Valued at a market cap of $48.2 billion, Edwards Lifesciences Corporation (EW) is a medical technology company based in Irvine, California. It develops, manufactures, and markets advanced devices used to treat patients with serious heart conditions. The company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

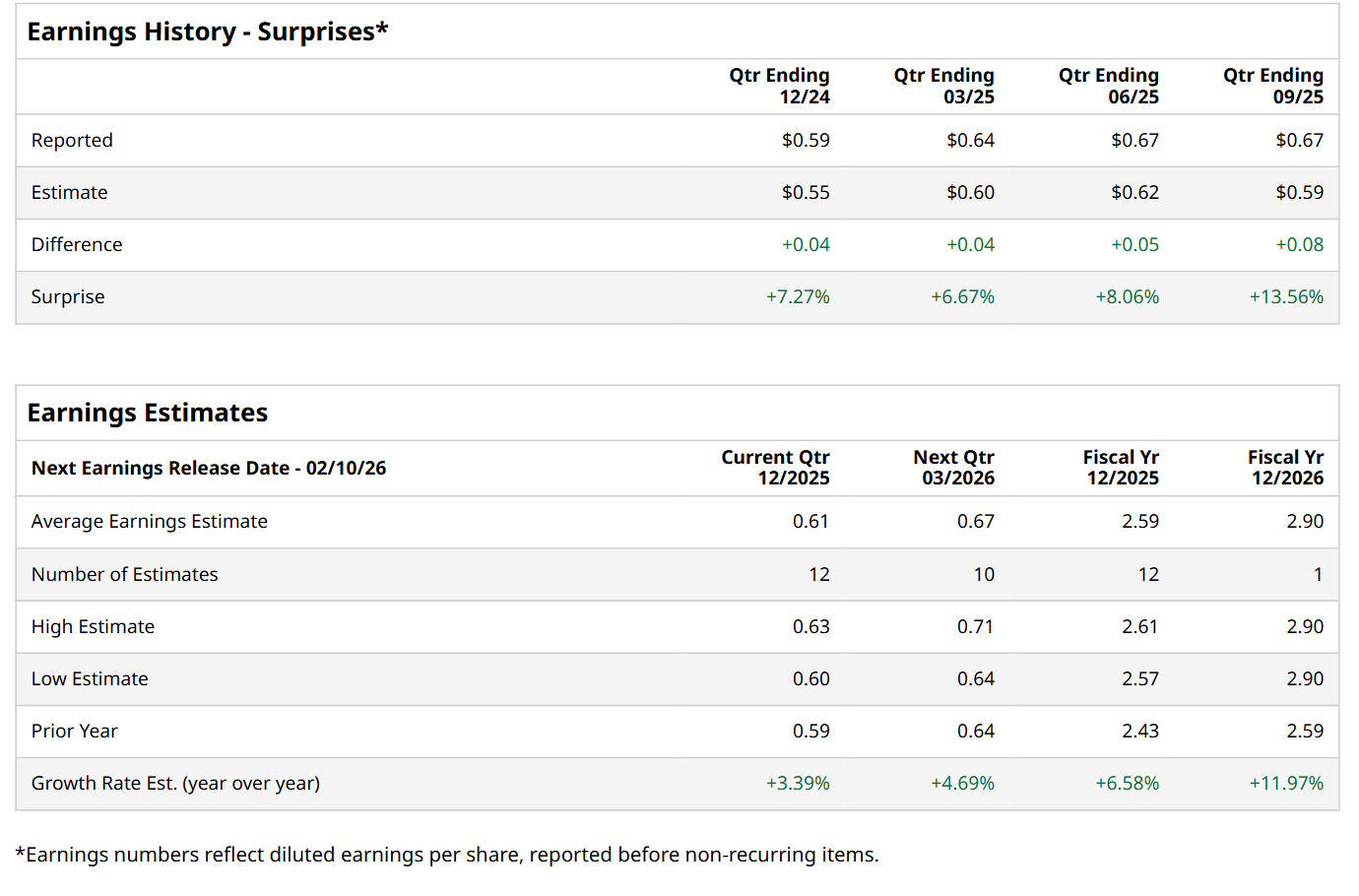

Ahead of this event, analysts expect this healthcare company to report a profit of $0.61 per share, up 3.4% from $0.59 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, its EPS of $0.67 exceeded the consensus estimates by 13.6%.

For the current fiscal year, ending in December, analysts expect EW to report a profit of $2.59 per share, up 6.6% from $2.43 per share in fiscal 2024. Its EPS is expected to further grow 12% year-over-year to $2.90 in fiscal 2026.

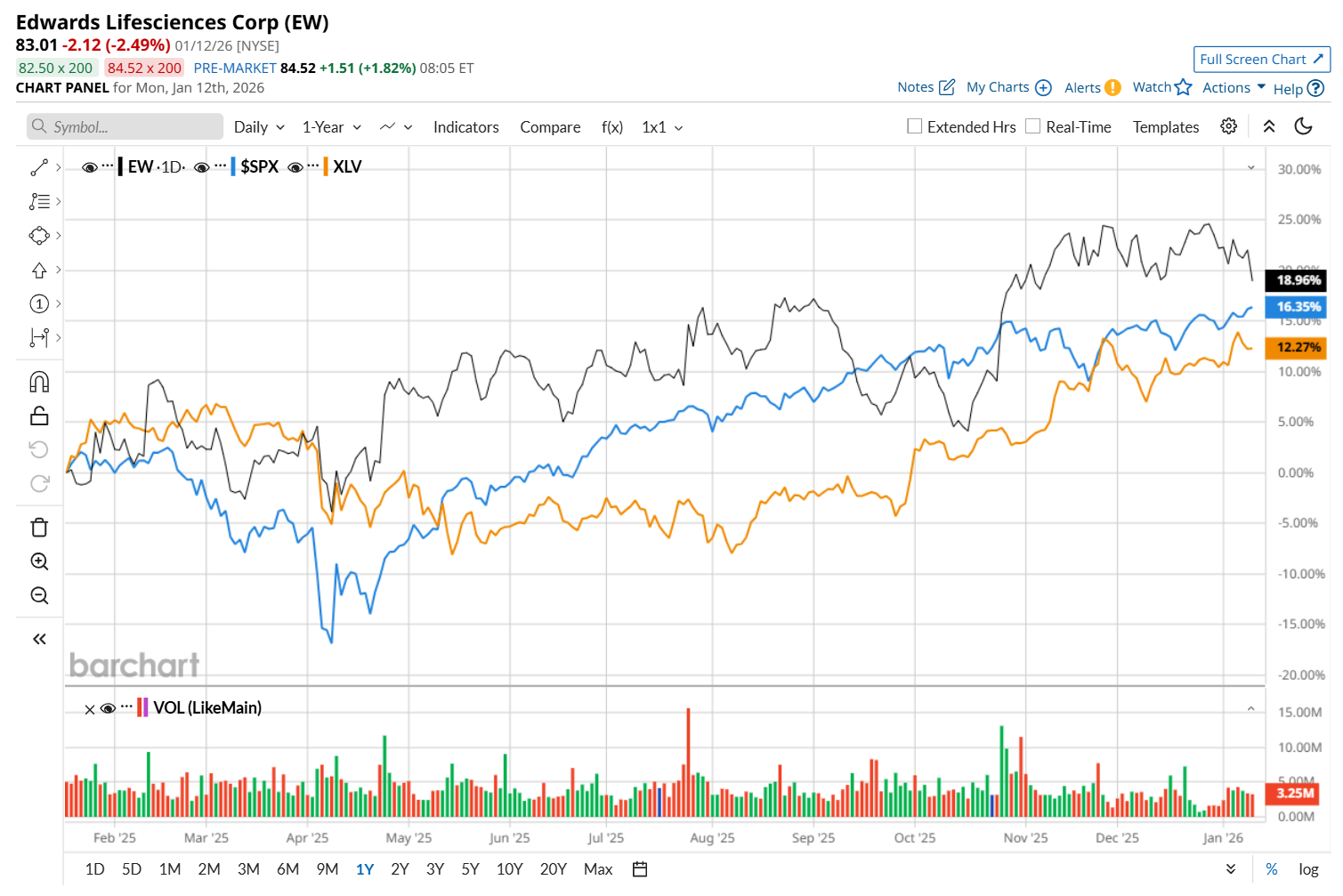

EW has gained 13.1% over the past 52 weeks, underperforming the S&P 500 Index's ($SPX) 19.7% return over the same time frame. However, it has outpaced the State Street Health Care Select Sector SPDR ETF’s (XLV) 12.7% uptick over the same time period.

EW reported its Q3 results on Oct. 30, and its shares plunged 1.2% in the following trading session. Due to strength across all product groups, the company’s net sales increased 14.7% year-over-year to $1.6 billion. Meanwhile, its adjusted EPS remained stable at $0.67 compared with the year-ago quarter but exceeded consensus expectations by a solid 13.6%.

Wall Street analysts are moderately optimistic about EW’s stock, with an overall "Moderate Buy" rating. Among 31 analysts covering the stock, 18 recommend "Strong Buy," two indicate “Moderate Buy," and 11 suggest "Hold.” The mean price target for EW is $96.32, indicating a 16% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- These 3 ETFs Help You Prosper in a Volatile Market. Which Is Right for You?

- Rocket Stock Just Hit a New 3-Year High as Trump Touts Plan for Home Affordability. Should You Buy RKT Here?

- How to Trade Venezuela 10 Days Later: Oil Prices, Energy Stocks, and the Biggest Winners and Losers

- Is PennyMac Stock a Buy, Sell, or Hold for January 2026?