IQVIA Holdings Inc. (IQV) is a leading global provider of advanced analytics, technology solutions, and clinical research services to the life sciences industry. Headquartered in Durham, North Carolina, the company draws on vast data resources, deep domain expertise, and Connected Intelligence to hasten clinical development and commercialization of innovative medical treatments.

Operating across several countries, IQVIA assists pharmaceutical, biotechnology, and medical device companies through its core segments: Technology & Analytics, Research & Development Solutions, and Contract Sales & Medical Solutions. The company has a market capitalization of $41.28 billion.

The company is expected to report its fourth-quarter results for fiscal 2025 soon. Ahead of the release, Wall Street analysts are optimistic about the company’s bottom-line trajectory.

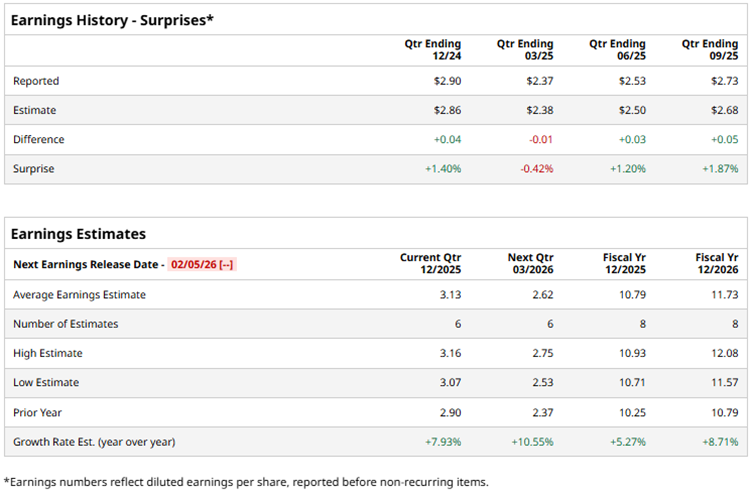

Analysts expect IQVIA to report a profit of $3.13 per share on a diluted basis for Q4, up 7.9% year-over-year (YOY). The company has a solid history of surpassing consensus estimates, topping them in three of the four trailing quarters. For the full fiscal year 2025, Wall Street analysts expect the company’s diluted EPS to grow by 5.3% annually to $10.79, followed by an 8.7% improvement to $11.73 in fiscal 2026.

IQVIA’s stock has underperformed the broader market over the past year but has outperformed over the past six months. Over the past 52 weeks, the stock has gained 18.5%, and over the past six months, it has gained 48%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 19.7% and 11.5% over the same periods, respectively.

Next, we compare the stock with its own sector’s performance. The State Street Health Care Select Sector SPDR ETF (XLV) has gained 12.7% over the past 52 weeks and 16.4% over the past six months. Therefore, the stock has outperformed its sector over these periods.

Last month, IQVIA announced a partnership with Amazon Web Services (AWS), under which AWS was named IQVIA’s Preferred Agentic Cloud Provider. IQVIA will also provide its own artificial intelligence (AI) platform on AWS to improve healthcare analytics. The partnership also keeps the option open for AWS and IQVIA to explore new life sciences opportunities.

On Oct. 28, 2025, IQVIA announced its third-quarter results for fiscal 2025, which exceeded Wall Street analysts' expectations. The company’s revenue increased 5.2% YOY to $4.10 billion. Its adjusted EPS grew 5.6% from the prior-year period to $3.00. This result had no significant immediate impact on its stock price; it gained slightly on Oct. 28 but dropped marginally on Oct. 29.

Wall Street analysts have been bullish about IQVIA’s future. Among the 22 analysts covering the stock, the consensus rating is “Strong Buy.” The rating configuration is more bullish than it was three months ago, with 16 “Strong Buy” now, up from 15. The stock also has one “Moderate Buy” rating and five “Holds.” The mean price target of $255.60 implies a 6.1% upside from current levels, while the Street-high price target of $290 implies 20.4% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- These 3 ETFs Help You Prosper in a Volatile Market. Which Is Right for You?

- Rocket Stock Just Hit a New 3-Year High as Trump Touts Plan for Home Affordability. Should You Buy RKT Here?

- How to Trade Venezuela 10 Days Later: Oil Prices, Energy Stocks, and the Biggest Winners and Losers

- Is PennyMac Stock a Buy, Sell, or Hold for January 2026?