With a market cap of $25.1 billion, Williams-Sonoma, Inc. (WSM) is an omni-channel specialty retailer offering a wide range of high-quality home products, including cookware, furniture, décor, lighting, and personalized gifts. It operates multiple well-known brands such as Williams Sonoma, Pottery Barn, West Elm, and Rejuvenation through e-commerce platforms, catalogs, and retail stores.

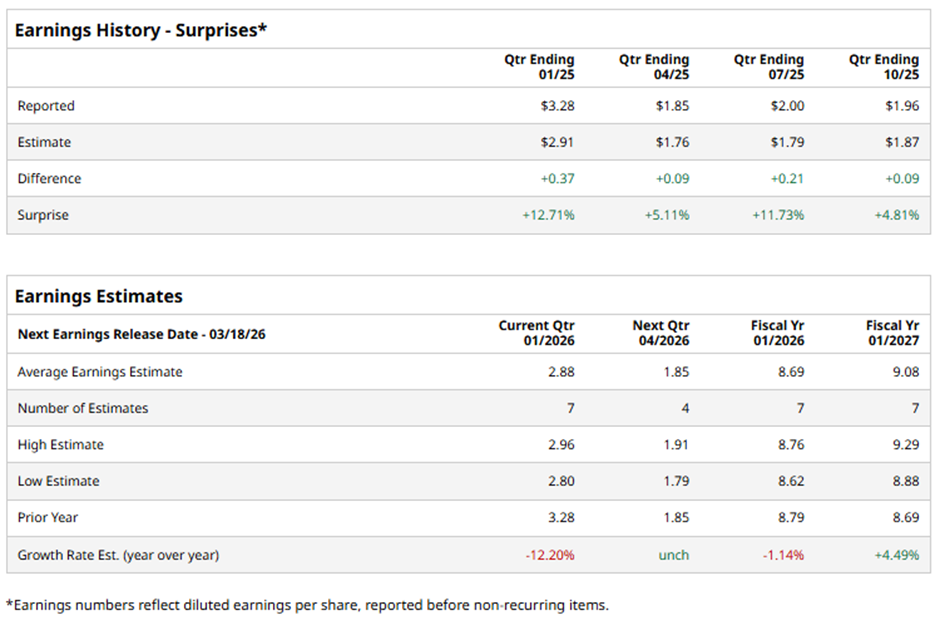

The San Francisco, California-based company is set to announce its Q4 2025 results soon. Ahead of this event, analysts expect Williams-Sonoma to report an EPS of $2.88, a 12.2% decrease from $3.28 in the year-ago quarter. However, it has exceeded Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the seller of cookware and home furnishings to report an EPS of $8.69, a 1.1% decline from $8.79 in fiscal 2024. Nevertheless, EPS is anticipated to rise 4.5% year-over-year to $9.08 in fiscal 2026.

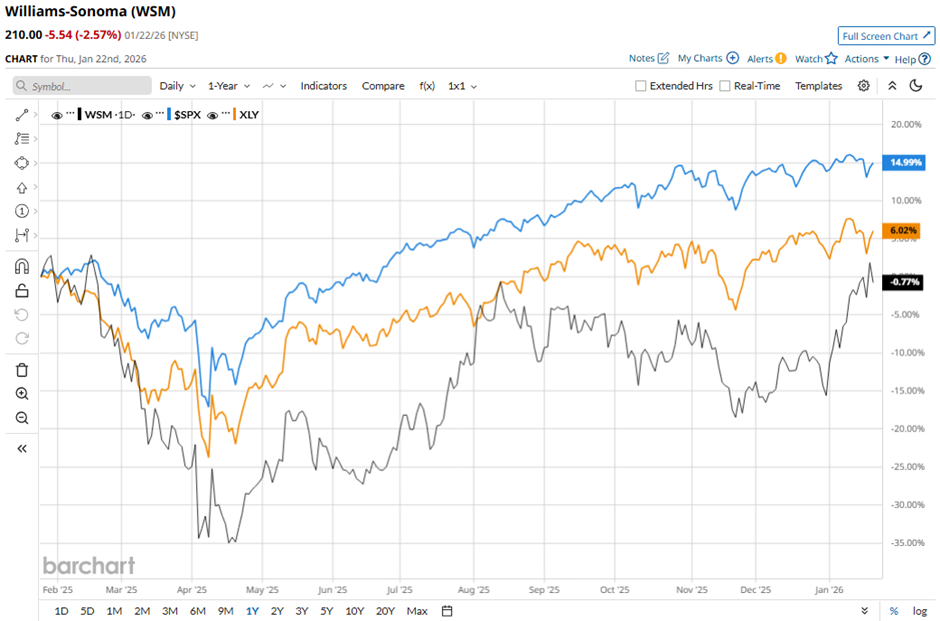

Shares of Williams-Sonoma have declined nearly 1% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 13.6% gain and the State Street Consumer Discretionary Select Sector SPDR ETF's (XLY) 6.6% rise over the period.

Despite reporting better-than-expected Q3 2025 EPS of $1.96 and revenue of $1.88 billion, Williams-Sonoma shares fell 3.4% on Nov. 19. The company highlighted significant tariff headwinds, including 20% tariffs on China and Vietnam, 50% on India, steel, aluminum, and copper and inventory growth of 9.6% to $1.5 billion.

Analysts' consensus view on WSM stock is moderately optimistic, with an overall "Moderate Buy" rating. Among 20 analysts covering the stock, six recommend "Strong Buy," one suggests "Moderate Buy," and 13 indicate “Hold.” As of writing, it is trading above the average analyst price target of $205.83.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart