Many investors think their only move in a volatile market is to “get out.”

But as I’ve always told people, that means you have to be right twice, on the way out and the way back in. Why play that game? I personally haven’t in a very long time.

To be clear, I am always simultaneously playing offense and defense. That means while I’m positioned for a stock market up move at all times, the degree to which I am exposed to it varies. So do the tools I use to craft, maintain, and adjust my positions. Sometimes I use stocks, other times ETFs, and options too. And most often, I use all three at once.

Traders and investors can do this all themselves. I am just one of many industry professionals who is devoted to teaching others.

But for those who prefer to outsource the whole process, there are several ETFs which play both sides of the fence. They use long/short and hedged strategies. The key is knowing how each one is built, because they are definitely not interchangeable. Armed with that knowledge, you can “ETF it” so to speak.

Here are three I’ve used in the past, and still like now.

3 ETFs to Trade a Volatile Market

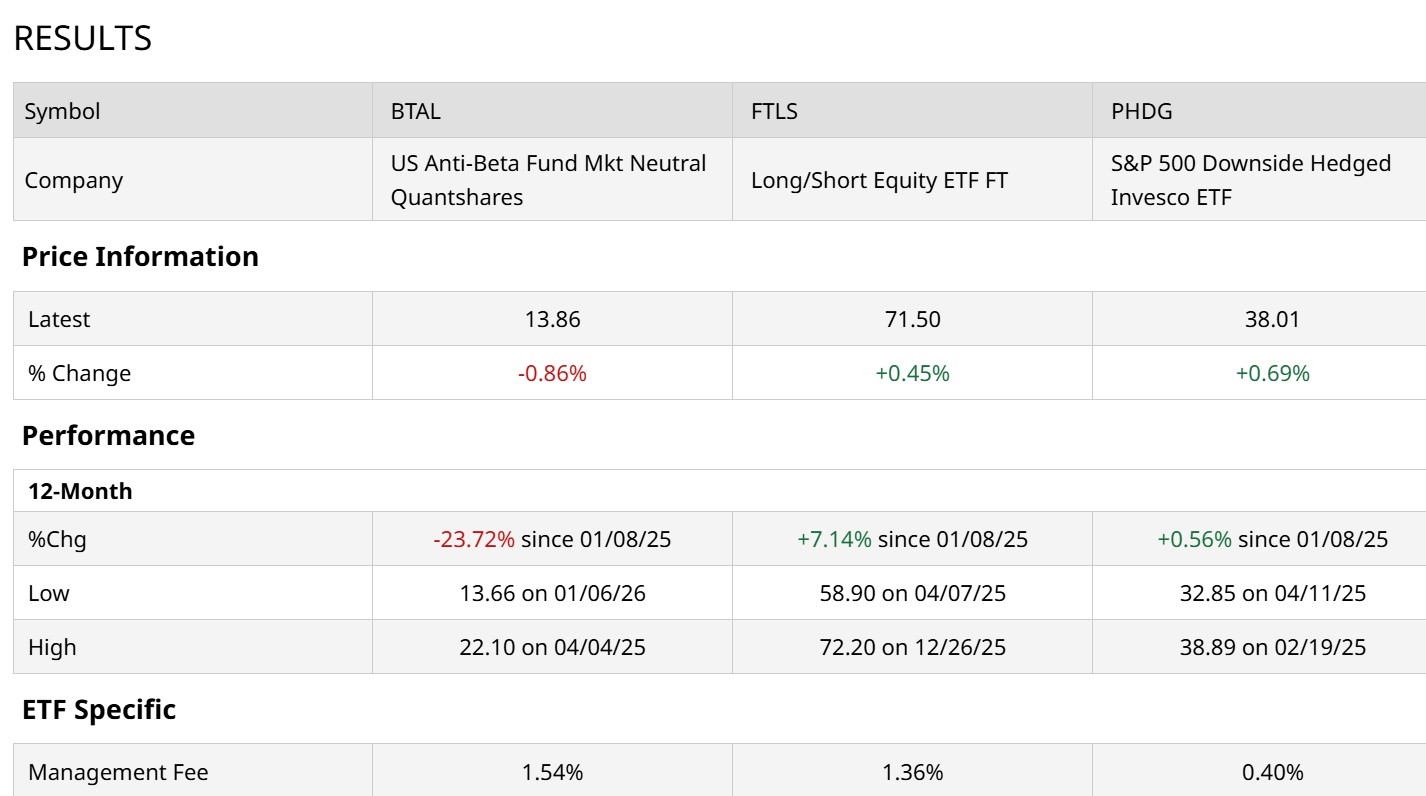

The US Anti-Beta Fund Market Neutral Quantshares (BTAL) is the most “pure insurance” play of the three. It goes long on boring, low-beta stocks and shorts the high-flying, high-beta names. When the market craters, BTAL usually shines because those “glamor” stocks fall much faster than the “defensive” ones. You own this when you’re convinced a bubble is about to burst. Or, if you simply want something to go counter to what most investors and traders have heavy exposure to currently, like tech and other high-beta names.

The Long/Short Equity ETF FT (FTLS) is more of an active navigator. It’s designed to be net long but uses short positions to dampen volatility. It’s for the investor who still wants to participate in an up market but doesn’t want the full 100% drawdown of an index fund. The goal is a smoother ride.

The S&P 500 Downside Hedged Invesco ETF (PHDG) starts as an S&P 500 Index ($SPX) fund, owning all 500 stocks. But it adds CBOE Volatility Index ($VIX) eposure, and that allocation varies. Though 10% of the portfolio is typical. As the fund’s description says, “The Index provides investors with broad equity market exposure with an implied volatility hedge by dynamically allocating between equity, volatility and cash.”

Which ETF Is Right for You?

Each of these has an offensive component. And you can see from the table above that BTAL has had a rough past 12 months. Because it’s doing its job as an “anti-beta” ETF at a time when high-beta stocks are all that matters for above-average performance in the stock market. FTLS and PHDG do very different things. PHDG looks a lot like an S&P 500 fund with some drag from the VIX exposure. And FTLS, like BTAL, is a long-short stock ETF, but with short positions smaller than longs.

As usual, it’s personal preference, largely determined by how you tend to play offense with your portfolio. And they also mix well together. These and other ETFs remind us that there’s a lot more to those funds than just tracking the stock market up and down.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer. For more of Rob’s research and investor coaching work, see ETFYourself.com on Substack. To copy-trade Rob’s portfolios, check out the new PiTrade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Say Capital One Stock Is a ‘Strong Buy.’ Did Trump Just Change That?

- Alphabet Stock Is Still Undervalued According to Analysts - 1 Month GOOGL Puts Yield 2.50%

- Is GOOGL Stock a Buy at $4 Trillion? What the Data, Wall Street Analysts Say.

- Rocket Companies Stock Is Up 125% as Trump Tackles Housing Affordability