This index is settling in to about a 3.5% annual rate of growth.

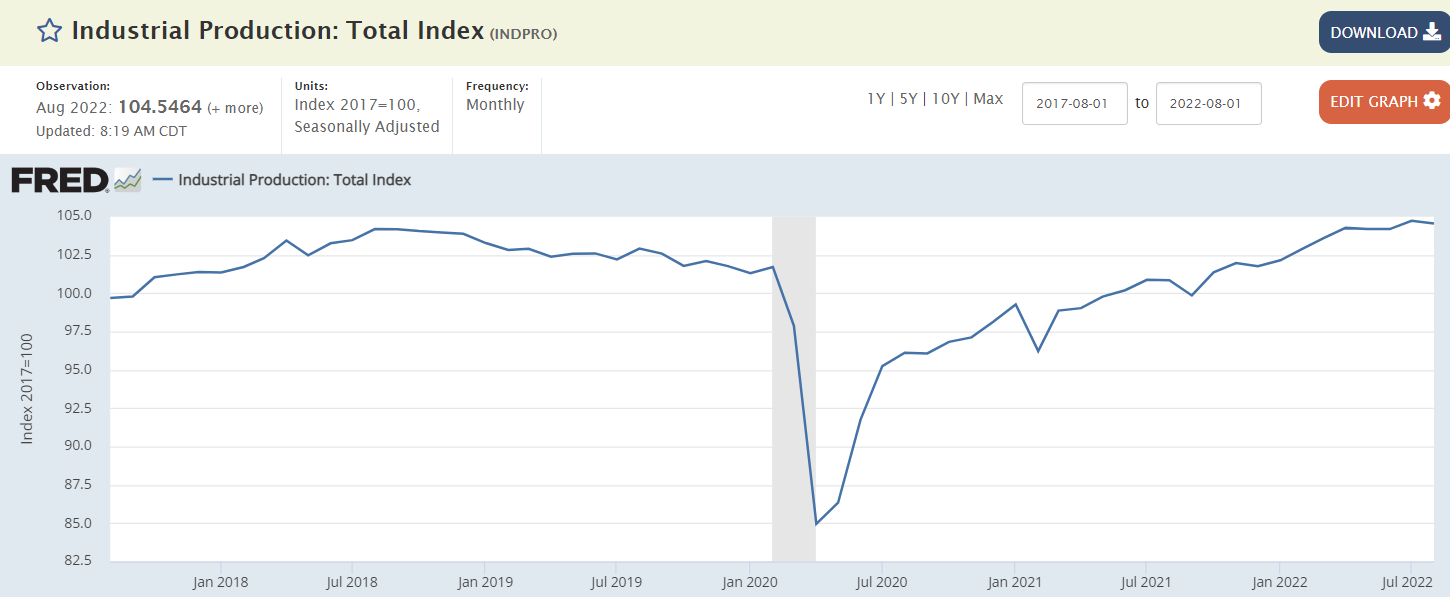

This index is settling in to about a 3.5% annual rate of growth.No recession indication here:

result in a sufficiently large increase in government deficit spending on those interest payments to support both the growth of private sector total spending on goods and services as well as to support prices.So what happens each cycle is the Fed raises rates and supports growth until something else causes a recession. Recent history has seen the automatic stabilizers (tax receipts rising and transfer payments falling with growth) bring down gov deficit spending sufficiently to end the cycle, while at the same time the Saudis have raised oil prices until the economy and demand collapses.

The post Industrial production, retail sales, unemployment claims, comments appeared first on Mosler Economics / Modern Monetary Theory.