Aptiv PLC (APTV), headquartered in Schaffhausen, Switzerland, is a global tech company advancing mobility solutions. It designs and manufactures software and hardware to enhance vehicle safety, sustainability, and connectivity.

Operations focus on two key areas: Signal and Power Solutions, which provide electrical architecture and connectivity components, and Advanced Safety and User Experience, encompassing software platforms, sensing technologies, automated driving systems, and interior experiences. The company has a market capitalization of $19.16 billion.

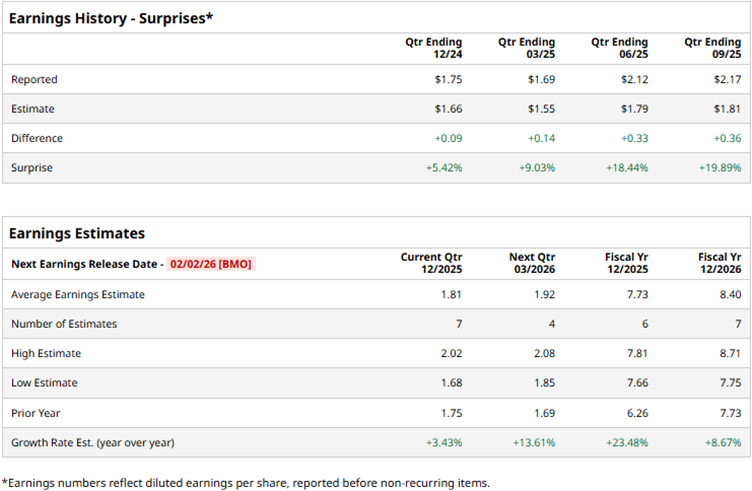

The company is expected to report its fourth-quarter results for fiscal 2025 on Feb. 2, 2026, before the market opens. Ahead of the release, Wall Street analysts are optimistic about the company’s bottom-line trajectory.

Analysts expect Aptiv to report a profit of $1.81 per share on a diluted basis for Q4, up 3.4% year-over-year (YOY). The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters. For the full fiscal year 2025, Wall Street analysts expect Aptiv’s diluted EPS to grow by 23.5% annually to $7.73, followed by an 8.7% improvement to $8.40 in fiscal 2026.

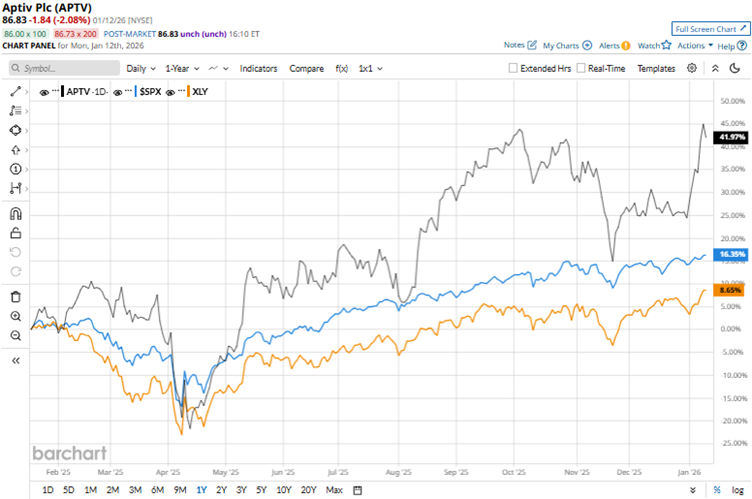

Strong sentiments surrounding Aptiv’s stock have led to its surge. Over the past 52 weeks, the stock has gained 46.3%, and over the past six months, 25.3%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 19.7% and 11.5% over the same periods, respectively. Therefore, the stock has outperformed the broader market.

Auto parts company Aptiv is classified as a consumer-discretionary stock. The State Street Consumer Discretionary Select Sector SPDR ETF (XLY) has increased 12.8% over the past 52 weeks and 12.5% over the past six months. Therefore, the stock has outperformed its sector over these periods.

As the scope for robotics grows, Aptiv is moving to capitalize on it. Last month, the company partnered with Vecna Robotics to develop next-generation Autonomous Mobile Robot (AMR) solutions, which are expected to be cost-efficient automation.

On Oct. 30, Aptiv reported its third-quarter results for fiscal 2025. The company’s net sales for the quarter increased by 7.4% YOY to $5.21 billion. Accounting for currency adjustments and commodity movements, revenue increased by 6%. Its adjusted EPS was $2.17 for the quarter, up 18.6% YOY. Despite this growth, the stock dropped by 4.3% intraday on Oct. 30.

Wall Street analysts have been bullish about Aptiv’s prospects. Among the 21 analysts covering the stock, the consensus rating is “Strong Buy.” The rating configuration is more bullish than it was a month ago: there are now 15 “Strong Buy” ratings, up from 14, and the overall rating has changed from “Moderate Buy” to “Strong Buy.” The ratings are rounded off by one “Moderate Buy” and five “Holds.”

The mean price target of $100.17 implies a 15.4% upside from current levels, while the Street-high price target of $109 implies 25.5% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Rocket Stock Just Hit a New 3-Year High as Trump Touts Plan for Home Affordability. Should You Buy RKT Here?

- How to Trade Venezuela 10 Days Later: Oil Prices, Energy Stocks, and the Biggest Winners and Losers

- Is PennyMac Stock a Buy, Sell, or Hold for January 2026?

- This Under-$10 Growth Stock May Be Better Positioned Than Investors Realize