Nvidia (NVDA) bulls may feel betrayed by Dan Ives. Although the popular tech analyst from Wedbush remains one of the biggest cheerleaders of the world's most valuable company, NVDA did not make it onto Ives' list of stocks to watch out for in 2026. Instead, one of the names that Ives is excited about more this year is Microsoft (MSFT).

Why is the Wedbush analyst so excited about MSFT stock? Let's take a closer look.

Why Is Ives So Bullish About Microsoft in 2026?

Making the case for Microsoft in a recent investor note, Ives and his team of analysts stated that Wall Street is “underestimating the Azure growth story” and that “the AI-driven shift about to happen in Redmond heading into 2026 [makes] Microsoft one of our favorite large-cap tech names." Ives and his team continued, "While AI use cases built markedly in [fiscal 2025], it's clear [fiscal 2026] for Microsoft remains the true inflection year of AI growth as CIO lines build for deployments."

This optimism around Microsoft is not new. Indeed, Ives has been bullish about the company ever since Satya Nadella took over as CEO in 2014. Basing his bullishness on cloud and enterprise, the analyst has called Microsoft one of the most under-sung cloud stories in tech.

After the pandemic-induced selloff in the MSFT stock, Ives highlighted it as a “table pounder” on the back of the company's pricing power, pristine balance sheet and significant cloud backlog. More recently, since the emergence of AI in the picture, the analyst's case for investing in Microsoft has only got stronger. Reiterating that Microsoft was in the “early innings” of its AI growth story, Ives maintained an “Outperform” rating on MSFT in late December with a $625 price target, citing AI and cloud momentum led by Azure.

Notably, Ives' assertions around Microsoft have paid off so far, with the company now commanding a market capitalization of $3.5 trillion and MSFT stock up significantly since Nadella took over as the CEO of the company. For the past 52-week period, MSFT stock is up 11%. It currently offers a dividend yield of 0.75%.

So, should investors follow Ives' suit and is MSFT stock the right choice in 2026?

Microsoft's Envious Financials

Microsoft kicked off fiscal 2026 with another beat on the revenue and earnings front in the first quarter. Revenues for the quarter came in at $77.7 billion, up 18% from the previous year. Cloud revenue, which made up more than 63% of the total revenues, grew by 26% year-over-year (YOY) to $49.1 billion. Meanwhile, earnings moved higher by 23% on a YOY basis to $4.13 per share, easily outpacing the consensus estimate of an EPS of $3.67. Notably, this marked the ninth consecutive quarter of earnings beat from the company.

Further, remaining performance obligations surged by 51% on a yearly basis to $392 billion, indicating strong revenue visibility and demand.

Overall, the past 10 years saw the company reporting revenue and earnings compound annual growth rates (CAGRs) of 12.47% and 23.65%, highlighting the continued demand for Microsoft's offerings among consumers and enterprises alike, combined with a profitability rise for shareholders.

Coming back to Q1, Microsoft remains a cash-generating machine, having generated net cash from operations of $45.1 billion in Q1, higher than the previous year's figure of $34.2 billion. Overall, Microsoft ended the quarter with a cash balance of $28.8 billion, which comfortably covers its short-term debt levels of $7.8 billion.

Moreover, unlike many of its "Magnificent Seven" peers, MSFT stock trades at reasonable levels. While its forward earnings multiple of 30.5 is actually lower than the sector median, its forward price-to-sales and price-cash flow multiples of 12.7 and 26.4 are both above the sector medians, with above-average growth rates predicted for the company.

AI Core to Drive Growth

Microsoft has effectively established itself as a foundational, nearly indispensable provider within the artificial intelligence (AI) landscape, leveraging its AI Factory infrastructure and the widespread embedding of Copilot throughout its software suite. The company's software ecosystem serves as the essential backbone for a vast majority of global enterprises, encompassing critical functions in security, data management, communications, and core productivity, from Word and Excel to Outlook and Teams. This suite represents one of the most sensitive areas of enterprise operations from a security standpoint, and Microsoft is actively incorporating innovative tech into it.

Notably, the AI Factory initiative fosters a self-reinforcing cycle of operational improvements. By normalizing the infrastructure for training and inference through a standardized, interchangeable fleet, Microsoft is driving down the incremental cost of computing over time. At the same time, the firm is transferring AI infrastructure expenses directly to customers while preserving profit margins, effectively increasing capital intensity.

Additionally, Microsoft's asset base is notably broad and varied, spanning from Windows and Azure to a substantial investment in ChatGPT, as well as GitHub, LinkedIn, Xbox, and Blizzard. This diversity insulates the firm from abrupt shifts in any single market. And with OpenAI pursuing a valuation of $830 billion in its upcoming funding round, Microsoft's ownership interest equates to approximately $225 billion. Microsoft has also inked an agreement with Anthropic, the other leading AI entity, further cementing its prominence in the field amid ongoing rivalry.

Fundamentally, Microsoft's solutions are deeply woven into the enterprise operational framework, forming a highly retentive software layer that constitutes the primary source of its competitive barrier. The company's expansion into cloud infrastructure and platform services has further fortified this advantage, countering attempts by challengers to erode its dominance.

Subsequently, if enterprise adoption of AI accelerates through 2027, it would likely reinforce the positive case for MSFT stock. Such progress could dispel current uncertainties among skeptics of Microsoft's distinctive competitive positioning in software.

Analyst Opinion on MSFT Stock

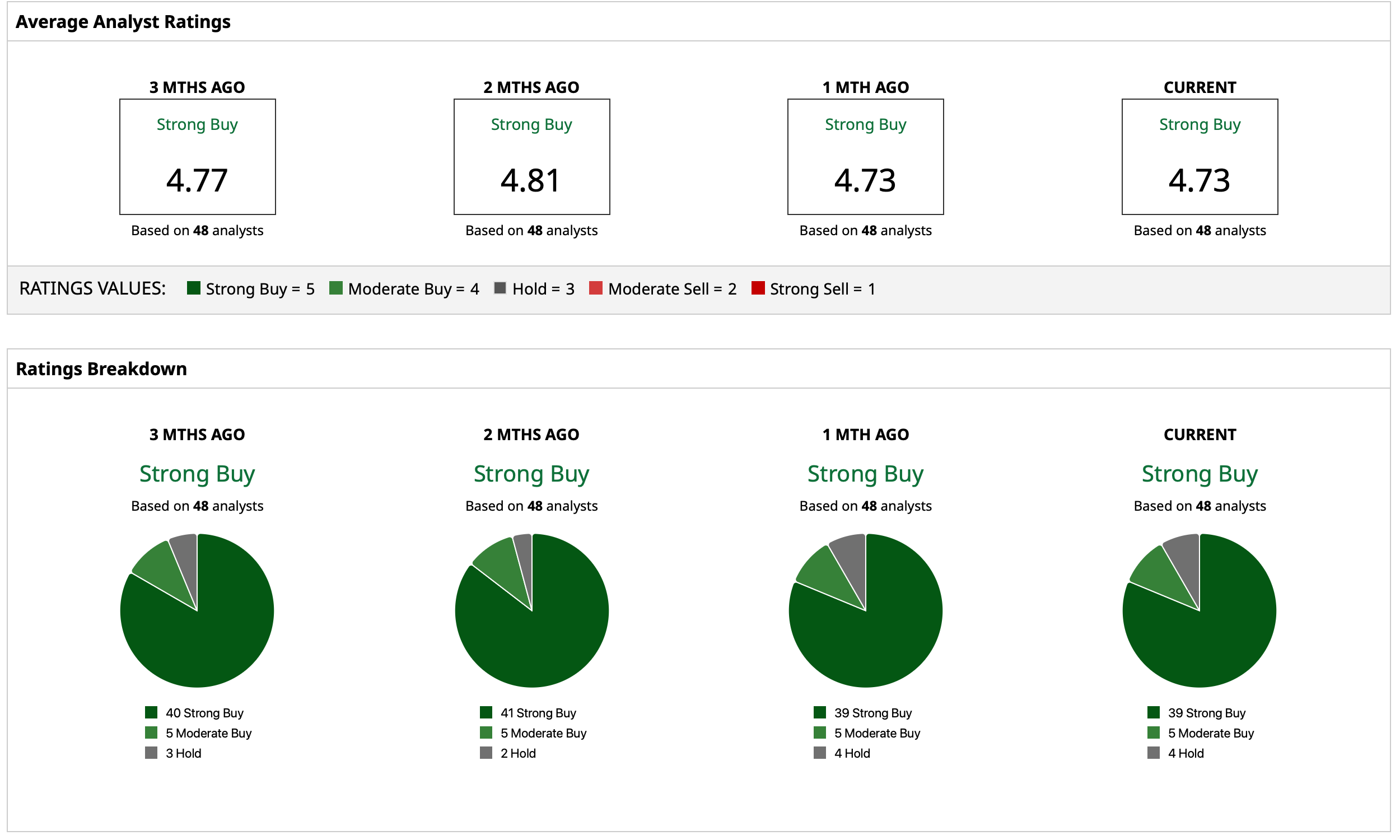

Analysts attribute a consensus rating of “Strong Buy” for MSFT stock with a mean target price of $630.07. This target denotes upside potential of about 33% from current levels. Out of 48 analysts covering the stock, 39 have a “Strong Buy” rating, five have a “Moderate Buy,” and four have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- An Alzheimer’s Drug Could Supercharge This High-Risk Stock. Is It Worth a Buy Here?

- Stranger Things Have Happened: Is 2026 the Year AMC Stock Goes Turbo Mode Again?

- Tesla Just Lost Its Crown. Should You Ditch TSLA Stock and Buy This No. 1 EV Seller Instead for 2026?

- Dear Nvidia Stock Fans, Mark Your Calendars for January 5