Eaton Corporation plc (ETN) is a global power management and industrial technology company headquartered in Dublin, Ireland. Valued at $127.1 billion by market cap, it designs and manufactures a wide range of products, including electrical distribution systems, circuit protection and wiring devices, hydraulic systems and pumps, aerospace components, and vehicle powertrain/electric mobility solutions, helping customers manage electrical, mechanical, and hydraulic power efficiently and safely.

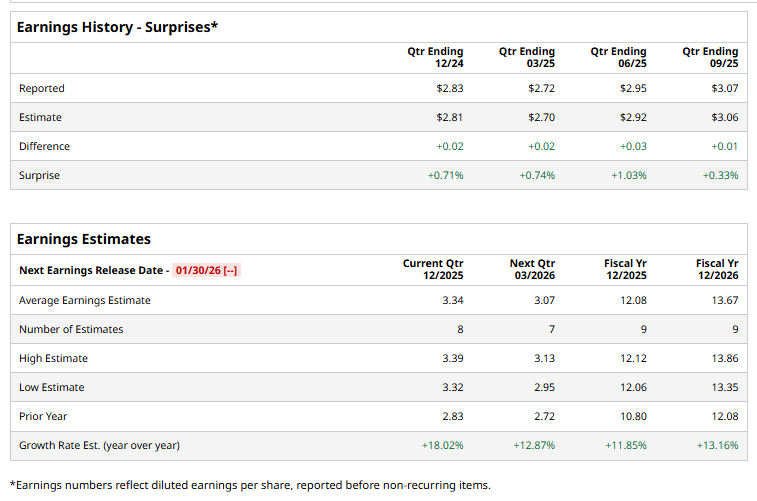

Eaton is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term. Ahead of the event, analysts expect the Intelligent power management company to report a profit of $3.34 per share on a diluted basis, up 18% from $2.83 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect ETN to report EPS of $12.08, up 11.9% from $10.80 in fiscal 2024. Its EPS is expected to rise 13.2% year over year to $13.67 in fiscal 2026.

ETN stock has declined 1.4% over the past year, underperforming the S&P 500 Index’s ($SPX) 16.9% gains and the Industrial Select Sector SPDR Fund’s (XLI) 20.3% gains over the same time frame.

ETN shares popped over 3% on Dec. 10, after the company announced plans to open a new manufacturing campus in Henrico County, Virginia, to support surging demand from data center customers. The power management titan will more than double its Richmond-area footprint with a 350,000-square-foot facility, expanding capacity and capabilities for critical power distribution technologies such as static transfer switches, power distribution units, and remote power panels. The investment reflects Eaton’s push to localize manufacturing in response to rapid data center growth in Virginia, where over 50 new data centers have already been permitted this year, with production at the new facility expected to begin in 2027.

Analysts’ consensus opinion on ETN stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 23 analysts covering the stock, 15 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and six give a “Hold.” ETN’s average analyst price target is $411.64, indicating a potential upside of 25.8% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stocks Set to Open Higher as Investors Stay Calm Despite Venezuela Tumult, U.S. Jobs Data Awaited

- CES 2026, Sector Rotation and Other Key Things to Watch this Week

- Tesla Stock Has Been Flat For 2 Months - How to Make a 3.2% Yield in One-Month Puts

- GOOGL Stock Rocked in 2025, But Is Google’s 2026 Forecast as Bright?