Investing in the pharmaceutical industry carries inherent risks, especially when it involves pre-commercial entities where the outcome hinges on the unpredictable reactions of chemicals within the human body and the critical approval of regulators. However, a distinct stage in the regulatory process progressively “de-risks” these investments. As drugs transition through Phase I, Phase II, and Phase III to NDA/BLA submissions, their likelihood of reaching commercialization, generating revenue, and turning a profit increases substantially.

A revealing 2021 study examining development candidates from 2011–2020 found a mere 7.9% success rate from Phase I to regulatory approval, typically spanning over 10.5 years. Yet, the scenario brightens considerably at Phase III, with 57.8% of drugs moving on to NDA/BLA submissions and 90.6% of these gaining regulatory approval. This progression underscores why investors are increasingly drawn to late-stage companies with substantially de-risked assets.

Citius Pharmaceuticals: A Beacon of Hope in Late-Stage Pharma

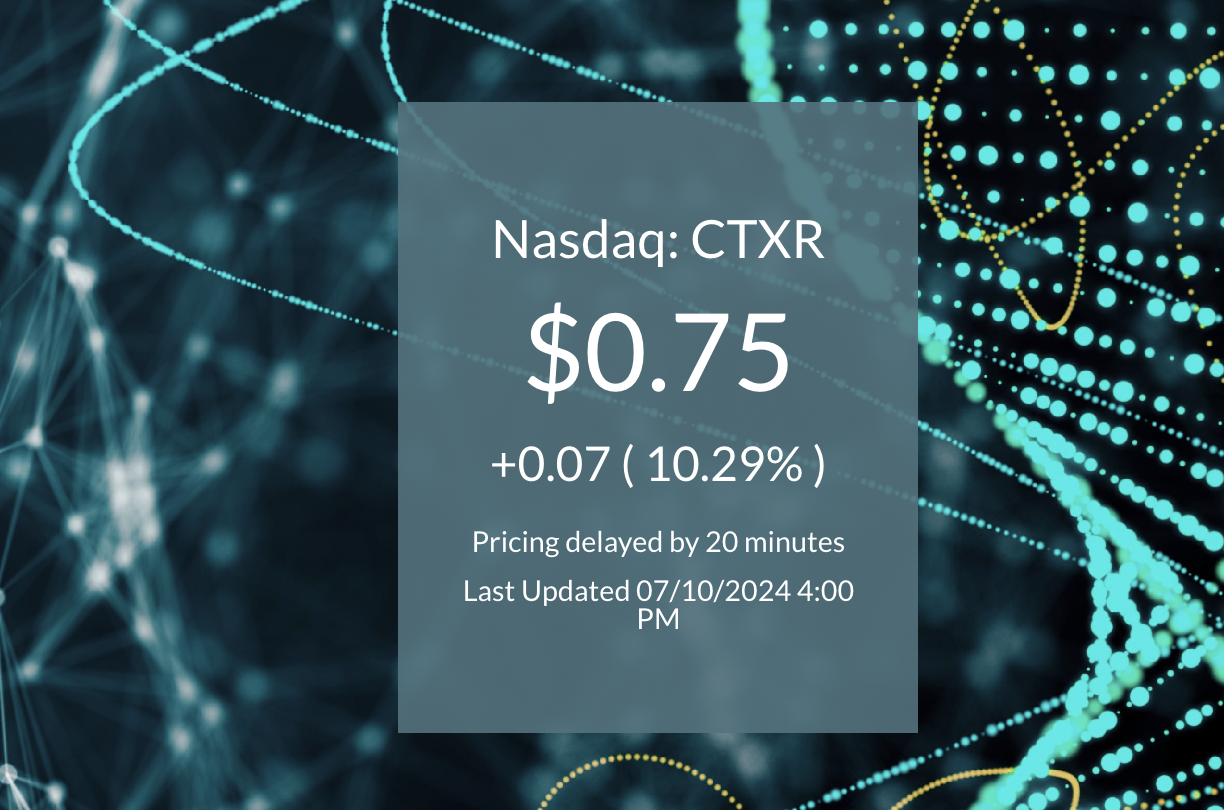

Citius Pharmaceuticals (Nasdaq: CTXR) stands out as a prime example of a late-stage biopharmaceutical firm with a clear trajectory toward revolutionizing patient care. Recently, EF Hutton initiated coverage on Citius, assigning a Buy rating with an ambitious $6.00 price target, suggesting a potential surge of over 500% from the current price of the stock.

Based in Cranford, New Jersey, Citius is poised to redefine the standard of care for patients with infections from Central Venous Catheters (CVCs). CVCs, essential in critical care, are used extensively across various patient demographics, including those in intensive care units, undergoing chemotherapy, or living with chronic conditions. These catheters, while vital, are susceptible to infections like CLABSI and CRBSI, which pose severe health risks and carry substantial financial burdens, with treatment costs soaring as high as $65,000.

Mino-Lok: A Game-Changing Therapy

Citius's flagship product, Mino-Lok, an antibiotic lock solution acquired from the University of Texas MD Anderson Cancer Center, is designed to sterilize catheters without the need for removal. Invented by Dr. Issam Raad, Mino-Lok targets the biofilms that protect bacteria from antibiotics. The solution combines minocycline, EDTA, and ethanol to effectively disrupt these biofilms, offering a robust alternative to the standard, often ineffective "home brew" solutions.

Mino-Lok's effectiveness was underscored by its “Fast Track” designation from the FDA, which expedites the review process. The solution has demonstrated its potential in a pivotal Phase III trial, achieving its primary endpoint with significant statistical significance and showing a favorable safety profile.

Expanding the Arsenal: LYMPHIR and Halo-Lido

Beyond Mino-Lok, Citius is developing LYMPHIR, a cancer drug targeting cutaneous T-cell lymphoma (CTCL). LYMPHIR, which has shown promising results in a Phase III trial, is awaiting FDA review. Additionally, Citius’s Halo-Lido, aimed at treating hemorrhoids, has shown positive outcomes in a Phase 2b trial and is moving towards further FDA discussions.

Looking Ahead

With multiple promising products in its pipeline and several near-term catalysts, Citius is strategically positioned for a potential breakout in the latter half of 2024. As the company approaches the breakeven point, with projected profits on the horizon in 2025, the commitment of Citius insiders and the optimistic assessments from analysts underscore a robust confidence in its future.

In conclusion, Citius Pharmaceuticals not only offers a compelling investment opportunity but also holds the promise of significantly enhancing the quality of life for patients through innovative treatments. With its strategic advancements and strong pipeline, Citius is well on its way to setting new standards in medical care and achieving substantial market success.

Other biotech stocks to keep on top of radar include Kazia Therapeutics (NASDAQ: KZIA), Biomarin Pharmaceuticals Inc. (NASDAQ: BMRN), Halozyme Therapeutics, Inc. (NASDAQ: HALO), Incyte Corporation (NASDAQ: INCY), Exelixis, Inc. (NASDAQ: EXEL), Mimedx Group, Inc. (NASDAQ: MDXG), Genmab AS (NASDAQ: GMAB), Vertex Pharmaceuticals Inc. (NASDAQ: VRTX), Bio-Techne Corp (NASDAQ: TECH), Jazz Pharmaceuticals PLC (NASDAQ: JAZZ).

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice or an endorsement of CTXR or its strategies. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Please ensure to fully read and comprehend our disclaimer found at https://investorbrandmedia.com/disclaimer/. InvestorBrandMedia.com has been compensated five hundred dollars by a 3rd party Momentum Media LLC for content distribution services on CTXR for July 17th, 2025. InvestorBrandMedia.com is neither an investment advisor nor a registered broker. No current owner, employee, or independent contractor of InvestorBrandMedia.com is registered as a securities broker-dealer, broker, investment advisor, or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. This article may contain forward-looking statements as defined under Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. These statements, often incorporating terms like “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or similar expressions about future performance or conduct, are based on present expectations, estimates, and projections, and are not historical facts. They carry various risks and uncertainties that may result in significant deviation from the anticipated results or events. Past performance does not guarantee future results.InvestorBrandMedia.com does not commit to updating forward-looking statements based on new information or future events. Readers are encouraged to review all public SEC filings made by the profiled companies at https://www.sec.gov/edgar/searchedgar/companysearch. It is always important to conduct thorough due diligence and exercise caution in trading.InvestorBrandMedia.com is not managed by a licensed broker, a dealer, or a registered investment adviser. The content here is purely informational and should not be taken as investment advice. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor regarding forward-looking statements. Any statement that projects, foresees, expects, anticipates, estimates, believes, or understands certain actions to possibly occur are not historical facts and may be forward-looking statements. These statements are based on expectations, estimates, and projections that could cause actual results to differ greatly from those anticipated. Investing in micro-cap and growth securities is speculative and entails a high degree of risk, potentially leading to a total or substantial loss of investment. Please note that no content published here constitutes a recommendation to buy or sell a security. It is solely informational, and you should not construe it as legal, tax, investment, financial, or other advice. No content in this article constitutes an offer or solicitation by InvestorBrandMedia.com or any third-party service provider to buy or sell securities or other financial instruments. The content in this article does not address the circumstances of any specific individual or entity and does not constitute professional and/or financial advice. InvestorBrandMedia.com is not a fiduciary by virtue of any person’s use of or access to this content.

Source:

https://go.bio.org/rs/490-EHZ-999/images/ClinicalDevelopmentSuccessRates2011_2020.pdf

https://www.fda.gov/drugs/drug-and-biologic-approval-and-ind-activity-reports/nda-and-bla-approvals

Media Contact

Company Name: Investor Brand Media

Contact Person: Ash K

Email: investorbrandmedia@gmail.com

Country: United States

Website: https://investorbrandmedia.com/