With a market cap of $23.5 billion, General Mills, Inc. (GIS) is a leading global packaged foods company best known for its iconic brands like Cheerios, Pillsbury, Betty Crocker, Häagen-Dazs, Blue Buffalo, and Nature Valley. Headquartered in Minneapolis, Minnesota, the company operates across North America and international markets, offering a wide portfolio of cereals, snacks, yogurt, baking products, frozen meals, pet food, and more. The company is slated to announce its fiscal Q3 2026 earnings results soon.

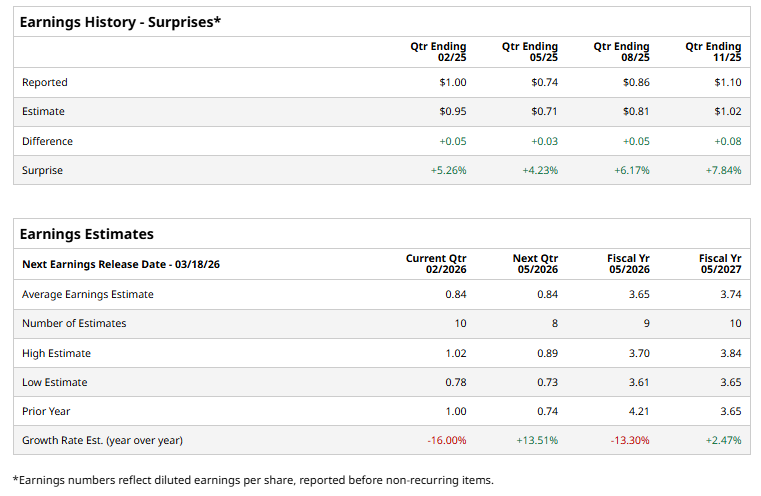

Ahead of the event, analysts expect General Mills to report a profit of $0.84 per share, down 16% from $1 per share reported in the year-ago quarter. It has exceeded analysts’ earnings estimates in each of the past four quarters, which is impressive.

For the current fiscal year, analysts are eyeing General Mills’ EPS to be about $3.65, down 13.3% from $4.21 in fiscal 2025. However, earnings are anticipated to surge 2.5% year over year to $3.74 per share in fiscal 2027.

Over the past year, GIS stock declined 25%, underperforming the S&P 500 Index’s ($SPX) 13.6% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 6.5% rise over the same time frame.

On Dec. 17, General Mills shares rose 3.4% after the company reported fiscal 2026 second-quarter results. The company posted revenue of about $4.9 billion, down 7% year over year, reflecting softer demand and portfolio adjustments, while adjusted earnings per share of $1.10 exceeded analyst estimates. Although operating profit and margins declined due to cost pressures and strategic investments, the results surpassed market expectations. Investors reacted positively to the earnings beat and the company’s reaffirmed full-year outlook, which signaled management’s confidence in stabilizing performance amid a challenging consumer environment.

Wall Street is cautious on GIS, keeping the stock parked at an overall “Hold” rating. Out of 20 analysts covering the stock, three suggest a “Strong Buy,” one recommends a “Moderate Buy,” 13 are playing it safe with a “Hold,” and the remaining three advise a “Strong Sell.” The mean price target of $53.63 indicates a 20.5% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart