With a market cap of $20.9 billion, Incyte Corporation (INCY) is a biopharmaceutical company focused on the discovery, development, and commercialization of innovative therapeutics across the United States, Europe, Canada, and Japan. It markets a diverse portfolio of oncology, immunology, and dermatology medicines, including JAKAFI, OPZELURA, and ICLUSIG.

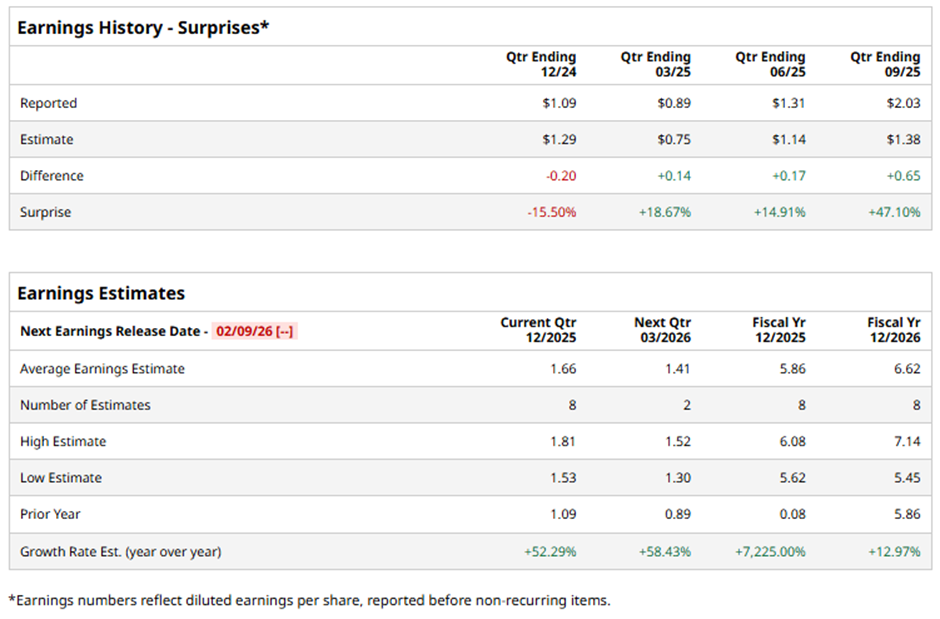

The Wilmington, Delaware-based company is set to unveil its fiscal Q4 2025 results soon. Ahead of this event, analysts expect INCY to report a profit of $1.66 per share, up 52.3% from $1.09 per share in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts forecast the specialty drugmaker to post EPS of $5.86, a significant surge from $0.08 in fiscal 2024.

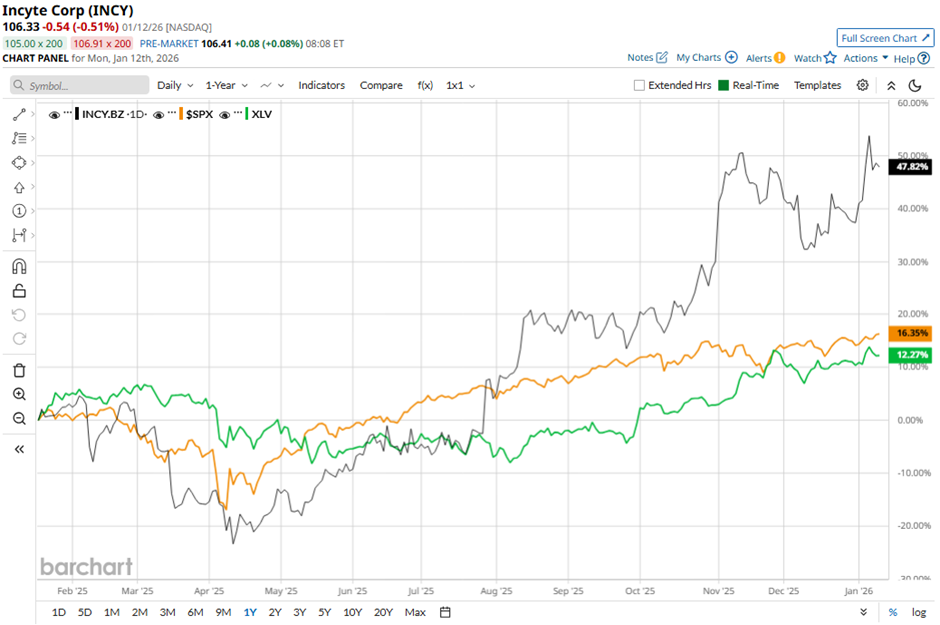

INCY stock has soared 50.7% over the past 52 weeks, outperforming the broader S&P 500 Index's ($SPX) 19.7% gain and the State Street Health Care Select Sector SPDR ETF's (XLV) 12.7% return over the same period.

Incyte reported strong Q3 2025 results on Oct. 28 that beat expectations, with adjusted EPS of $2.26 and total revenue of $1.37 billion, up 20% year-over-year. Investor sentiment was further boosted by robust product performance, including Jakafi revenue of $791 million, Opzelura revenue of $188 million, and strong early uptake of Niktimvo with $46 million in sales. Additionally, Incyte raised its full-year 2025 net product revenue guidance to $4.23 billion - $4.32 billion. Nevertheless, the stock fell 1.5% on that day.

Analysts' consensus rating on INCY stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 25 analysts covering the stock, opinions include 12 "Strong Buy,” 12 "Holds,” and one "Strong Sell.” This configuration is slightly more bullish than three months ago, with 11 analysts suggesting a "Strong Buy." As of writing, it is trading above the average analyst price target of $102.09.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- These 3 ETFs Help You Prosper in a Volatile Market. Which Is Right for You?

- Rocket Stock Just Hit a New 3-Year High as Trump Touts Plan for Home Affordability. Should You Buy RKT Here?

- How to Trade Venezuela 10 Days Later: Oil Prices, Energy Stocks, and the Biggest Winners and Losers

- Is PennyMac Stock a Buy, Sell, or Hold for January 2026?