Valued at $16.7 billion by market cap, Gen Digital Inc. (GEN) is a global consumer cybersecurity company that provides subscription-based digital safety, privacy, and identity protection solutions. Through well-known brands such as Norton, Avast, AVG, Avira, LifeLock, and CCleaner, the company offers antivirus software, VPNs, identity theft protection, and system optimization tools primarily to individuals and small businesses.

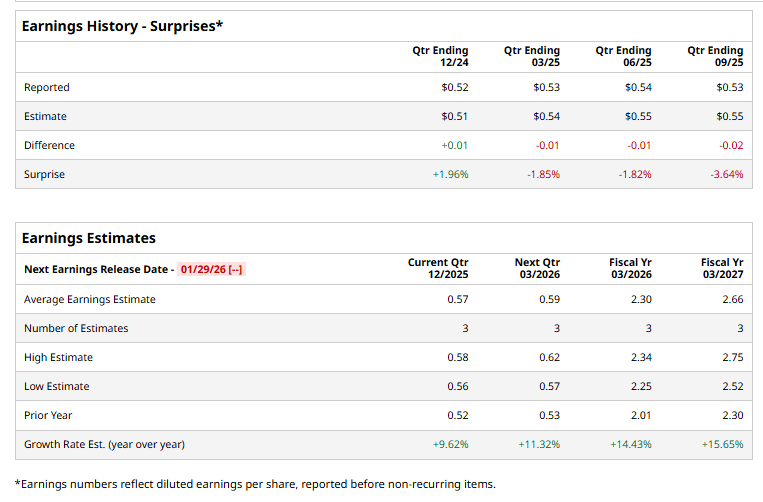

The Tempe, Arizona-based company is expected to announce its fiscal third-quarter earnings soon. Ahead of the event, analysts expect GEN to report a profit of $0.57 per share on a diluted basis, up 9.6% from $0.52 per share in the year-ago quarter. The company missed the consensus estimates in three of the last four quarters while surpassing the forecast on another occasion.

For the current year, analysts expect GEN to report EPS of $2.30, up 14.4% from $2.01 in fiscal 2025. Its EPS is expected to rise 15.7% year over year to $2.66 in fiscal 2027.

GEN shares have plunged marginally over the past year, trailing the S&P 500 Index’s ($SPX) 16.4% gains and the Technology Select Sector SPDR Fund’s (XLK) 22.8% gains over the same time frame.

Gen Digital has trailed the broader market over the past year largely due to investor concerns around growth and positioning. While the company has continued to generate steady, recurring revenue and meet or modestly beat earnings expectations, its growth profile is viewed as relatively low compared with higher-momentum technology themes such as AI infrastructure and cloud software. Competitive pressure in consumer cybersecurity, including free or built-in security features from major platforms, has capped multiple expansions. At the same time, diversification moves and integration of acquired businesses have introduced execution risk and uncertainty.

Analysts’ consensus opinion on GEN stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of nine analysts covering the stock, four advise a “Strong Buy” rating, and five give a “Hold.” GEN’s average analyst price target is $34.38, indicating an ambitious potential upside of 26.4% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stock Index Futures Climb in Strong Start to 2026

- FTAI Aviation Is Getting into the Data Center Game. Should You Buy FTAI Stock Here?

- CrowdStrike Insiders Are Offloading CRWD Stock. Should You?

- After Record Runs for Western Digital and Sandisk in 2025, Consider This 1 Data Center Storage Stock for 2026