In its quest to enhance user experience through the integration of artificial intelligence (AI), Snap Inc. (SNAP) has released a generative AI feature called “Dreams.” This follows on the heels of an earlier AI-driven chatbot named My AI.

However, controversy stalked SNAP last month when My AI began operating autonomously, creating its own Story and not responding to users. The glitch caused strong reactions and concerns over privacy.

Moreover, SNAP’s fundamentals hardly substantiate a buying strategy. The company’s last quarterly report showed a dip in revenue, while its bottom line remained in the red. Furthermore, it provided a weaker-than-expected forecast for the current period.

SNAP projects its daily active users to reach between 405 million and 406 million in the current quarter. Its total sales for the third quarter is expected to come between $1.07 billion and $1.13 billion, implying negative 5% to flat year-over-year growth.

Analysts were projecting Snap to report third-quarter sales of $1.13 billion along with 406 million daily active users.

Also, given the rising tide of competition and a weak advertising market, it might be prudent to steer clear of SNAP. There are several crucial factors which validate my pessimistic view regarding this particular venture.

Analyzing Snap Inc.’s Financial Performance from 2020 to 2023: Examining Net Income, Revenue, Gross Margin, and Current Ratio Trends

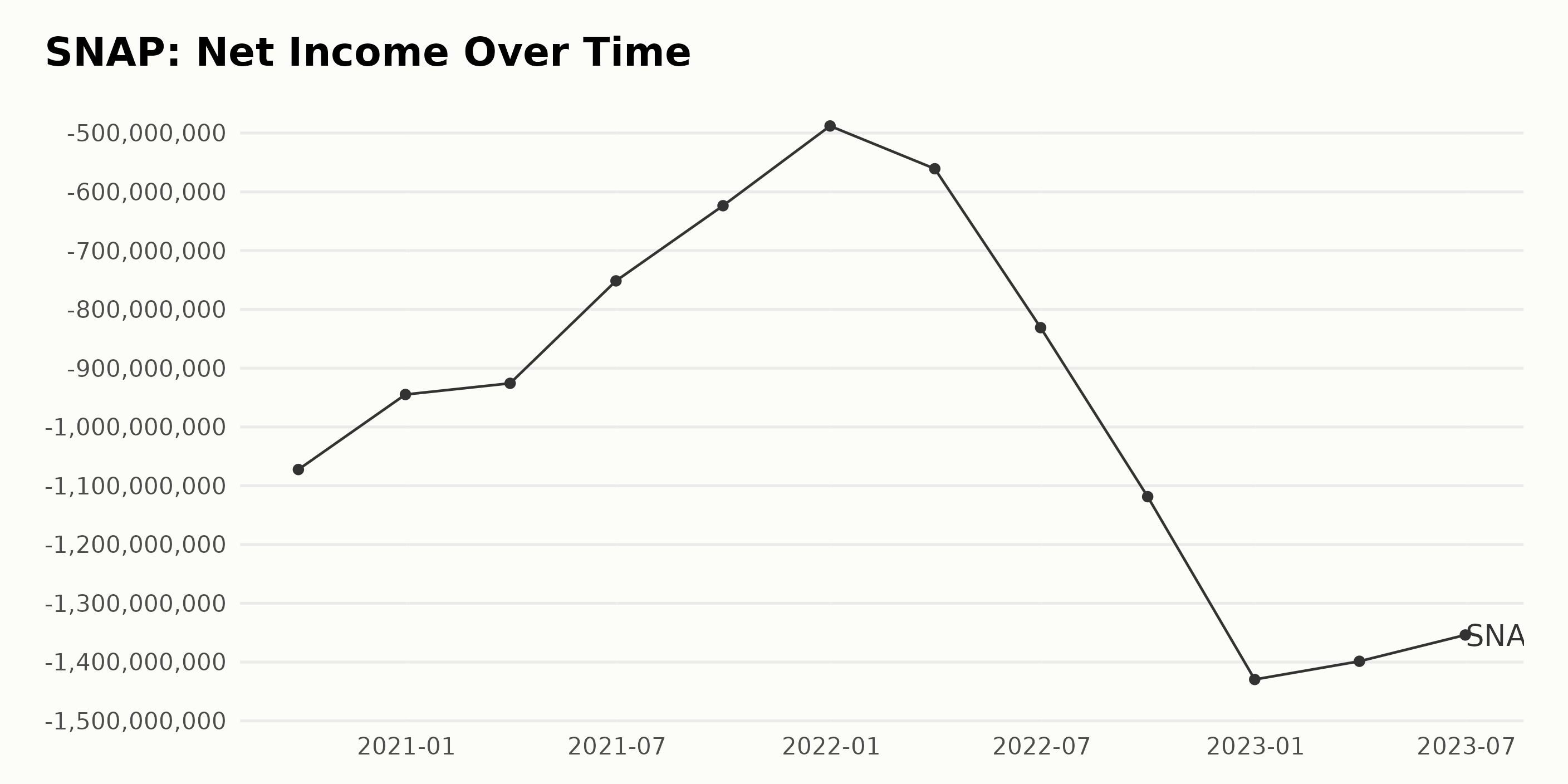

The data series represents the trailing-12-month net income of SNAP from September 2020 through June 2023.

- On September 30, 2020, SNAP’s net income stood at a deficit of -$1.07 billion.

- This improved to a lesser deficit of -$944.83 million by December 31, 2020.

- Throughout 2021, there was a downward trend, with the net income deficit decreasing to -$487.96 million by December 31, 2021.

- However, in the first quarter of 2022, SNAP saw an increase in its net income deficit, reaching $560.70 million.

- This trend continued with a sharp increase in net loss, reaching -$831.10 million and -$1.12 billion in the second quarter and third quarter of 2022, respectively.

- By the end of 2022, the net income deficit peaked at -$1.43 billion.

- In the first quarter of 2023, the net income deficit declined slightly to -$1.40 billion and continued to decrease to -$1.35 billion in the second quarter.

Upon measuring the last value from the first, there is an increase in the net income deficit by approximately 26%, indicating a negative growth rate over the period. Despite some periods of improvement, the overall trend shows increasingly negative net income for SNAP over this time. The most recent observations from 2023 reveal a slight decrease in net losses, although they remain significantly high.

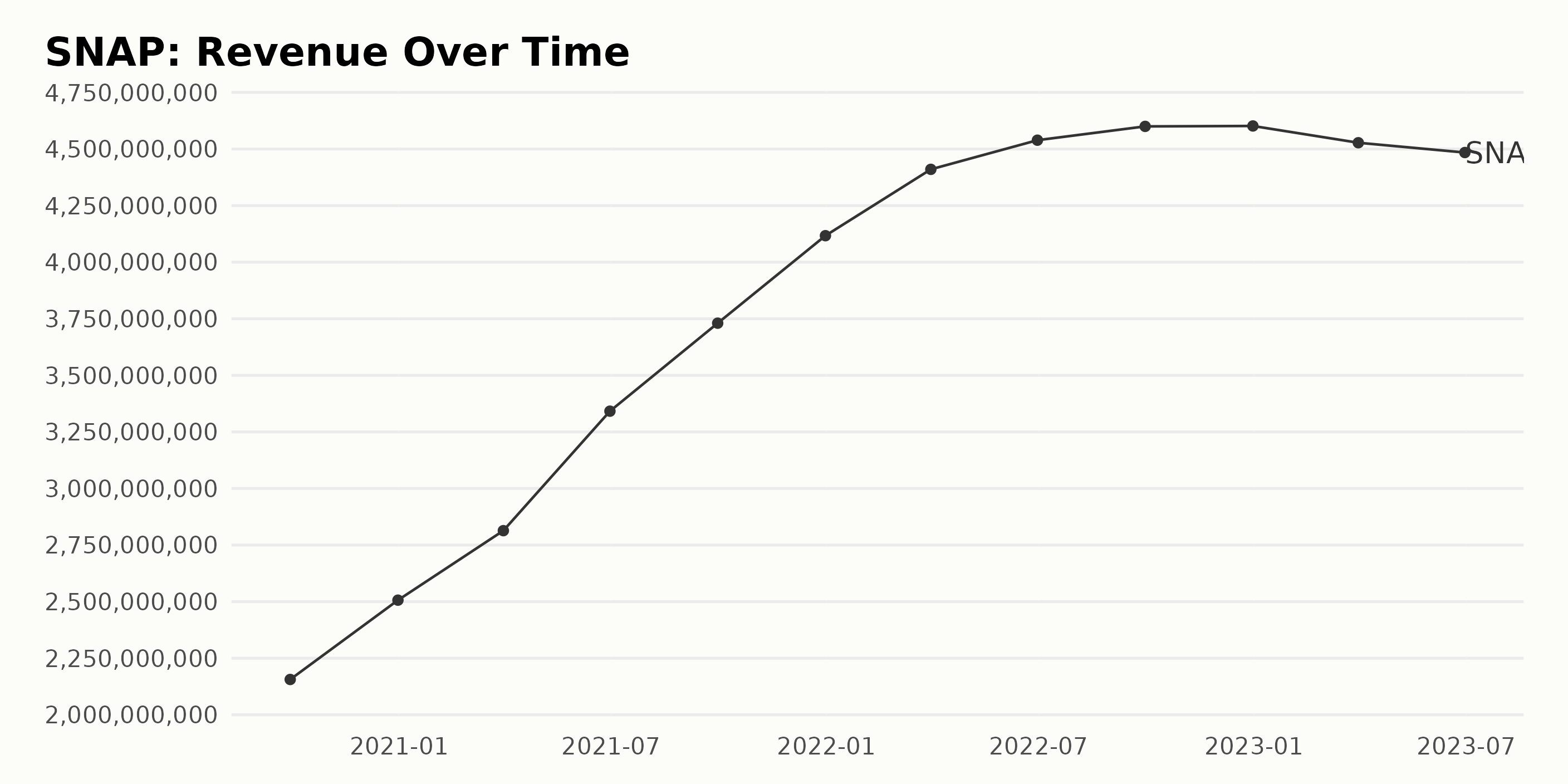

The trend in the trailing-12-month revenue of SNAP has generally been positive over the three-year period from 2020 to 2023. However, there have been notable fluctuations in this trend.

- At the end of the third quarter of 2020, SNAP’s revenue was $2.16 billion.

- The company saw a steady increase in its revenue, reaching up to $4.11 billion by the end of 2021. This marks an approximate growth rate of 90% when measured from the start of the given data series.

- In the first three quarters of 2022, the revenue continued to exhibit growth, peaking at $4.60 billion in the fourth quarter of 2022, which is the highest value throughout the series.

- Interestingly, the first dip in this upward trend was noticed in 2023, with the first quarter revenue dropping slightly to $4.53 billion compared to the last quarter of 2022.

- The decline persisted through the second quarter of 2023 when revenue leveled to $4.48 billion. This drop-in value from its peak in late 2022 indicates a mild downtrend.

Although there have been variations in the growth speed, it’s clear that the more recent data indicates a potential slowdown in revenue expansion for SNAP. More observation would be required to ascertain if the decrease in revenue in 2023 signals a new trend or is merely a temporary downturn.

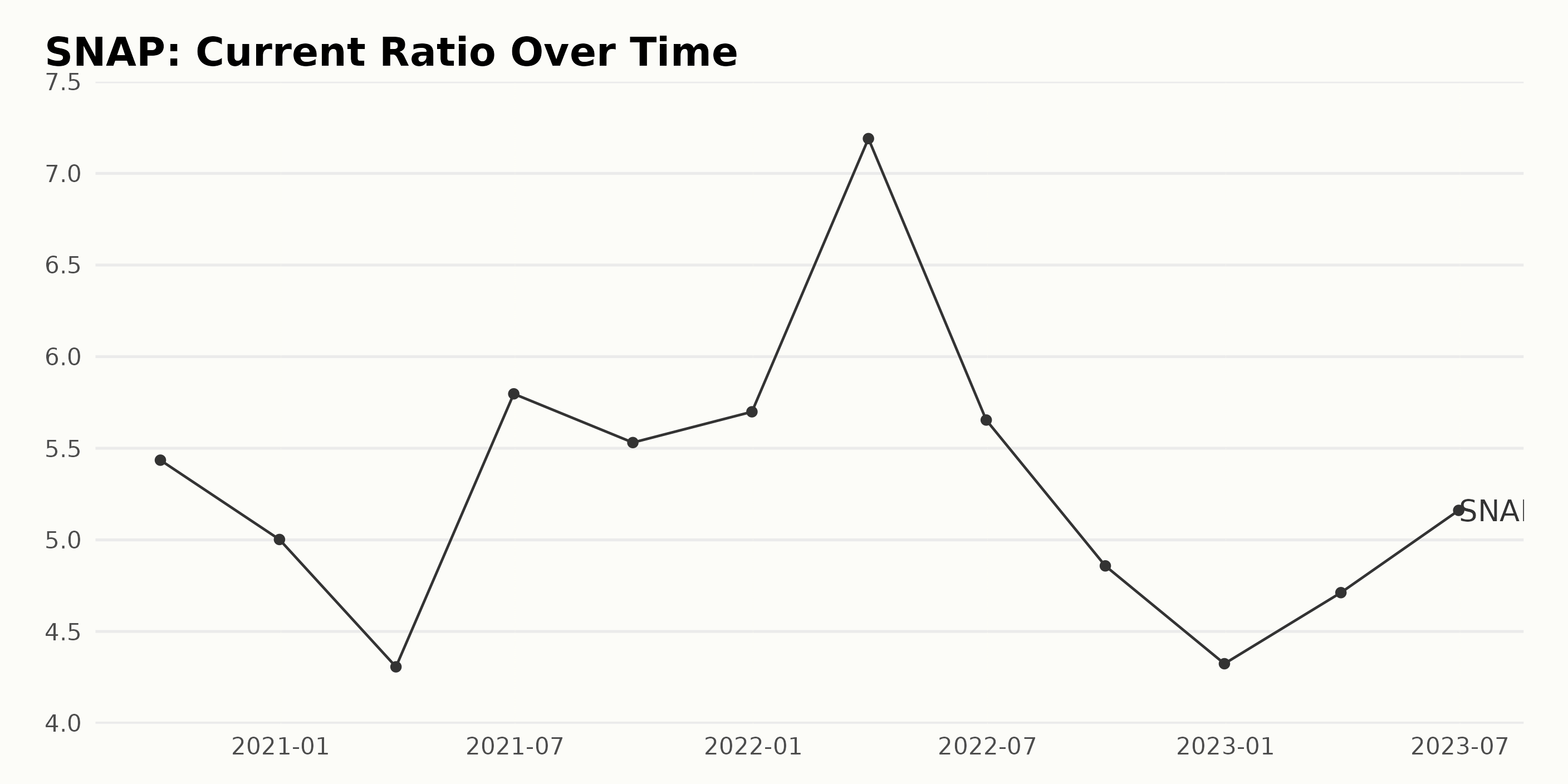

Here is a summary of the trend and fluctuations in SNAP’s Current Ratio from September 2020 to June 2023.

- Started at a value of 5.43 on September 30, 2020.

- Encountered a minor dip, declining to 5.00 on December 31, 2020.

- Reported a significant drop to 4.31 on March 31, 2021.

- A sharp rebound was observed, rising to 5.80 on June 30, 2021.

- Demonstrated slight instability, with values fluctuating between 5.53 and 5.70 for the rest of 2021.

- It experienced a substantial surge, reaching its peak of 7.19 on March 31, 2022.

- A steady decline followed, returning to 4.32 on December 31, 2022.

- Closed the series at a slightly improved value of 5.16 on June 30, 2023.

The latest number (June 2023) represents a decrease of 21% from the first figure in this series (September 2020).

In general, the current ratio exhibited both ups and downs during this period, but it ended with a negative growth rate, indicating decreased liquidity over the apparent duration.

SNAP’s March-September 2023 Price Volatility: Analysis and Overview

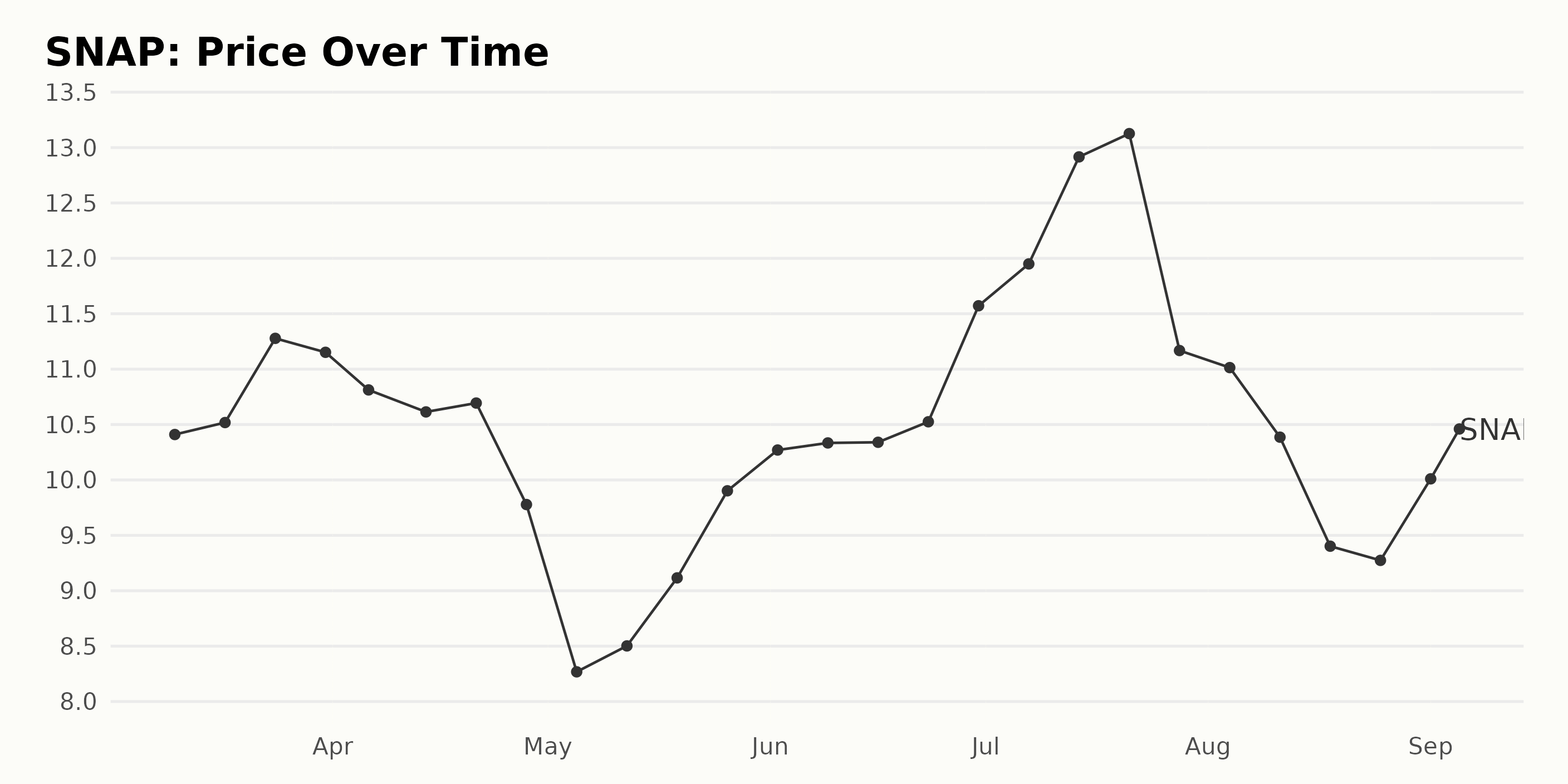

The price trend and growth rate of SNAP from March to September 2023 are as follows:

- In March 2023, Snap’s share price showed a slight, yet inconsistent, increase from $10.41 on March 10 to $11.15 at the end of the month.

- April 2023 saw a gradual decreasing pattern, starting at $10.81 on April 6 and dropping to $9.77 on the 28th.

- May 2023 marked a low point in share value, starting at $8.27 on May 5, but then began to recover steadily, reaching $9.90 on May 26.

- June 2023 maintained this momentum with values around $10.34 mid-month, rising to $11.57 by month-end.

- In July 2023, SNAP peaked within this period, hitting a high of $13.12 on July 21. However, it experienced a significant drop to $11.168 by July 28.

- August 2023 presented a downward trend again, with the share price falling steadily from $11.01 on August 4 to $9.27 on August 25.

- Finally, in early September 2023, the stock made a small recovery, standing at $10.46 on September 5.

Overall, SNAP’s share price showed volatility and multiple fluctuations throughout the March to September 2023 period. While there was a significant growth spur in July, it was not sustained, and therefore, no steady or accelerating growth trend can be detected in this period. Here is a chart of SNAP’s price over the past 180 days.

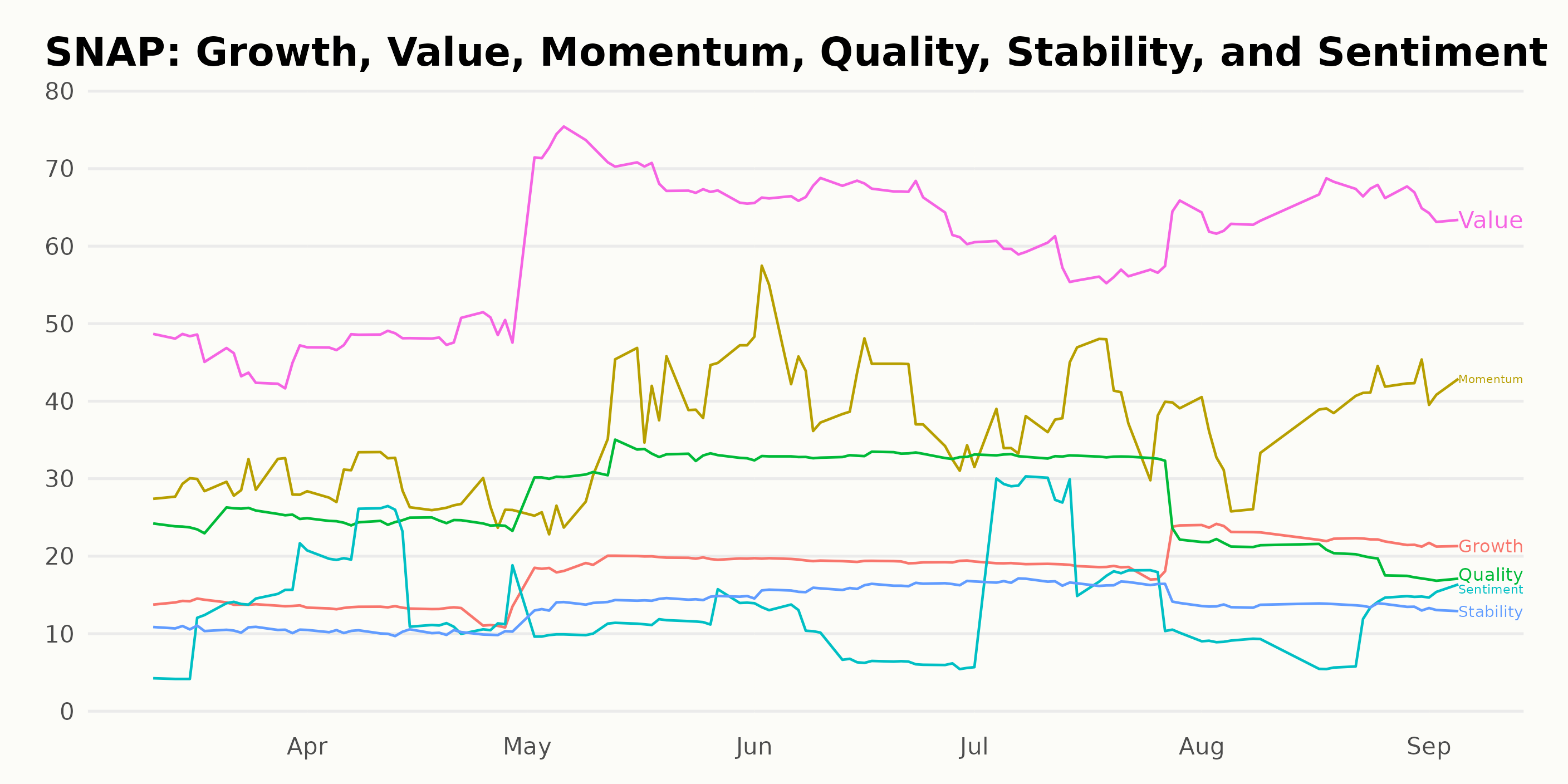

Examining Snap Inc.’s Value, Momentum, and Growth Ratings in 2023

SNAP has an overall D rating, translating to a Sell in our POWR Ratings system. This means the company’s stock is considered to be underperforming compared to its peers in the Internet category. By the end of the latest period given (September 5, 2023), SNAP is ranked #57 out of 60 stocks within the Internet category. Remember that for rank in category data, lower values are better and denote a superior rank.

Here are the three most noteworthy dimensions for SNAP according to the POWR Ratings.

Value: The value rating was at its highest in May 2023, with a score of 70. It has been quite high throughout the year, reaching a score of 46 in March to a slightly lower score of 64 in September. The value dimension consistently presents the highest ratings among the six categories of POWR Ratings.

Momentum: Momentum saw a clear upward trend from March to June 2023, rising from a score of 29 to 42. This increment signifies a strong momentum buildup. However, it slightly dropped to 39 in July, saw a minor rise back to 38 in August, and again increased to 41 in September 2023.

Growth: - Growth showed an impressive leap from 13 in April 2023 to 19 in May 2023, and this score remained steady till July. There was a slight improvement in August 2023 as it reached 23, but fell back down to 21 by September 2023.

Stocks to Consider Instead of Snap Inc. (SNAP)

Other stocks in the Internet sector that may be worth considering are Yelp Inc. (YELP), Travelzoo (TZOO), and Despegar.com Corp. (DESP) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

SNAP shares fell $10.46 (-100.00%) in premarket trading Wednesday. Year-to-date, SNAP has gained 16.87%, versus a 18.36% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is Snap (SNAP) a September Internet Buy? appeared first on StockNews.com