( click to enlarge )

( click to enlarge )Shares of Vuzix Corporation (NASDAQ:VUZI) are starting to heat up again and are worth watching. The stock broke out last week of a large flag formation. This technical move is very significant and could be marking a new trend higher that is still in the early stages of development. The MACD is also confirming this as it moves to cross up, while the RSI starts to go up. If volume can pick up I think this stock can break through resistance at $8.50 and re-test its recent highs around $9.30. I started a big position in VUZI.

( click to enlarge )

( click to enlarge )Adamis Pharmaceuticals Corp (NASDAQ:ADMP) As I expected, the stock had a very strong day on Friday, as the stock broke out of its key horizontal resistance line on the way to closing up 70 cents on the day. Friday’s high was $3.57, which is resistance for Monday’s follow through move. You want to keep an eye on ADMP so you do not miss when the stock does break through resistance.

( click to enlarge )

( click to enlarge )Last week's view on First Solar, Inc. (NASDAQ:FSLR) stock remains unchanged. The short-term outlook appears bullish and would remain so as long as the share price holds above $36.75. The immediate resistance is seen at $38.68 and then at $40.02. RSI and MACD are also showing some positive divergences on the daily charts. These technical factors suggest taking a long position with a stop at 36.75.

( click to enlarge )

( click to enlarge )There is no change from my previous updates on Banner Corporation VirnetX Holding Corporation (NYSEMKT:VHC). I think the stock looks poised to move higher. The short-term trend is bullish and technical indicators suggest the upside bias is still in progress. RSI and the MACD lines are rising up, indicating strength in the upmove. To the upside the 2.93 level has now become resistance. To the downside the 2.53 level is seen as the next support level.

( click to enlarge )

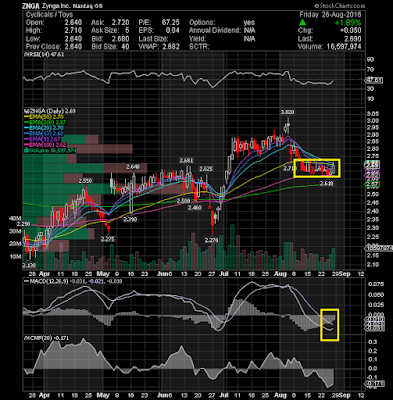

( click to enlarge )Zynga Inc (NASDAQ:ZNGA) is showing signs of buying activity at current levels, as the stock has been able to hold up the past few sessions. Resistance level in ZNGA is the high of Friday, which is $2.71. Watch the stock closely next week for a possible move.

( click to enlarge )

( click to enlarge )I have Globalstar, Inc. (NYSEMKT:GSAT) on my watchlist due to the recent price action, volume and momentum. Potential swing long above 2.41

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC