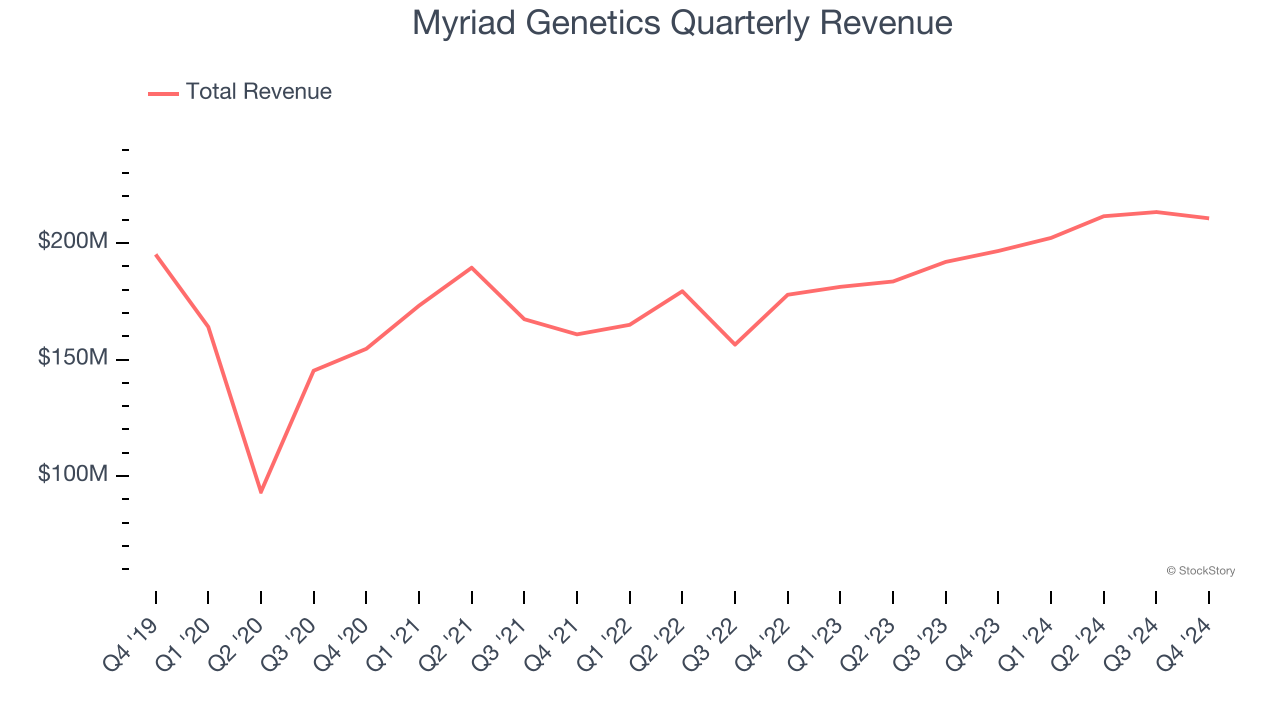

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Myriad Genetics struggled to consistently increase demand as its $837.6 million of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

2. EPS Trending Down

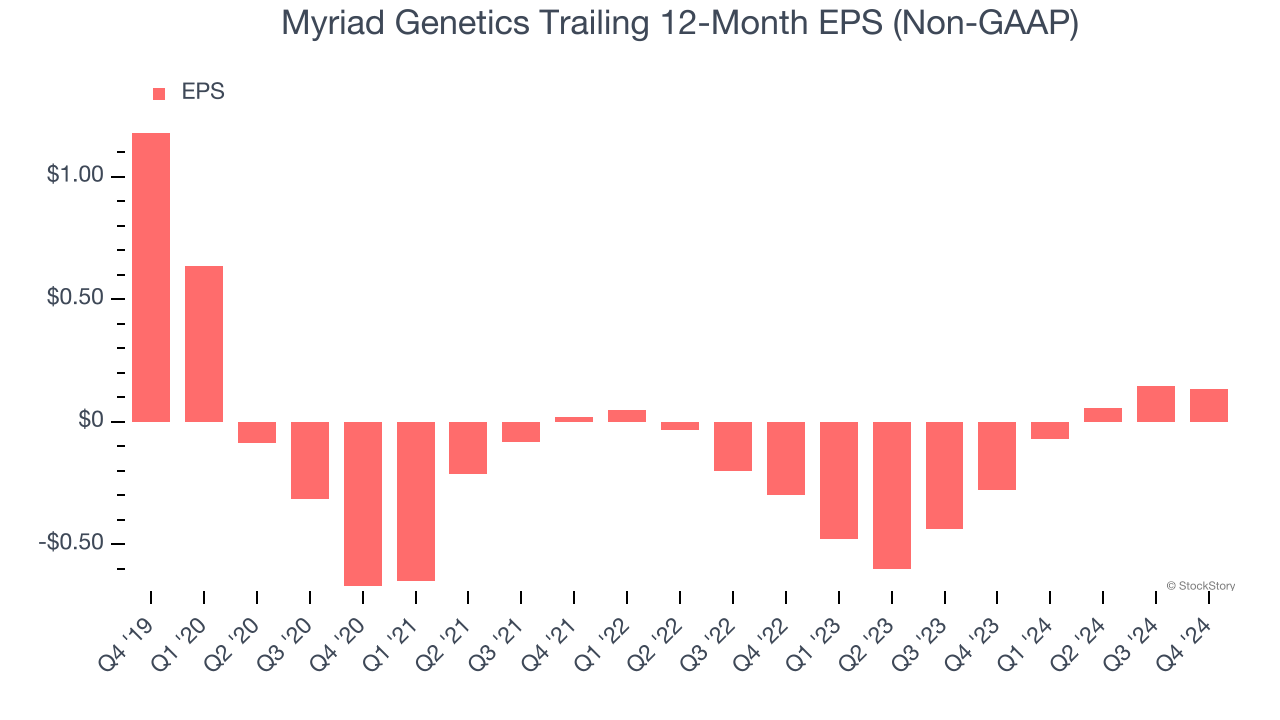

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Myriad Genetics, its EPS declined by 35.3% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

3. Previous Growth Initiatives Have Lost Money

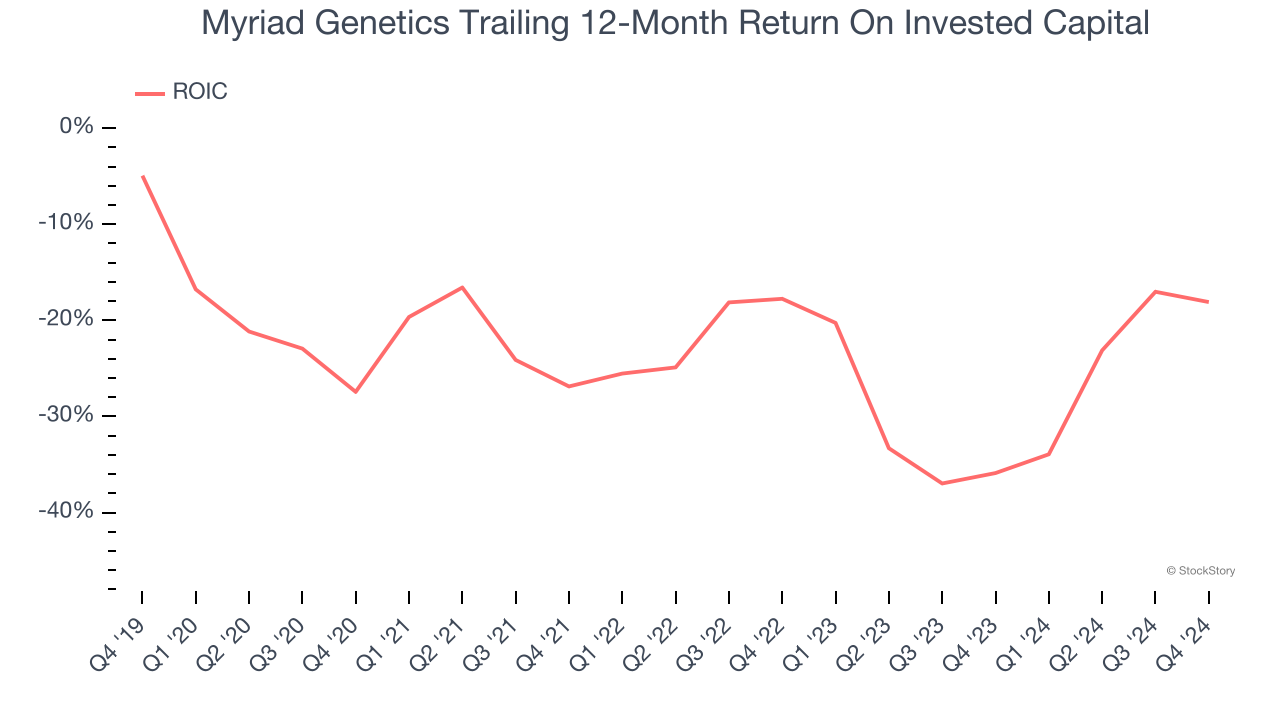

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Myriad Genetics’s five-year average ROIC was negative 25.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

Myriad Genetics doesn’t pass our quality test. After the recent drawdown, the stock trades at 192.9× forward price-to-earnings (or $9.99 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Myriad Genetics

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.