Regency Centers Corporation (REG), based in Jacksonville, Florida, is a key player in owning, managing, and developing grocery-anchored retail centers in U.S. communities. The real estate investment trust (REIT) specializes in necessity-driven shopping destinations that anchor neighborhoods with reliable grocers and supporting shops for daily essentials. The company has a market capitalization of $12.75 billion.

The company is expected to report its fourth-quarter results for fiscal 2025 on Feb. 5, 2026, after the market closes. Ahead of the release, Wall Street analysts are optimistic about the company’s bottom-line trajectory.

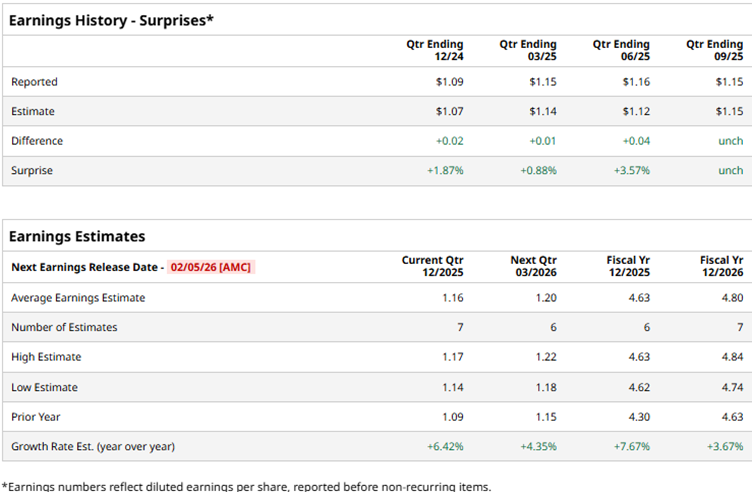

Analysts expect Regency to report a profit of $1.16 per share on a diluted basis for Q4, up 6.4% year-over-year (YOY). The company has a solid history of surpassing consensus estimates, topping them in three of the four trailing quarters and matching them in one instance. For the full fiscal year 2025, Wall Street analysts expect Regency’s diluted EPS to grow by 7.7% annually to $4.63, followed by a 3.7% improvement to $4.80 in fiscal 2026.

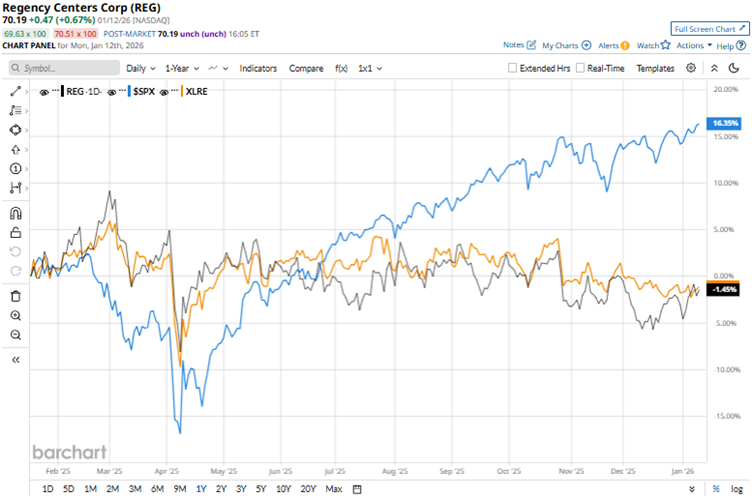

Stable earnings, quarterly dividends, and portfolio acquisitions have supported gradual appreciation despite broader REIT-sector pressures. Over the past 52 weeks, the stock has gained 2%, and over the past six months, 1.2%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 19.7% and 11.5% over the same periods, respectively. Therefore, the stock has underperformed the broader market.

We now compare REG’s performance with that of its sector. The State Street Real Estate Select Sector SPDR ETF (XLRE) has increased 3.7% over the past 52 weeks but dropped 2.3% over the past six months. Therefore, while the stock has underperformed the sector over the past year, it has outperformed over the past six months.

On Oct. 28, Regency reported its third-quarter results for fiscal 2025. The company’s quarterly operations were characterized by property acquisitions, and development and redevelopment projects. Moreover, by the end of Q3, Regency’s same property portfolio was 96.4% leased and 94.4% commenced. Its Nareit FFO was $1.15 per diluted share, up from $1.07 per diluted share in the prior-year period. Despite this growth, the stock dropped 3.1% intraday on Oct. 29.

Wall Street analysts have been bullish about Regency Centers’ future. Among the 20 analysts covering the stock, the consensus rating is “Moderate Buy.” The rating configuration is less bullish than it was a month ago, with nine “Strong Buy” ratings now, down from 11. The ratings are rounded off by two “Moderate Buys” and nine “Holds.” The mean price target of $79.16 implies a 12.8% upside from current levels, while the Street-high price target of $85 implies 21.1% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Rocket Stock Just Hit a New 3-Year High as Trump Touts Plan for Home Affordability. Should You Buy RKT Here?

- How to Trade Venezuela 10 Days Later: Oil Prices, Energy Stocks, and the Biggest Winners and Losers

- Is PennyMac Stock a Buy, Sell, or Hold for January 2026?

- This Under-$10 Growth Stock May Be Better Positioned Than Investors Realize