With a market cap of $116.9 billion, Vertex Pharmaceuticals Incorporated (VRTX) is a biotechnology company focused on developing and commercializing innovative therapies, best known for its leading portfolio of cystic fibrosis treatments including TRIKAFTA/KAFTRIO, ALYFTREK, and KALYDECO. It also advances medicines for serious diseases such as sickle cell disease, beta thalassemia, diabetes, kidney disease, and acute pain through a strong research pipeline and strategic collaborations.

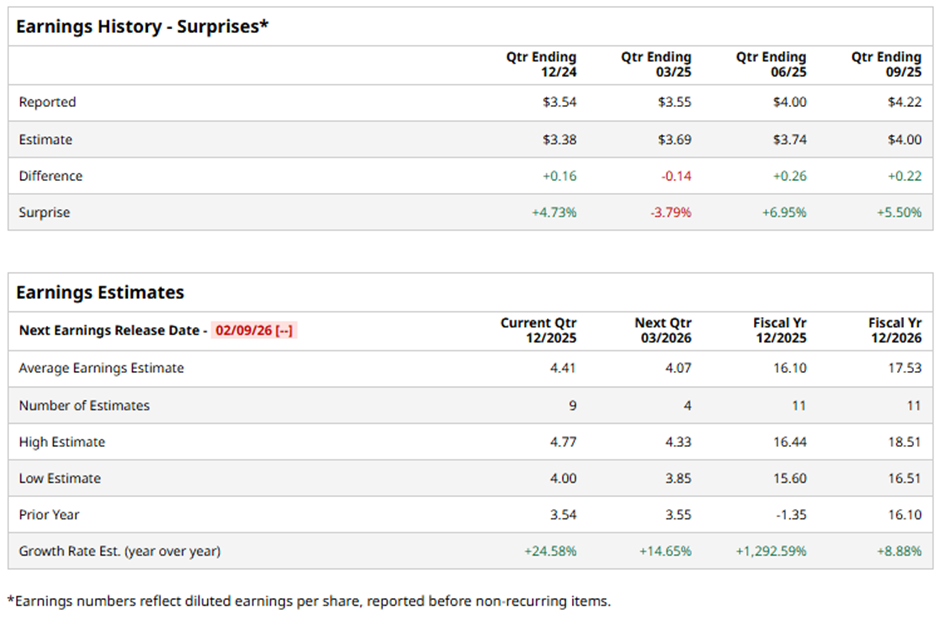

The Boston, Massachusetts-based company is slated to announce its fiscal Q4 2025 results soon. Ahead of the event, analysts expect VRTX to report an adjusted EPS of $4.41, up 24.6% from $3.54 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in three of the past four quarterly reports while missing on another occasion.

For fiscal 2025, analysts predict the drugmaker to report adjusted EPS of $16.10, a significant surge from a loss of $1.35 per share in fiscal 2024.

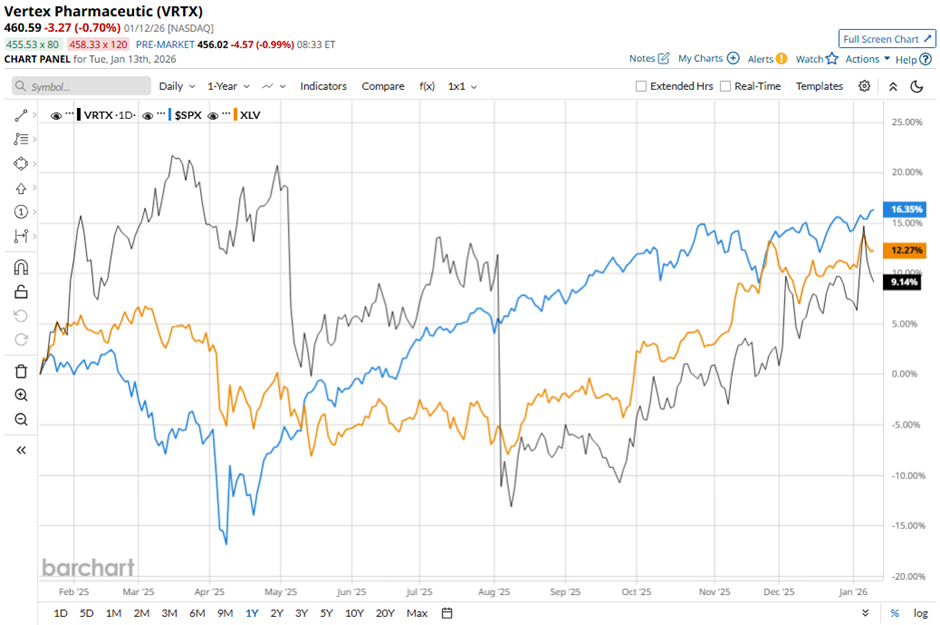

Shares of Vertex Pharmaceuticals have increased 11.8% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 19.7% gain. However, the stock has slightly outpaced the State Street Health Care Select Sector SPDR ETF's (XLV) 11.3% return over the same period.

Shares of Vertex rose marginally on Nov. 3 after the company reported strong Q3 2025 results, including total revenue of $3.08 billion, up 11% year-over-year, driven by continued growth in its cystic fibrosis franchise and early contributions from CASGEVY and JOURNAVX. Investors were encouraged by Vertex’s refined full-year 2025 revenue guidance of $11.9 billion to $12 billion and improved outlook for operating performance, supported by expanding global launches and rising U.S. demand.

Analysts' consensus rating on VRTX stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 32 analysts covering the stock, 20 recommend a "Strong Buy,” one has a "Moderate Buy" rating, 10 give a "Hold" rating, and one has a "Strong Sell.” The average analyst price target for Vertex Pharmaceuticals is $495.76, indicating a potential upside of 7.6% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Shell CEO Wael Sawan Talks Venezuela Oil with Trump, Should You Buy SHEL Stock?

- These 3 ETFs Help You Prosper in a Volatile Market. Which Is Right for You?

- Rocket Stock Just Hit a New 3-Year High as Trump Touts Plan for Home Affordability. Should You Buy RKT Here?

- How to Trade Venezuela 10 Days Later: Oil Prices, Energy Stocks, and the Biggest Winners and Losers