Over the past six months, A. O. Smith’s stock price fell to $66.30. Shareholders have lost 19.6% of their capital, disappointing when considering the S&P 500 was flat. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy A. O. Smith, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we're cautious about A. O. Smith. Here are three reasons why you should be careful with AOS and a stock we'd rather own.

Why Is A. O. Smith Not Exciting?

Credited with the invention of the glass-lined water heater, A.O. Smith (NYSE: AOS) manufactures water heating and treatment products for various industries.

1. Slow Organic Growth Suggests Waning Demand In Core Business

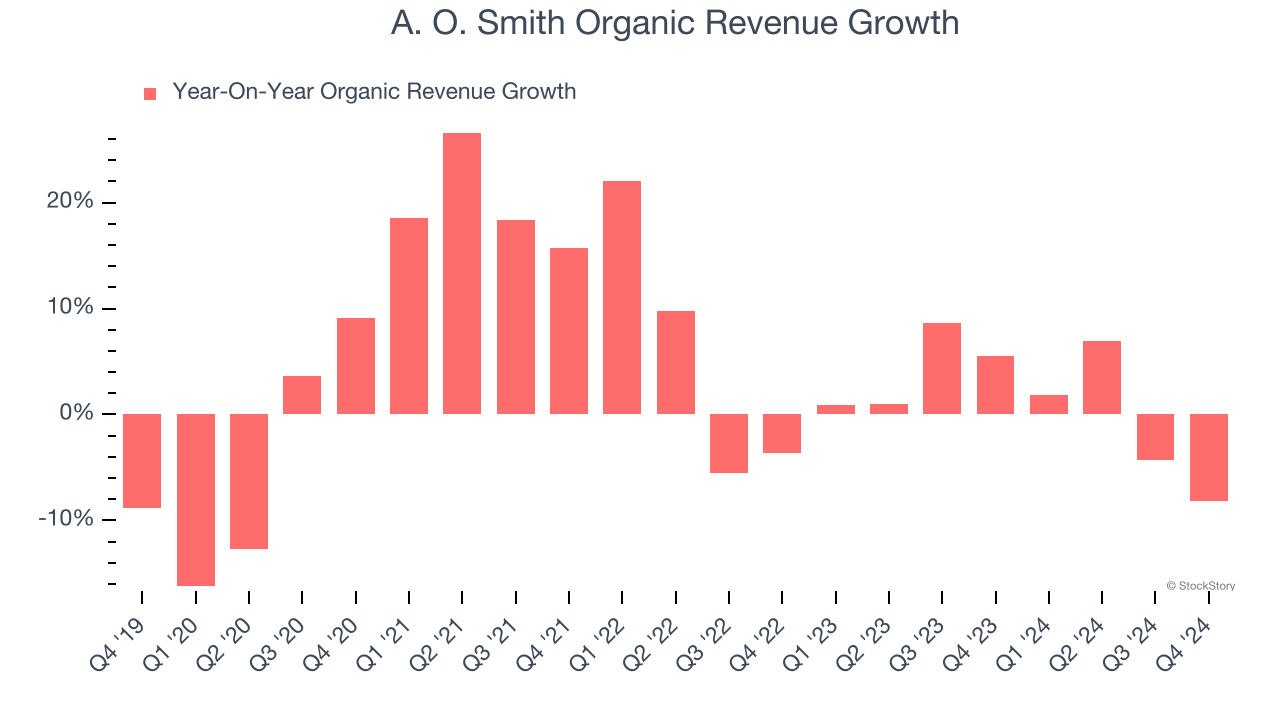

Investors interested in HVAC and Water Systems companies should track organic revenue in addition to reported revenue. This metric gives visibility into A. O. Smith’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, A. O. Smith’s organic revenue averaged 1.5% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect A. O. Smith’s revenue to stall, close to its flat sales for the past two years. This projection doesn't excite us and indicates its newer products and services will not lead to better top-line performance yet.

3. Free Cash Flow Margin Dropping

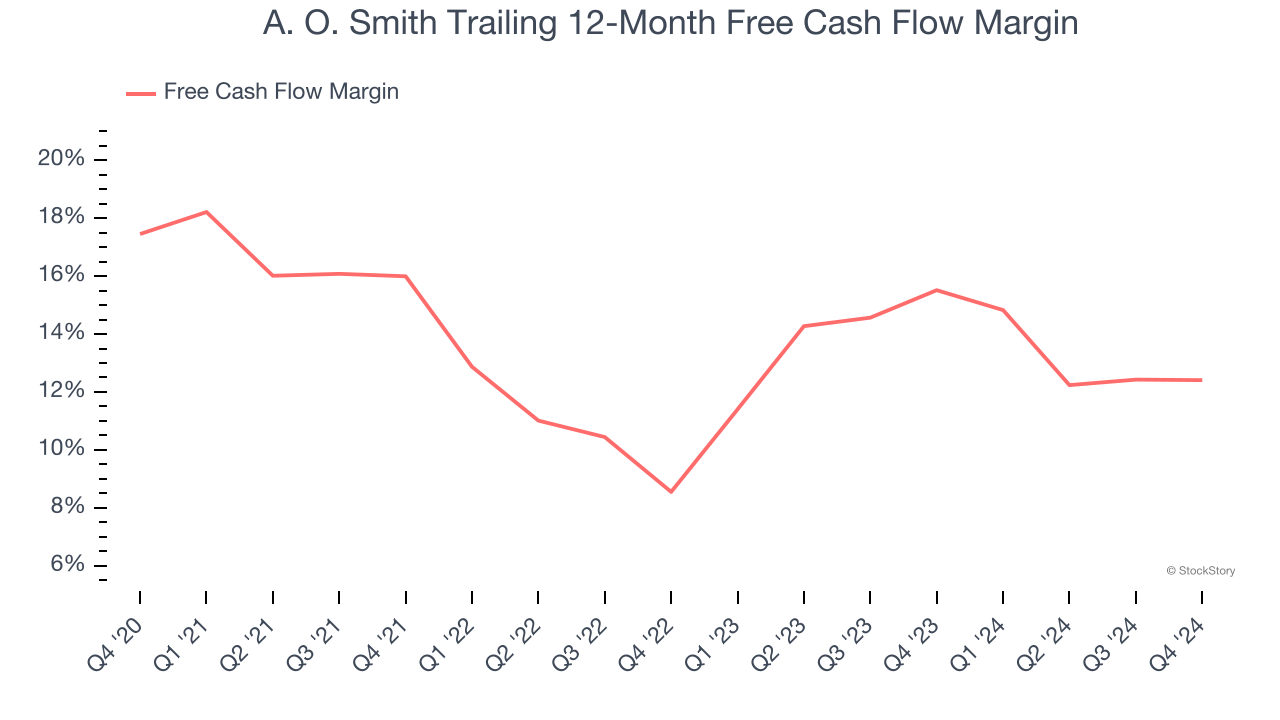

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, A. O. Smith’s margin dropped by 5 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. A. O. Smith’s free cash flow margin for the trailing 12 months was 12.4%.

Final Judgment

A. O. Smith isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 16.6× forward price-to-earnings (or $66.30 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than A. O. Smith

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.